Bad economic news appears to have had an interesting impact on the stock market recently.

Traditionally, negative economic data might be anticipated to result in falling stock prices; however, recent trends have diverged from this norm.

News trend

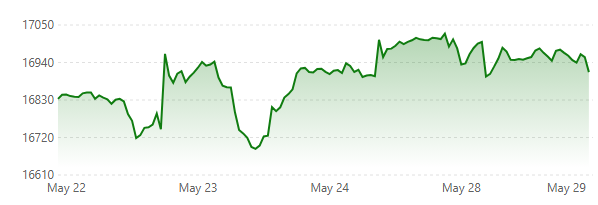

In the past two months, negative economic news has had a paradoxically positive effect on equities. Investors have responded well to poor economic indicators, partly due to the belief that these could lead the Federal Reserve to begin reducing interest rates.

Dollar and the stock market

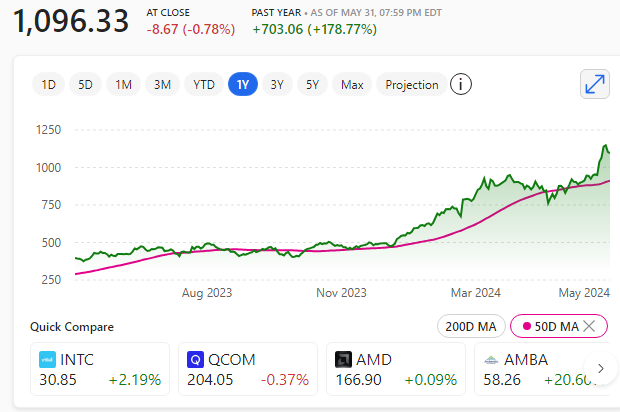

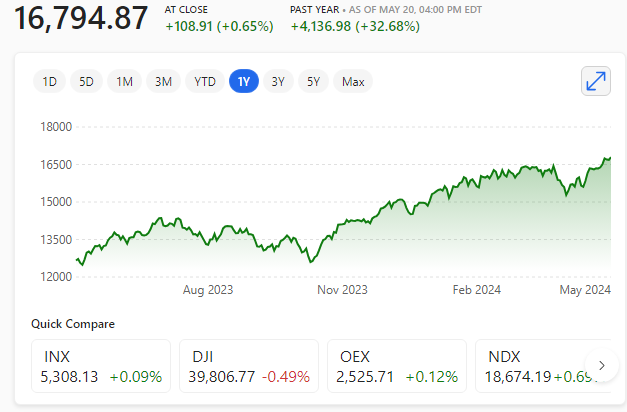

In recent times, the S&P 500, a large-cap equity index, and the U.S. dollar have exhibited a nearly perfect correlation. As the dollar has seen a gradual decline, the stock market has conversely experienced a rise. Typically, investors flock to the security of cash, and consequently the dollar, in times of uncertainty, yet they also channel investments into stocks upon the arrival of favourable news.

Economic data

Despite the upbeat trend in the stock market, real economic data has frequently fallen short of Wall Street’s predictions. The Citi Economic Surprise Index, a gauge that compares data to expectations, has been on a downward trajectory. This suggests that expectations have been surpassing the actual economic conditions, signalling that the economic situation may not be as favorable as previously thought.

Dilemma for the Fed

The Federal Reserve methodically reviews economic indicators to influence their interest rate decisions. Typically, unfavorable economic reports might prompt the Fed to reduce rates, unless there’s an uptick in inflation. Escalating inflation generally nudges the Fed towards a tighter monetary policy.

Monthly data roll-out

Data concerning the U.S. labour market presented to the Fed and markets may create that ‘pivotal’ moment – it often does – markets move of Fed comments and ‘awaited’ news. Reports detailing job openings, private sector job creation, and the Bureau of Labour Statistics’ nonfarm payrolls will shed light on the economy’s condition.

If job growth remains within the ‘Goldilocks range’ (neither too strong nor too weak), it may preserve the fragile equilibrium where unfavourable economic news has paradoxically favoured stock prices, while preventing excessive gloom.

Conclusion

To summarize, although adverse economic news has lately been advantageous for stock markets, monitoring this precarious balance is crucial. Excessive pessimism could be a harbinger of impending difficulties, despite its current benefits.

Note about Citigroup Economic Surprise Index

The Citigroup Economic Surprise Index is the sum of the difference between the actual value of various economic data and their consensus forecast. If the index is greater than zero, it means that the overall economic performance is generally better than expected, and the S&P 500 has a high probability of strengthening, and vice versa.