U.S. core wholesale prices rose 0.8% in January 2026, a sharper-than-expected acceleration that has renewed concerns about lingering inflationary pressures across the American economy.

The increase, reported by the Bureau of Labor Statistics, exceeded both December 2025’s 0.6% rise and the consensus expectation of 0.3%, marking one of the strongest monthly gains in recent months.

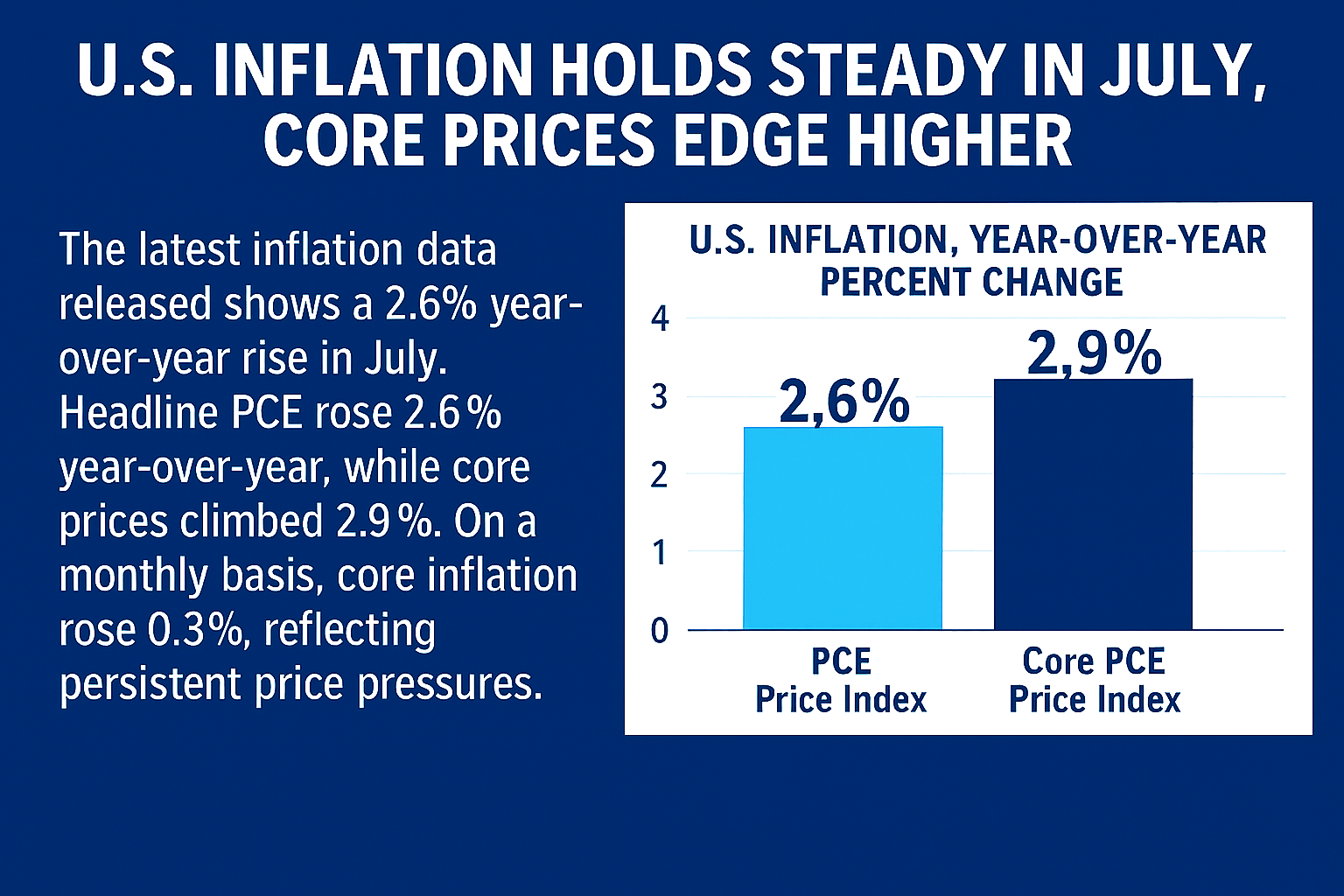

The core U.S. Producer Price Index (PPI), which strips out volatile food and energy components, is closely watched as an indicator of underlying cost pressures faced by businesses.

January’s jump suggests that inflationary forces remain embedded in key service sectors, even as goods prices continue to soften.

Indeed, services were the primary driver of the month’s overall wholesale inflation, with final demand services advancing 0.8%, while goods prices fell by 0.3% amid notable declines in gasoline and several food categories.

Divergence

This divergence between services and goods highlights a structural shift in inflation dynamics. Goods inflation has eased significantly as supply chains normalise and commodity prices stabilise.

By contrast, service-sector inflation—often tied to labour costs, logistics, and profit margins—has proven more persistent.

January 2026’s data underscores this trend, with strong increases in areas such as professional and commercial equipment wholesaling, telecommunications access services, and health and beauty retailing.

Complicates Inflation Outlook

For policymakers, the report complicates the inflation outlook. While headline PPI rose a more modest 0.5%, the strength of the core measure suggests that underlying pressures may not be cooling as quickly as hoped.

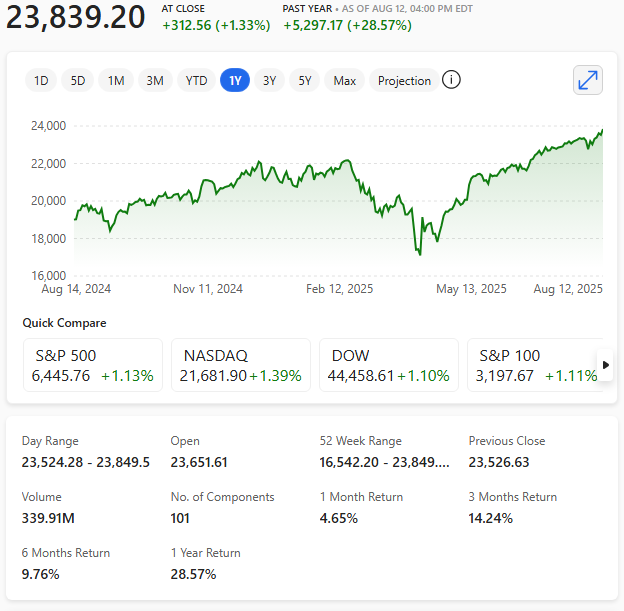

Markets had been anticipating a gradual easing that would give the Federal Reserve more confidence to consider rate cuts later in the year.

Instead, the January 2026 figures may reinforce a more cautious stance, particularly if upcoming consumer inflation data echoes the same pattern.

Businesses and consumers alike will be watching February 2026’s data closely to determine whether January represents a temporary spike or the beginning of a more stubborn inflation trend.