The question of whether China can overtake the United States in artificial intelligence has shifted from speculative debate to a central geopolitical storyline.

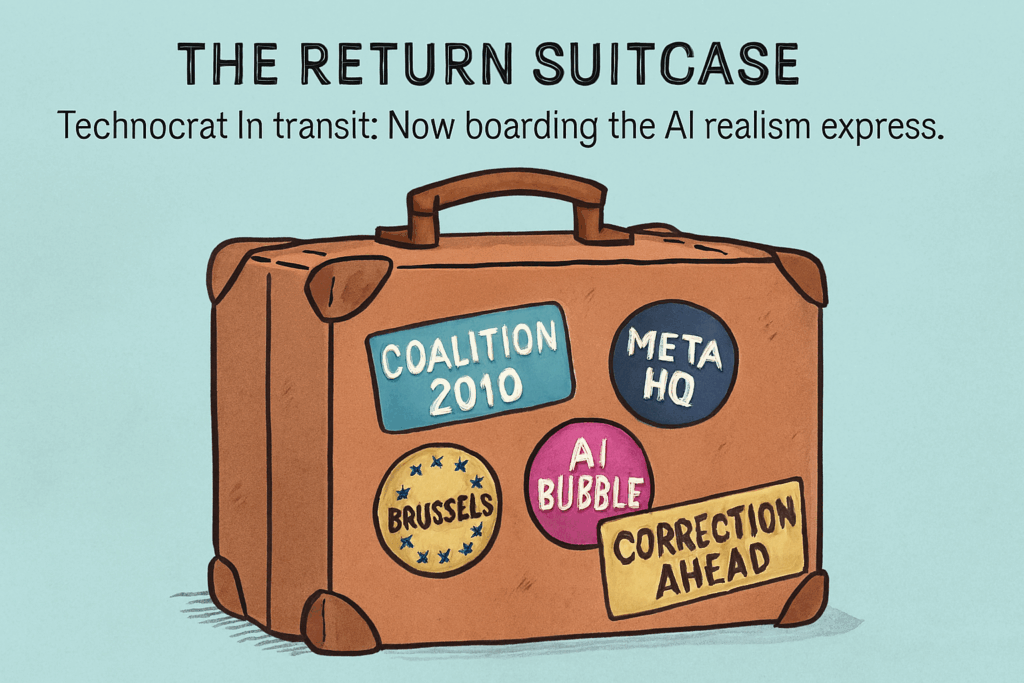

What once looked like a distant rivalry is now a tightly contested race, shaped by compute constraints, divergent industrial strategies, and the growing importance of AI deployment rather than pure research supremacy.

Chinese Technology

China’s progress over the past few years has been impossible to ignore. A wave of domestic model developers has emerged, producing systems that—while not yet at the absolute frontier—are increasingly competitive.

Their rapid ascent has unsettled assumptions about a permanent American lead. Analysts now argue that a significant share of the world’s population could be running on a Chinese technology stack within a decade, particularly across regions where cost, accessibility, and political alignment matter more than brand prestige or cutting‑edge performance.

Yet China’s momentum is not without friction. The country’s biggest structural challenge remains compute.

Export controls have sharply limited access to the most advanced GPUs, creating a ceiling on how far and how fast Chinese labs can scale their largest models.

Even leading Chinese developers openly acknowledge that they operate with fewer resources than their American counterparts.

