The stock market has been experiencing some volatility and uncertainty in September and October 2023, as investors fret about inflation, interest rates, and the possibility of a U.S. recession.

Main facts affecting the current stock market

The month of October has produced some severe stock market crashes over the past century, such as the Bank Panic of 1907, the Wall Street Crash of 1929, and Black Monday 1987.

October has also marked the start of several major long-term stock market rallies, such as Black Monday itself and the 2002 nadir of the Nasdaq-100 after the bursting of the dot-com bubble.

The S&P 500 dropped 4.5% in September 2023 and finished the third quarter in the red.

The U.S. Treasury yield curve has been inverted for months – which is a historically strong recession indicator.

The Fed maintained interest rates at the current target range of between 5.25% and 5.5% in September 2023, but signalled that it may need to raise rates again to combat inflation.

The consumer price index gained 3.7% year-over-year in August 2023, down from peak inflation levels of 9.1% in June 2022 but still well above the Fed’s 2% long-term target.

The bond market is currently pricing in an 81.7% chance the Fed will choose not to raise rates again on 1st November 2023.

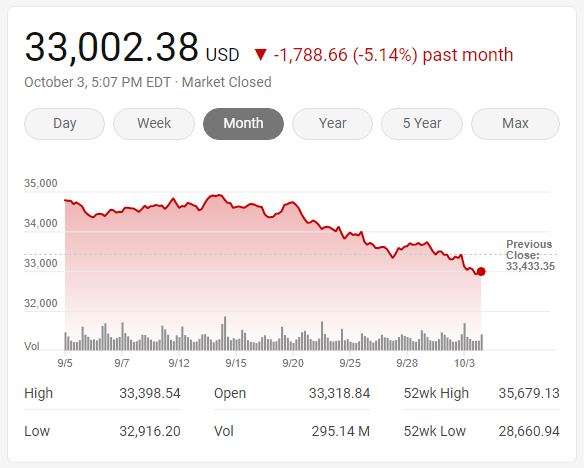

Wall Street closed down on 3rd October 2023 as the yield on the U.S. 10-year treasury rose to 4.80%, reaching its highest level since 2007.

The Dow Jones Industrial Average was down at 33002, Tuesday 3rd October 2023.

Stocks fell as investors pulled money from equities and moved it to the hot bond market.

International markets also faced significant turmoil, sending mini shockwaves through global financial centres, which reverberated in equities.

The dollar rose to the highest since December and is heading towards the twelfth positive week in a row.

Uncertainty

Uncertainty in the U.S. political system is having a major affect too. Especially with the ousting of the speaker and the real fear of a government shutdown looming large.