Investing in individual stocks can be both thrilling and profitable, yet it carries inherent risks. To make informed decisions, it’s important to adhere to some fundamental steps.

Define Your Goals

Before diving into stock picking, consider your investment goals

Invest for the longer-term, it works!

KIS – Keep It Simple! Keep your investment strategies as simple as possible.

Generate income – For regular payouts, consider focusing on dividend-paying stocks.

Preserve capital – If your primary goal is to keep pace with inflation and safeguard your savings, consider opting for lower-risk investments.

Grow capital – If you’re a young investor aiming for long-term growth, you might consider higher-risk stocks, being cautious with your selections.

Invest for the long-term

Choose your investment strategy

Value Investing – Consider purchasing stocks that are undervalued and have been neglected by the market.

Growth Investing – Invest in companies that exhibit signs of success and have the potential for further advancement.

Momentum Investing – Dispose of underperforming assets and invest in successful ones by following market trends. Be ruthless – there is no room for emotion!

Pound-Cost Averaging – Gradually invest money into the market to reduce the impact of volatility. Look into investing in funds or unit trusts.

Stay informed

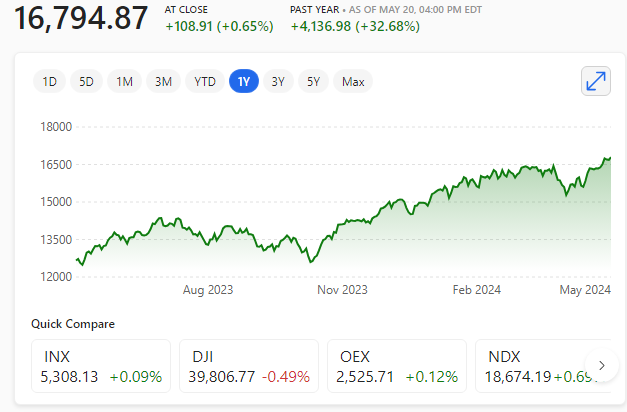

Before selecting individual stocks, it’s crucial to stay informed about broader economic trends. Consult financial news websites and specialized magazines to gauge the performance of various industries. For example, economic volatility or significant global incidents, such as the emergence of a new virus variant, can affect the stock market.

Pay close attention to economic announcements from central banks, like interest rate changes. Monitor the newswires regularly and track market trends.

Explore industries you understand

Focus on investing in sectors you understand well. For instance, if your expertise lies in technology, look towards tech companies. If renewable energy is your area of interest, consider stocks in that domain. Knowledge of the industry can lead to more informed evaluations of companies.

Assess company fundamentals

When evaluating a specific stock, consider the following

Financial Health – Examine the company’s balance sheet, income statement, and cash flow. Scrutinize the levels of company debt. Observe the sales and purchases by directors. Determine if they are financially stable.

Earnings Growth – Verify whether the company has demonstrated consistent growth in its earnings over time.

Valuation – Comparing a stock’s price-to-earnings (P/E) ratio with that of its industry peers is crucial for assessing its market value relative to its earnings.

Competitive Advantage – A company’s competitive edge can stem from a unique product, a strong brand, or other distinctive factors. These elements can set a business apart and enable it to outperform its rivals in the market.

After a general market downturn – there is usually a good opportunity to pick-up good companies at a knock down bargain price.

Diversify your portfolio

It’s wise not to concentrate all your resources in a single area. Diversify your investments across various sectors and asset classes. Look into exchange-traded funds (ETFs) or mutual funds to gain wider market exposure. Consider precious metals such as gold maybe and keep cash on the sidelines for those occasional deals that crop up from time to time.

In summary

Selecting stocks involves thorough research, patience, and a vision for the long-term. Keep in mind that all investments carry some level of risk – past performance is not indicative of future outcomes. It is advisable to seek guidance from a financial advisor prior to making any investment choices.

Remember, investing involves risk, and it’s essential to do thorough research and consider professional advice before making any investment decisions.

RESEARCH! RESEARCH! RESEARCH!

Good luck with your stock-picking choices.