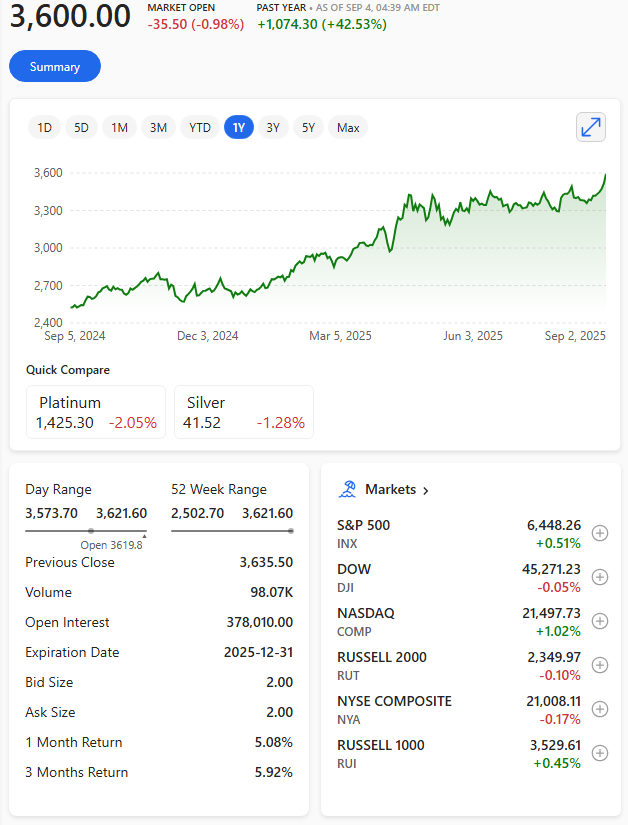

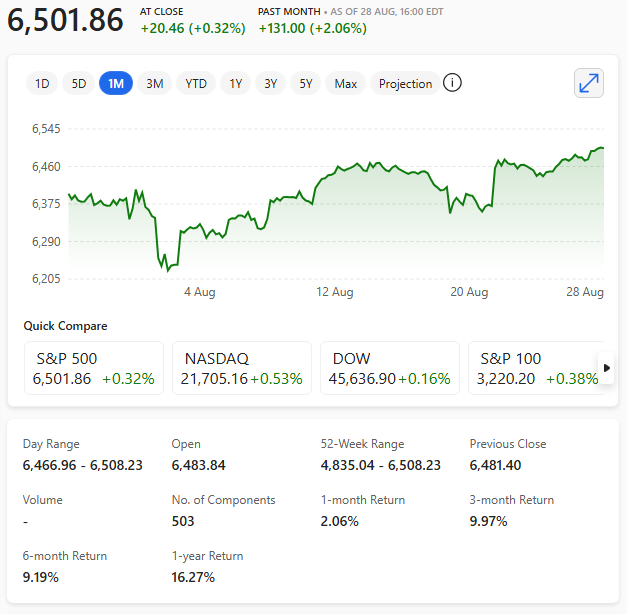

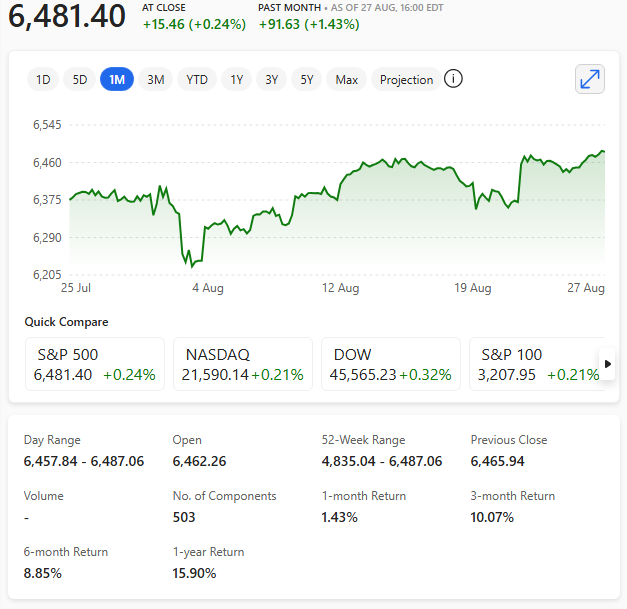

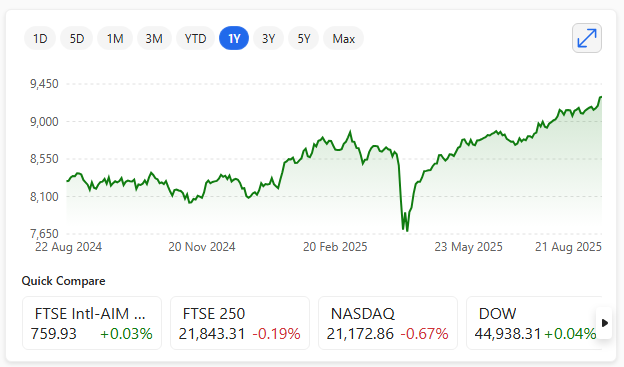

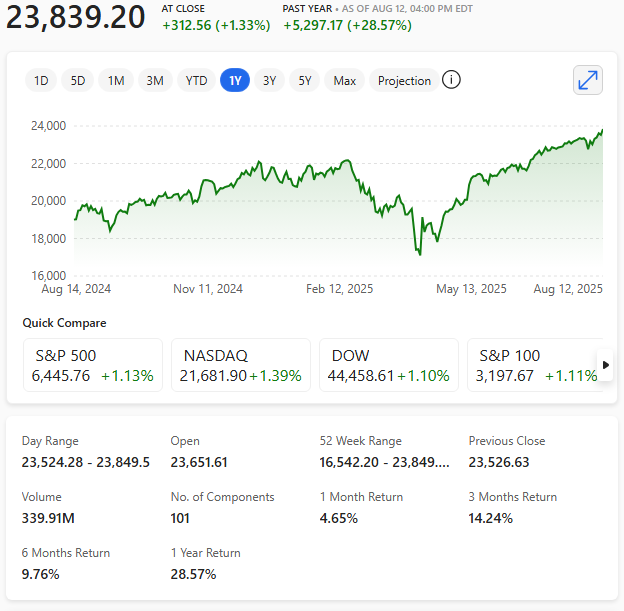

The Nasdaq Composite closed at a record high of 21,798.70 on Monday, 8th September 2025. That 0.45% gain was driven largely by a rally in chip stocks—Broadcom surged 3.2%, and Nvidia added nearly 1%.

The broader market also joined the party:

- S&P 500 rose 0.21% to 6,495.15

- Dow Jones Industrial Average climbed 0.25% to 45,514.95

Investor optimism is swirling around potential Federal Reserve rate cuts, especially with inflation data due later this week. The market’s momentum seems to be riding a wave of AI infrastructure spending and tech sector strength.

Negative news is not affecting the market – but why?

- The Nasdaq Composite closes at a record high on Monday 8th September 2025.

