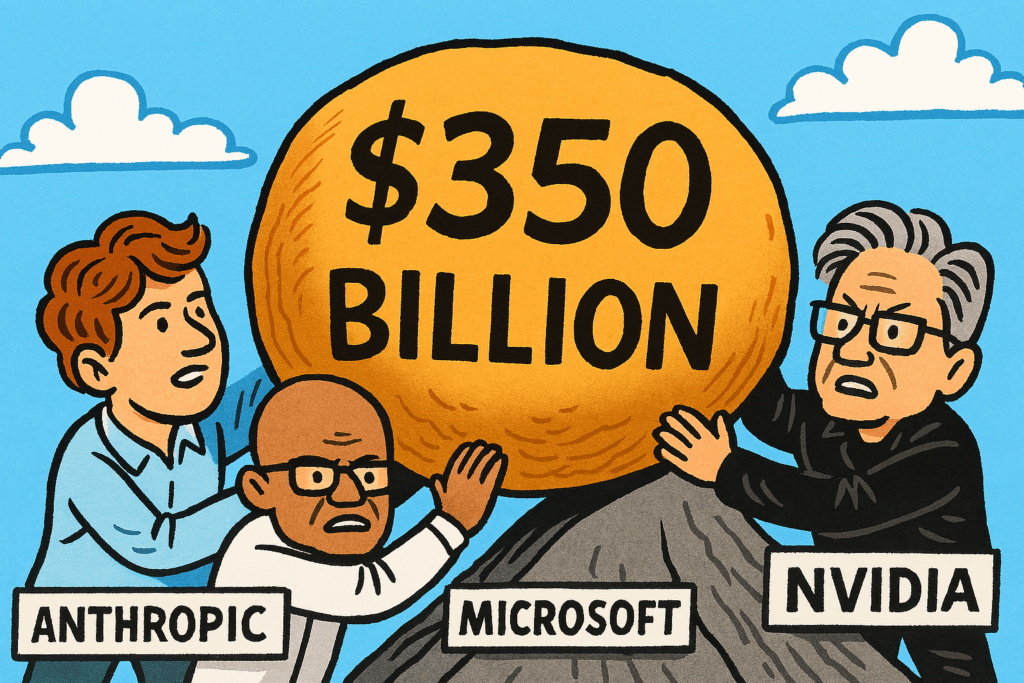

Anthropic has reportedly struck major deals with Microsoft and Nvidia. On Tuesday 18th November 2025, Microsoft announced plans to invest up to $5 billion in the startup, while Nvidia will contribute as much as $10 billion. According to a reports, this brings Anthropic’s valuation to around $350 billion. Wow!

Google has unveiled its newest AI model, Gemini 3. According to Alphabet CEO Sundar Pichai, it will deliver desired answers with less prompting.

This update comes just eight months after the launch of Gemini 2.5 and is reported to be available in the coming weeks.