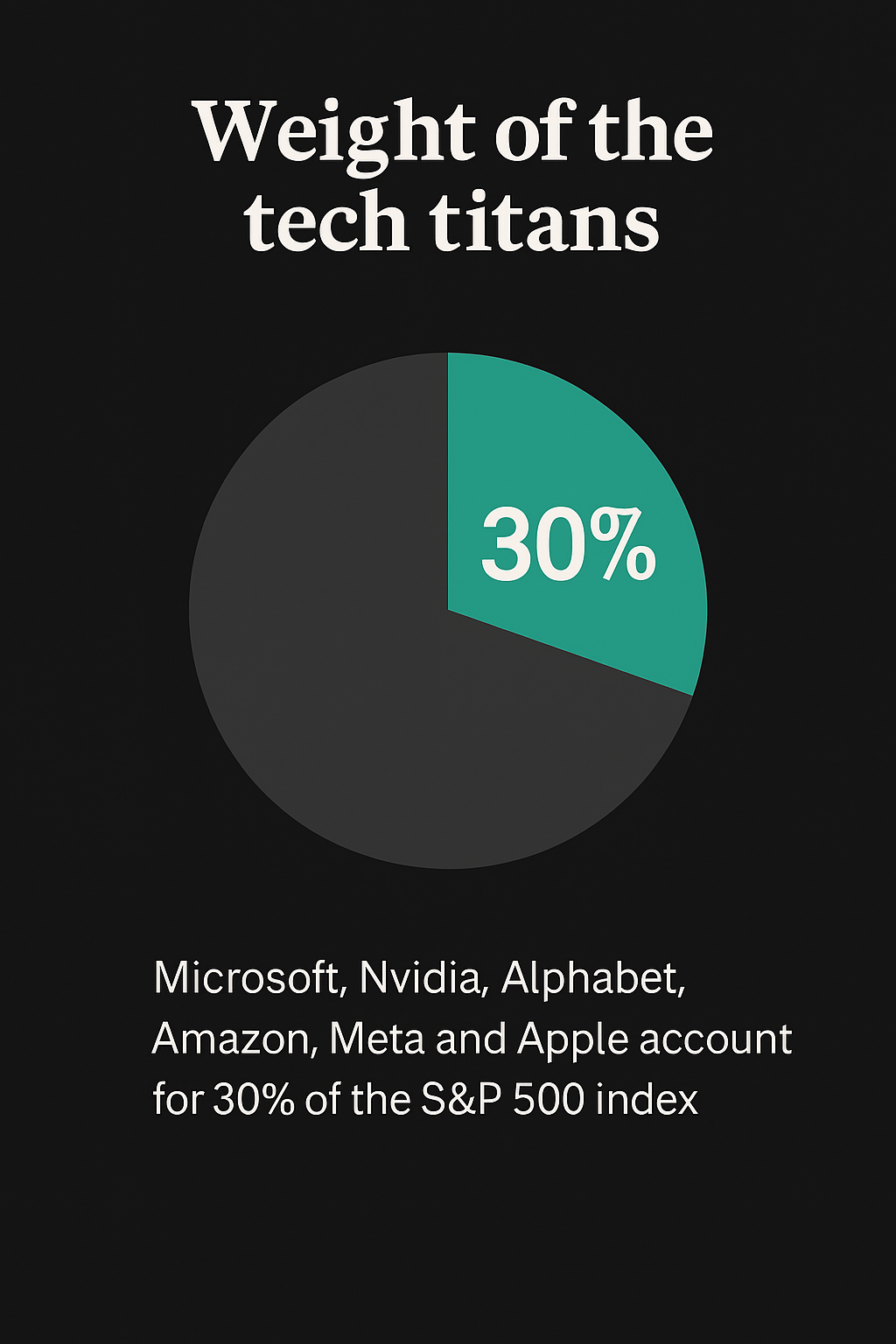

AI Investment Research

This gap matters: frontier AI research is still heavily dependent on vast compute budgets, and the United States retains a decisive advantage in both semiconductor technology and hyperscale infrastructure.

But China has turned constraint into strategy. Rather than chasing brute‑force scale, its labs have doubled down on efficiency—pioneering quantisation techniques, optimised inference pipelines, and compute‑lean architectures that deliver strong performance at lower cost.

In a world where enterprises increasingly care about value rather than theoretical peak capability, this approach is resonating.

Open‑weight Chinese models, in particular, are eroding the commercial moat of closed‑source American systems by offering capable alternatives that organisations can run cheaply on their own hardware.

Power Hungry

Energy is another under‑appreciated factor. China’s massive expansion of power generation—adding more capacity in four years than the entire U.S. grid—gives it a long‑term advantage in scaling data‑centre infrastructure.

AI is an energy‑hungry technology, and the ability to deploy at national scale may prove as important as breakthroughs in model design.

Still, the United States retains formidable strengths. It leads in advanced chips, frontier‑model research, and global cloud platforms.

American firms continue to attract enormous investment and maintain deep relationships with governments and enterprises worldwide. These advantages are not easily replicated.

The most realistic outcome is not a single winner but a universal AI landscape. China will dominate in some regions and layers of the stack; the U.S. will lead in others.

Translation of AI Power

The race is no longer about who builds the ‘best’ model, but who can translate artificial intelligence into economic and strategic power at scale.

China may not ‘win’ outright—but it no longer needs to. It only needs to be close enough to reshape the global balance of technological influence.

And on that front, the race is already far tighter than many expected.