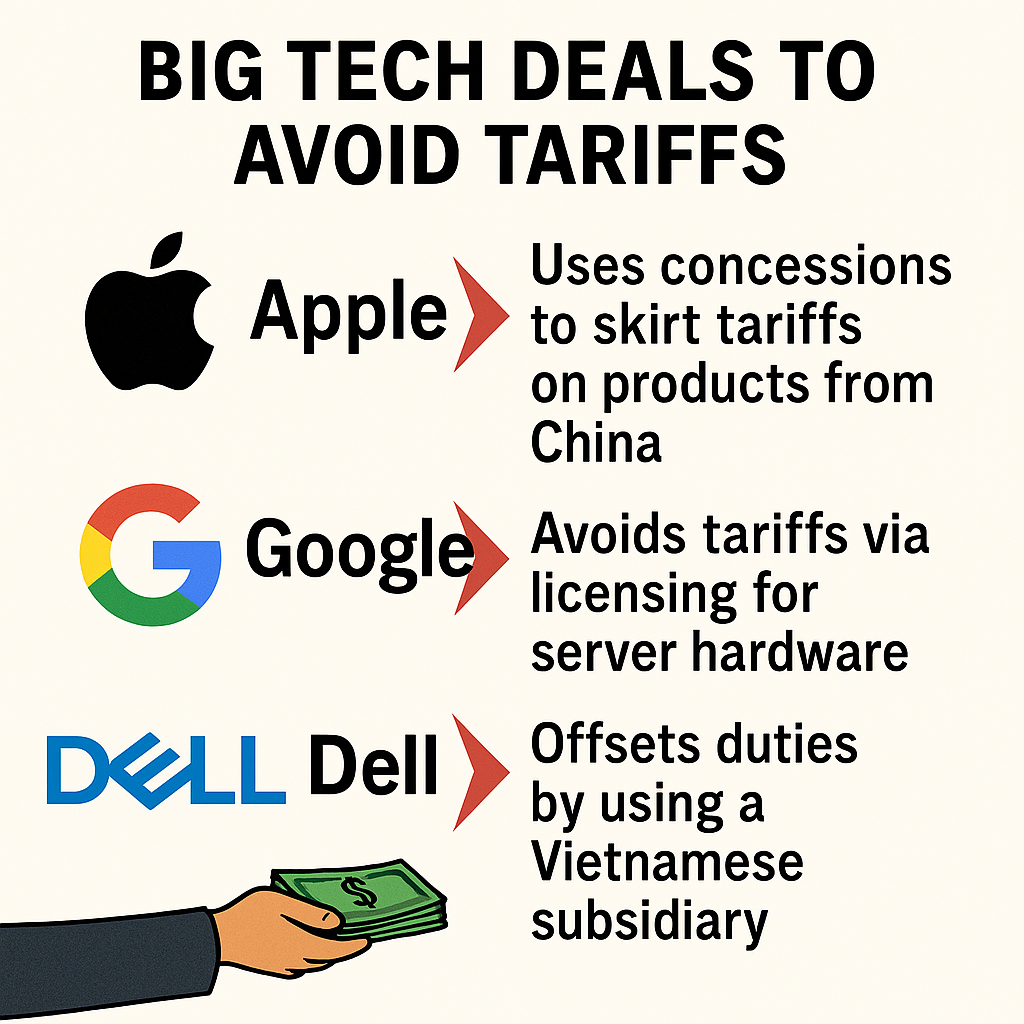

- Refunds could hit $1 trillion if tariffs are deemed illegal.

- China’s Xpeng eyes global launch of its Mona brand.

- French Prime Minister Francois Bayrou loses no-confidence vote.

- UK deputy PM resigns after tax scandal.

Stocks are rising despite August’s dismal jobs report because investors are interpreting the weak labor data as a signal that interest rate cuts may be on the horizon—and that’s bullish for equities.

📉 The contradiction at the heart of the market The U.S. economy showed signs of slowing, with job numbers actually declining in June and August’s report falling short of expectations.

Normally, that would spook investors—fewer jobs mean less consumer spending, which hurts corporate earnings and stock prices.

📈 But here’s the twist Instead of panicking, markets rallied. The Nasdaq Composite hit a record high, and the S&P 500 and Dow Jones also posted gains.

Why? Because a weaker jobs market increases the likelihood that the Federal Reserve will cut interest rates to stimulate growth. Lower rates make borrowing cheaper and boost valuations—especially for tech stocks.