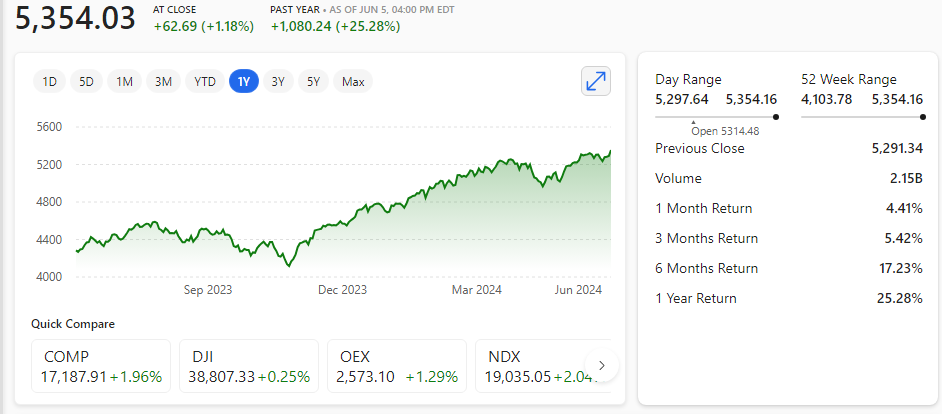

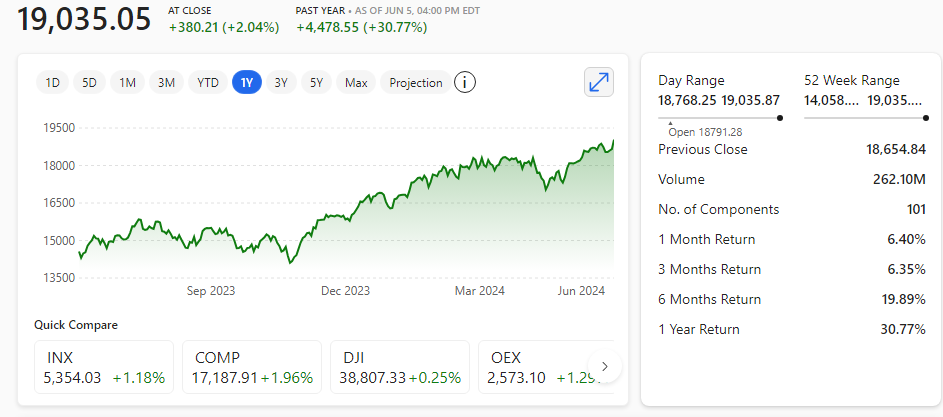

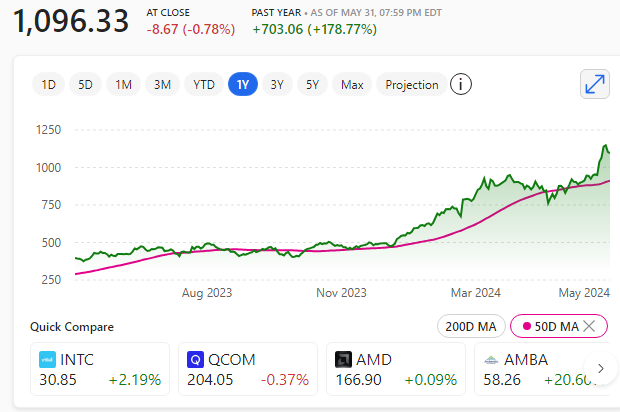

Money keeps flowing

Money keeps flowing into artificial intelligence companies but out of AI stocks

In what seems like yet another case of mutual ‘back-scratching’, Microsoft and Nvidia are set to invest a combined $15 billion in Anthropic, with the OpenAI rival agreeing to purchase computing power from its two newest backers.

Lately, a large chunk of AI news feels like it boils down to: ‘Company X invests in Company Y, and Company Y turns around and buys from Company X’.

That’s not entirely correct or fair. There are plenty of advancements in the AI world that focus on actual development rather than investments. Google recently introduced the third version of Gemini, its AI model.

Anthropic’s valuation has surged to around $350 billion, propelled by a landmark $15 billion investment from Microsoft and Nvidia.

Anthropic, the AI start-up founded in 2021 by former OpenAI employees, has rapidly ascended into the ranks of the world’s most valuable companies, more than doubling its worth from $183 billion just a few months earlier.

A valuation of $350 billion for a company only 4 years old is astounding!

The deal reportedly sees Microsoft commit up to $5 billion and Nvidia up to $10 billion. Anthropic has agreed to purchase an extraordinary $30 billion in Azure compute capacity and additional infrastructure from Nvidia.

This strategic alliance is not merely financial; it signals a deliberate diversification of Microsoft’s AI ecosystem beyond its reliance on OpenAI. And Nvidia strengthens its dominance in AI hardware.

Anthropic’s valuation has reached $350 billion, following the massive $15 billion investment from Microsoft and Nvidia, which positions the company among the most valuable in the world.

This astronomical figure reflects both the scale of its partnerships — including $30 billion in Azure compute commitments and Nvidia’s cutting-edge hardware.

The valuation underscores both the intensity of the global AI race and the confidence investors place in Anthropic’s safety-conscious approach to artificial intelligence.

Yet, it also raises questions about whether such astronomical figures reflect genuine long-term value. Or is it the froth of an overheated market.

Hyperscalers keep pumping the money into AI but are they getting the justified returns yet? Probably not yet – but it will come in the future.

But by then, it will be time to upgrade the system as it develops and so more money will be pumped in