Avoiding common investing and trading pitfalls is crucial. Here are some typical investing errors you should try to avoid.

Warren Buffett wisely cautions against investing in businesses that are not well understood. It is crucial to have a deep understanding of the company, its market sector, the broader industry, and its financial stability before committing to an investment.

Understand your investment

Take time to research whether it be a company, fund, unit trust or savings account. Make sure you understand what you are doing. Not understanding the investment is a massive failing.

Love the company, but resist falling in love with it. An emotional attachment to a specific stock can obscure your judgement. Keep in mind that investing should be a process of making rational decisions based on data, not on personal emotions.

Patience

Successful investing demands patience. Don’t anticipate immediate results; give your investments the necessary time to mature. Resist the urge to frequently check the markets and make hasty uninformed decisions.

Investment turnover

Excessive trading, known as churning, can result in significant transaction fees and tax consequences. It is advisable to adopt a long-term investment strategy and minimize superfluous trades.

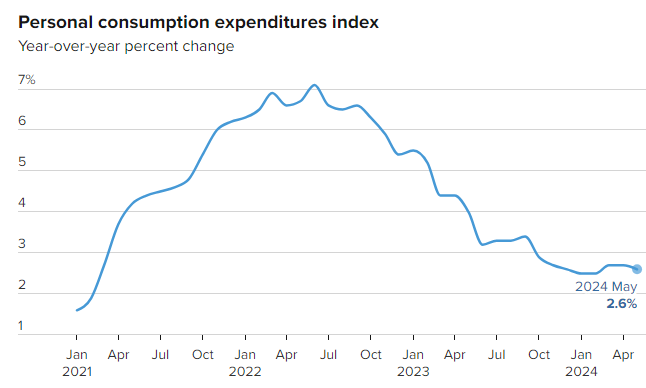

Attempting to time the market

Consistently timing the market is a difficult task. Instead, the emphasis should be on the duration of market involvement. Steady contributions and maintaining investments yield benefits in the long-term.

Getting even

Clinging to underperforming investments with the hope of just breaking even can be harmful. It’s crucial to assess each investment on its own merits and be prepared to take losses when needed. Run the winners!

Diversify

Investing all your funds in a single stock or asset class heightens the risk. Mitigate this by diversifying your investments across various asset types, industries, sectors and regions.

Cut emotions

Fear and greed often result in unwise decisions. It’s crucial to remain disciplined, adhere to your investment plan, and resist the urge to make hasty decisions driven by emotions.

You

Always maintain honesty with yourself when investing. Do not persuade yourself of anything other than the FACTS regarding your investment choices!

Keep in mind that investing is a journey where learning from mistakes is an integral part of the experience. By steering clear of these common pitfalls, you’ll set yourself up for greater long-term success.

Spread out your investments. Diversify. Aim for the long term. Remove emotion. Let the winners run. And doe your RESEARCH!

RESEARCH! RESEARCH! RESEARCH!