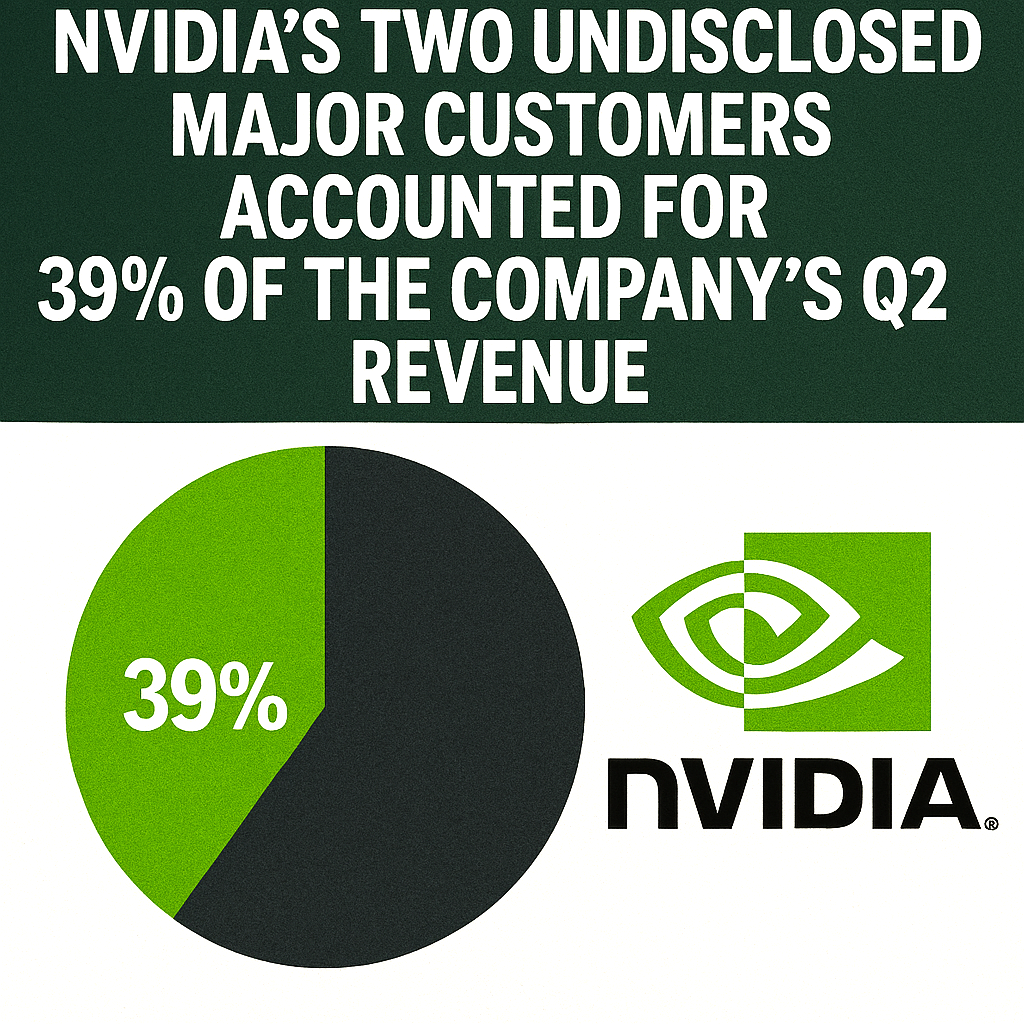

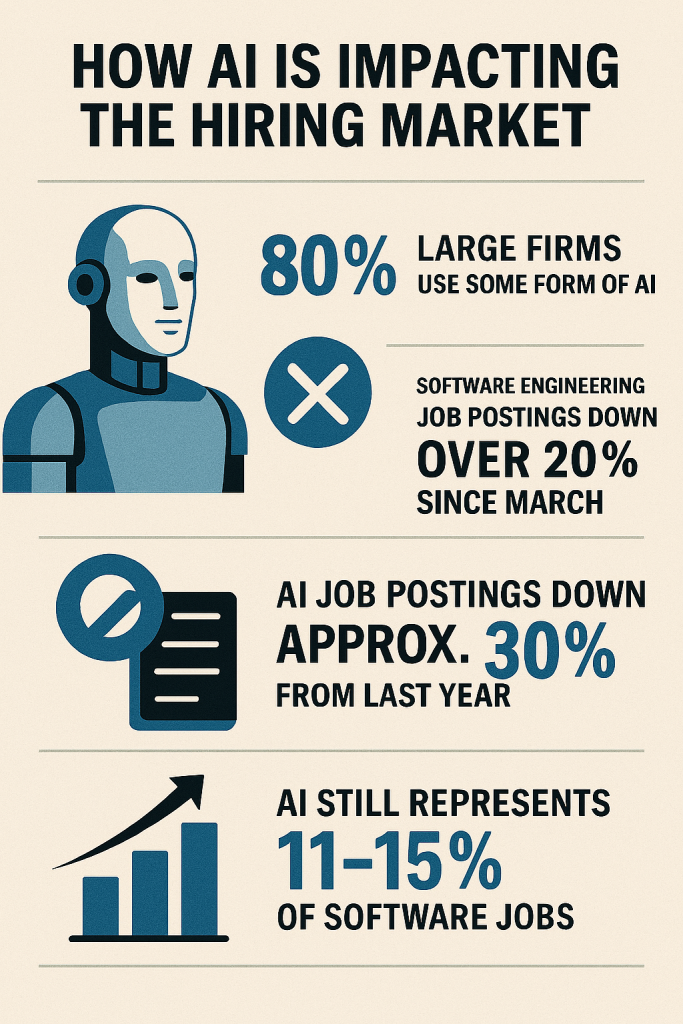

🤖 AI’s role in the rally Tech firms, particularly those tied to artificial intelligence like Broadcom and Nvidia, led the charge.

The suggestion is that investors may be viewing job cuts as a sign that AI is ‘working as intended’—streamlining operations and improving margins. Salesforce and Klarna, for instance, have both reportedly cited AI as a reason for major workforce reductions.

Summary

| Indicator | Value / Change | Interpretation |

|---|---|---|

| Nasdaq Composite | 📈 21,798.70 (Record High) | Tech led rally, investor optimism |

| S&P 500 | ➕ 6,495.15 | Broad market strength |

| Dow Jones | ➕ 45,514.95 | Industrial resilience |

| August Jobs Report | 📉 Missed expectations | Labour market weakness |

| Job Growth (June & Aug) | 📉 Negative | Economic slowdown |

| Investor Reaction | 🟢 Rate cuts expected | Bullish for equities |

| AI Layoff Narrative | 🤖 ‘Efficiency gains’ | Tech streamlining |

| Featured Stocks | Broadcom +3.2%, Nvidia +0.9% | AI infrastructure driving |

So, while the jobs report paints a gloomy picture for workers, the market sees a silver lining: rate relief and tech-driven efficiency.

It’s a classic case of Wall Street optimism—where bad news for Main Street can be good news for stock prices.

The career ladder is broken—but the Nasdaq is building a rocket.

The Fed up next to move the market.