If the U.S.–Iran conflict drags on for weeks or months, the global impact will extend far beyond oil markets. Energy prices are only the first domino.

The deeper, more destabilising effects emerge through shipping disruption, fertiliser shortages, food‑price inflation, financial volatility, cyber escalation, and regional political instability.

For the UK — already wrestling with structural food‑system fragility — the conflict becomes a real‑world stress test.

This report outlines 15 potential major knock‑on effects that would shape the global economy if the conflict becomes protracted.

1. Global Shipping Disruption

The Strait of Hormuz is not just an oil artery; it is a global shipping chokepoint. As vessels reroute or halt operations:

- Container shipping delays spread across Asia, Europe and the Gulf.

- War‑risk insurance premiums spike for all vessels.

- Freight costs rise, feeding into non‑energy inflation.

This is the mechanism by which a regional conflict becomes a global economic event.

2. Aviation and Travel Disruption

Iranian retaliation has already included strikes on Gulf airports and hotels. If this continues:

- Airlines reroute or cancel flights across the Gulf, South Asia and East Africa.

- Longer flight paths increase fuel burn and fares.

- Tourism in the UAE, Oman, Bahrain and potentially Turkey contracts sharply.

Aviation is one of the fastest channels through which geopolitical instability hits consumers.

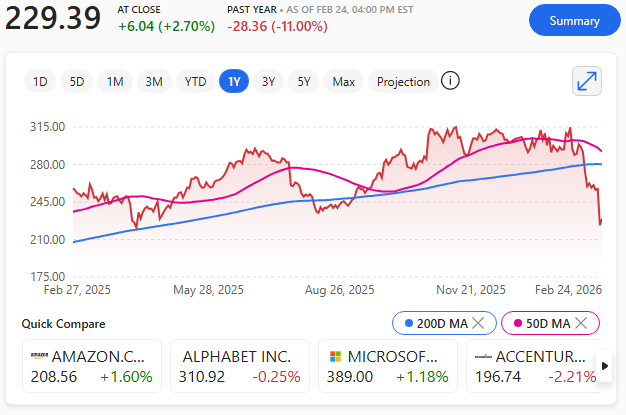

3. Financial Market Volatility

Markets dislike uncertainty, and this conflict delivers it in abundance.

- Investors flee to gold, the dollar and U.S. Treasuries.

- Emerging markets face capital outflows.

- Equity volatility rises in shipping, aviation and manufacturing sectors.

The longer the conflict persists, the more entrenched this volatility becomes.

4. Fertiliser Disruption: The Hidden Trigger

Over one‑third of global fertiliser trade moves through the Strait of Hormuz. With shipments stranded:

- Urea, ammonia, phosphates and sulphur prices surge.

- Farmers worldwide face higher input costs.

- Lower fertiliser availability leads to reduced crop yields.

This is the beginning of a food‑system shock that unfolds over months, not days.

5. Global Food‑Price Inflation

As fertiliser shortages ripple through agriculture:

- Wheat, rice, maize and oilseed yields fall.

- Livestock feed becomes more expensive, pushing up meat, dairy and egg prices.

- Food‑importing regions face acute pressure.

- Grain futures markets become more volatile.

This is how a conflict becomes a global cost‑of‑living crisis.

UK Exposure

The UK is particularly vulnerable because:

- It imports a large share of its fertiliser and food.

- Its agricultural sector is energy‑intensive.

- Supermarket supply chains are sensitive to freight and insurance costs.

Bread, cereals, dairy and meat are the first categories to feel the squeeze.

6. Supply Chain Strain Beyond Food and Energy

A prolonged conflict disrupts:

- Petrochemicals

- Plastics

- Fertilisers

- Industrial metals

- Gulf‑based manufacturing and logistics

This feeds into higher costs for everything from packaging to electronics.

7. Corporate Investment Freezes

Businesses hate uncertainty. Expect:

- Delays or cancellations of Gulf megaprojects.

- Slower investment in petrochemicals, logistics and tech hubs.

- Reduced appetite for Gulf‑exposed assets.

This undermines diversification efforts like Saudi Vision 2030.

8. Cyber Escalation

Iran has a long history of cyber retaliation. Likely developments include:

- Attacks on Western banks, utilities and government systems.

- Disruptions to Gulf infrastructure, including airports and desalination plants.

- Rising cybersecurity costs for businesses globally.

Cyber conflict is asymmetric, deniable and cheap — making it a likely pressure valve.

9. Regional Political Destabilisation

The killing of senior Iranian leadership has already shaken the region.

Possible outcomes include:

- Internal instability within Iran.

- Escalation involving Hezbollah, Iraqi militias, Syrian factions and the Houthis.

- Pressure on Gulf monarchies if civilian infrastructure continues to be targeted.

This is where the conflict risks widening beyond its initial theatre.

10. Migration and Humanitarian Pressures

If the conflict intensifies:

- Refugee flows from Iran, Iraq and Syria could rise.

- Europe — especially Greece, Turkey and the Balkans — faces renewed border pressure.

- Humanitarian budgets shrink as Western states divert funds to defence.

This adds a political dimension to the economic fallout.

11. Insurance Market Stress

War‑risk insurance is already spiking.

Expect:

- Higher premiums for shipping, aviation and energy infrastructure.

- Reduced insurer appetite for Gulf‑exposed assets.

- Knock‑on effects on global trade costs and consumer prices.

Insurance is a silent amplifier of geopolitical risk.

12. Higher Global Borrowing Costs

Sustained conflict spending creates:

- Budgetary strain for the U.S., UK, EU and Gulf states.

- Reduced fiscal space for domestic programmes.

- Higher global borrowing costs as markets price in sustained uncertainty.

This tightens financial conditions worldwide.

13. Pressure on Emerging Markets

Countries heavily reliant on imported energy or food face:

- Worsening trade balances

- Currency depreciation

- Higher inflation

- Greater risk of sovereign stress

This is especially acute in South Asia, North Africa and parts of Latin America.

14. Strain on Multilateral Institutions

A prolonged conflict diverts attention and resources from:

- Climate finance

- Development aid

- Humanitarian relief

- Global health programmes

Institutions already stretched by Ukraine, Gaza and climate disasters face further overload.

15. The Strategic Reordering of Alliances

A drawn‑out conflict may accelerate geopolitical realignment:

- Gulf states hedge between Washington and Beijing.

- India and Turkey pursue more independent foreign policies.

- Europe faces renewed pressure to define its own security posture.

- Russia benefits from higher energy prices and Western distraction.

This is the long‑term consequence: a shift in the global balance of power.

Conclusion: A Conflict That Radiates Far Beyond Oil

If the U.S.–Iran war limps on, the world will feel it in supermarket aisles, shipping lanes, financial markets and political systems.

The most consequential knock‑on effect is not oil — it is fertiliser. That is the hinge on which global food security turns.

For the UK, the conflict exposes the fragility of a food system dependent on imports, long supply chains and energy‑intensive agriculture.

This is not just a Middle Eastern conflict. It is a global economic event in slow motion.

And who says we don’t need oil still!