Some of the main takeaways from the chancellor’s autumn statement November 2023

National Insurance rate cut from 12% to 10% from 6 January, affecting 27 million people.

The 75% business rates discount for retail, hospitality and leisure firms in England extended for another year.

Class 2 National Insurance – paid by self-employed people earning more than £12,570 – abolished from April.

Class 4 National Insurance for self-employed – paid on profits between £12,570 and £50,270 – cut from 9% to 8% from April.

Full tax break permitting companies to deduct spending on new machinery and equipment from profits – now made permanent.

Funding of £4.5bn to attract investment to strategic manufacturing sectors, including aerospace, green energy, aerospace, life sciences and zero-emission vehicles.

Some £500m over the next two years to fund artificial intelligence (AI) innovation centres.

New premium planning services for England, with faster decision times for major business applications and fee refunds when these are not met.

Defence spending to remain at 2% of national income – a Nato commitment.

Overseas aid spending kept at 0.5% of national income, below the official 0.7% target.

Reaffirms previous commitments made last autumn to provide £14.1bn for the NHS and adult social care in England, as well as an extra £2bn for schools, in both 2023‑24 and 2024-25.

All alcohol duty frozen until 1 August next year.

Tobacco products duty increases by 2% above RPI inflation; hand-rolling tobacco rises 12% above RPI.

Fuel duty remains 52.95p per litre for petrol and diesel, after the chancellor announced a 5p per litre cut for 12 months in March 2023

State pension payments to increase by 8.5% from April, in line with average earnings.

Claimants in England and Wales deemed able to work who refuse to seek employment to lose access to their benefits and extras like free prescriptions.

Further £1.3bn to help people who have been unemployed for over a year.

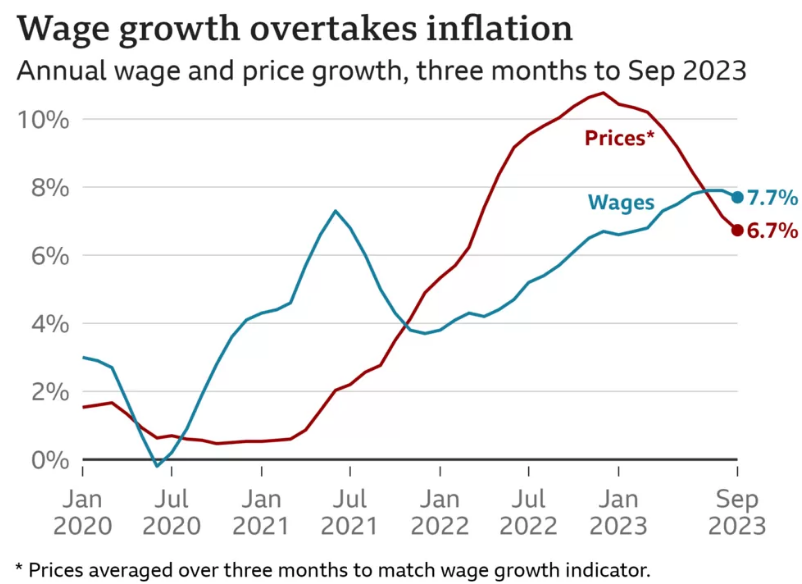

National Living Wage – to increase from £10.42 to £11.44 an hour from April.

Funding of £1.3bn over the next five years to help people with health conditions find jobs.

OBR Stats

Independent Office for Budget Responsibility (OBR) expects the economy to grow by 0.6% this year and 0.7% next year, rising to 1.4% in 2025; then 1.9% in 2026; 2% in 2027 and 1.7% in 2028.

Living standards not expected to return to pre-pandemic levels until 2027-28.

Underlying debt forecast to be 91.6% of GDP next year; 92.7% in 2024-25; 93.2% in 2026-27; before declining to 92.8% in 2028-29. (One to watch)

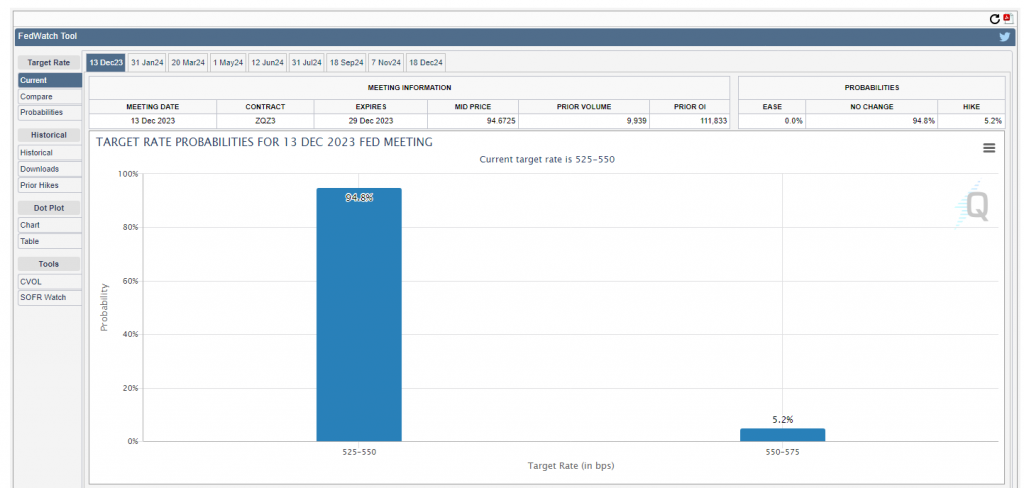

OBR forecasts that inflation – the rate prices are rising – will fall to 2.8% by the end of 2024, before reaching the Bank of England’s 2% target rate in 2025. (One to watch)

The OBR says higher inflation means real value of departmental budgets will be £19bn lower by 2027/28 compared with March 2023 forecasts.

Borrowing forecast to fall from 4.5% of GDP in 2023-24; to 3% in 2024-25; 2.7% in 2025-26; 2.3% in 2026-27; 1.6% in 2027-28 and 1.1% in 2028-29. (One to watch)