The Resilient Stock Market: A Double-Edged Shield Against Recession

In a year marked by political volatility, Trumps tariff war, soft labour data, and persistent inflation anxieties, one pillar of the economy has stood tall: the stock market.

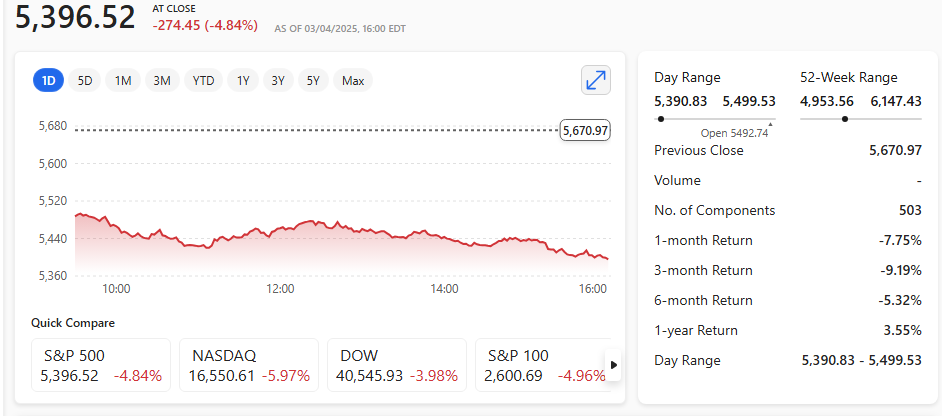

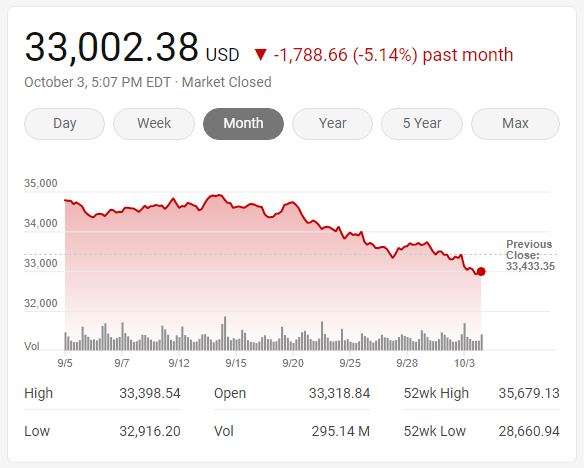

Defying expectations, major indices like the Nasdaq, Dow Jones and S&P 500 have surged, buoyed by AI-driven optimism and industrial strength. This resilience has helped stave off a technical recession—but not without raising deeper concerns about economic fragility and inequality.

At the heart of this phenomenon lies the ‘wealth effect’. As equity portfolios swell, high-net-worth households feel richer and spend more freely.

This consumer activity props up GDP figures and masks underlying weaknesses in wage growth, job creation, and productivity.

August’s economic data showed surprising strength in consumer spending and housing, despite lacklustre employment figures and fading stimulus support.

But here’s the rub: this buoyancy is not broadly shared. According to the University of Michigan’s sentiment index, confidence has declined sharply since January, especially among those without significant stock holdings.

Balance

The U.S. economy, in effect, is being held aloft by a narrow slice of the population—those with the means to benefit from rising asset prices. For everyone else, the recovery feels distant, even illusory.

This divergence creates a dangerous illusion of stability. Policymakers may hesitate to intervene—whether through fiscal support or monetary easing—because headline indicators look healthy. Yet beneath the surface, vulnerabilities abound.

If the market were to correct sharply, the spending it fuels could evaporate overnight, exposing the economy’s dependence on asset inflation.

Moreover, the market’s resilience may be distorting capital allocation. Companies flush with investor cash are prioritising stock buybacks and speculative ventures over wage growth or long-term investment. This can exacerbate inequality and erode the foundations of sustainable growth.

In short, while the stock market’s strength has delayed a recession, it has also deepened the disconnect between Wall Street and Main Street.

The danger lies not in the market’s success, but in mistaking it for economic health. A resilient market may be a shield—but it’s not a cure. And if that shield cracks, the consequences could be swift and severe.

The challenge now is to look beyond the indices and ask harder questions: Who is benefitting? What are we neglecting?

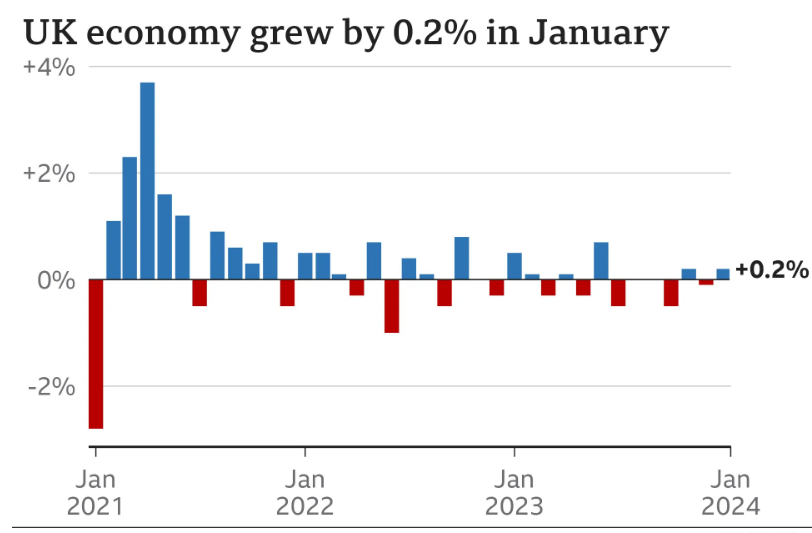

And how do we build an economy that’s resilient not just in numbers, but in substance, regardless of nation.