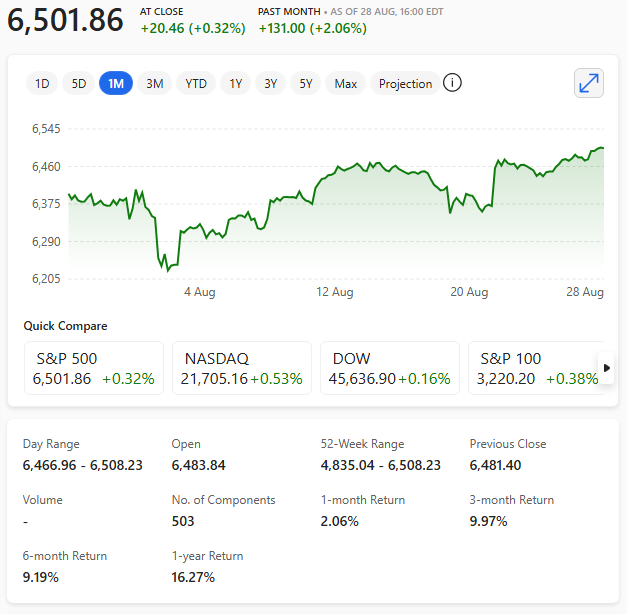

The United States economy lost momentum at the end of 2025, with fourth‑quarter GDP rising just 1.4%, a sharp deceleration from the 4.4% expansion recorded in the previous quarter.

The first estimate from the U.S. Bureau of Economic Analysis underscored a cooling backdrop that contrasts with the resilience seen through much of last year.

The slowdown was broad‑based. Government spending, which had previously provided a meaningful lift, swung lower.

Exports weakened

Exports also weakened, reflecting softer global demand and a less favourable trade environment.

Consumer spending — the backbone of the U.S. economy — continued to grow but at a more subdued pace, suggesting households are becoming more cautious as borrowing costs remain elevated. Although there has been some easing in U.S. mortgage rates.

Imports declined, which mechanically supports GDP, but the underlying signal points to softer domestic demand.

Analysts had expected a stronger finish to the year, with forecasts clustered closer to 2.5%.

The miss raises questions about the durability of U.S. growth heading into 2026, particularly as fiscal support fades and the effects of tighter monetary policy continue to filter through.

Q3 surge to Q4 slowdown

The contrast with the previous quarter is stark: Q3’s surge was driven by robust consumer activity, firmer government outlays, and a rebound in exports — dynamics that have since reversed.

Even so, the latest figures do not point to an imminent recession. Investment remains mixed rather than collapsing, and consumer spending is still contributing positively.

But the data does reportedly suggest the economy is entering a more fragile phase, where small shocks could have outsized effects.

For policymakers, the report complicates the Federal Reserve’s path. Inflation has eased but remains above target, and a softer growth profile may strengthen the case for rate cuts later in the year — though officials will want clearer evidence before shifting course.