China’s latest tightening of rare earth exports has reignited global concerns over supply chain fragility and strategic resource dependence.

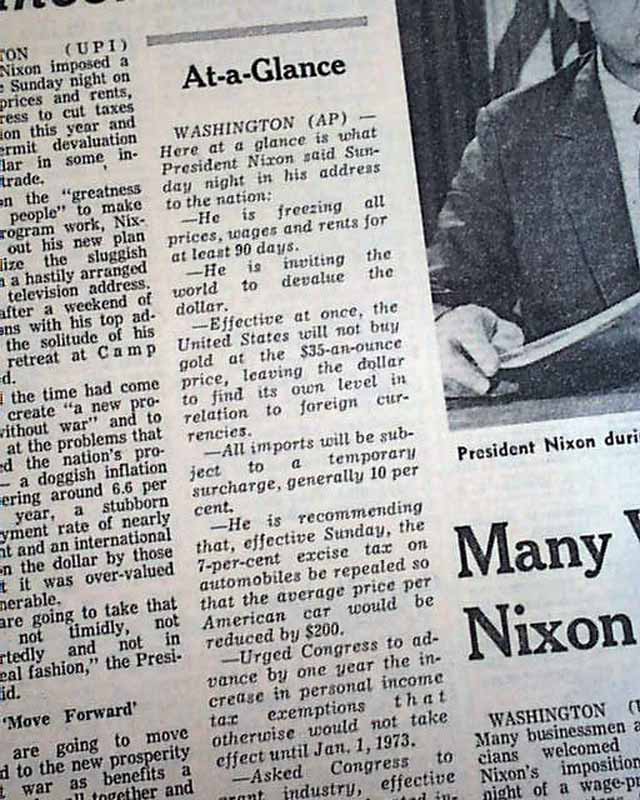

With Beijing now requiring special permits for the export of key rare earth elements—used in everything from electric vehicles to missile guidance systems—the move is widely seen as a geopolitical lever in an increasingly fractured global trade landscape.

Rare earths, despite their name, are not scarce—but China controls over 60% of global production and an even larger share of refining capacity. The new restrictions, framed as national security measures, have already begun to ripple through equity markets.

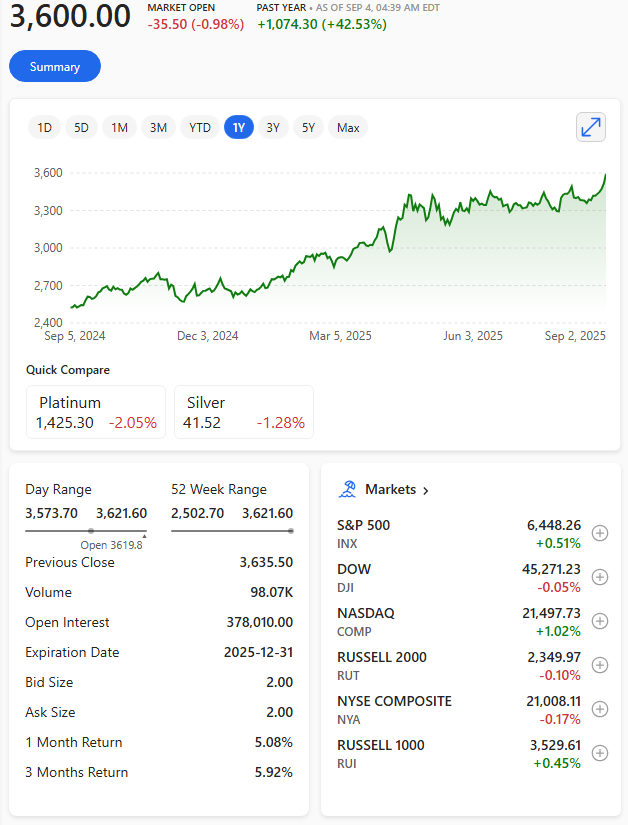

Shares of Western mining firms such as Albemarle and MP Materials surged on the news, as investors bet on alternative sources gaining traction. Meanwhile, defence and tech stocks in Europe dipped, reflecting fears of supply bottlenecks and rising input costs1.

This isn’t China’s first foray into rare earth brinkmanship. Similar curbs in 2010 triggered a scramble for diversification, but progress has been slow.

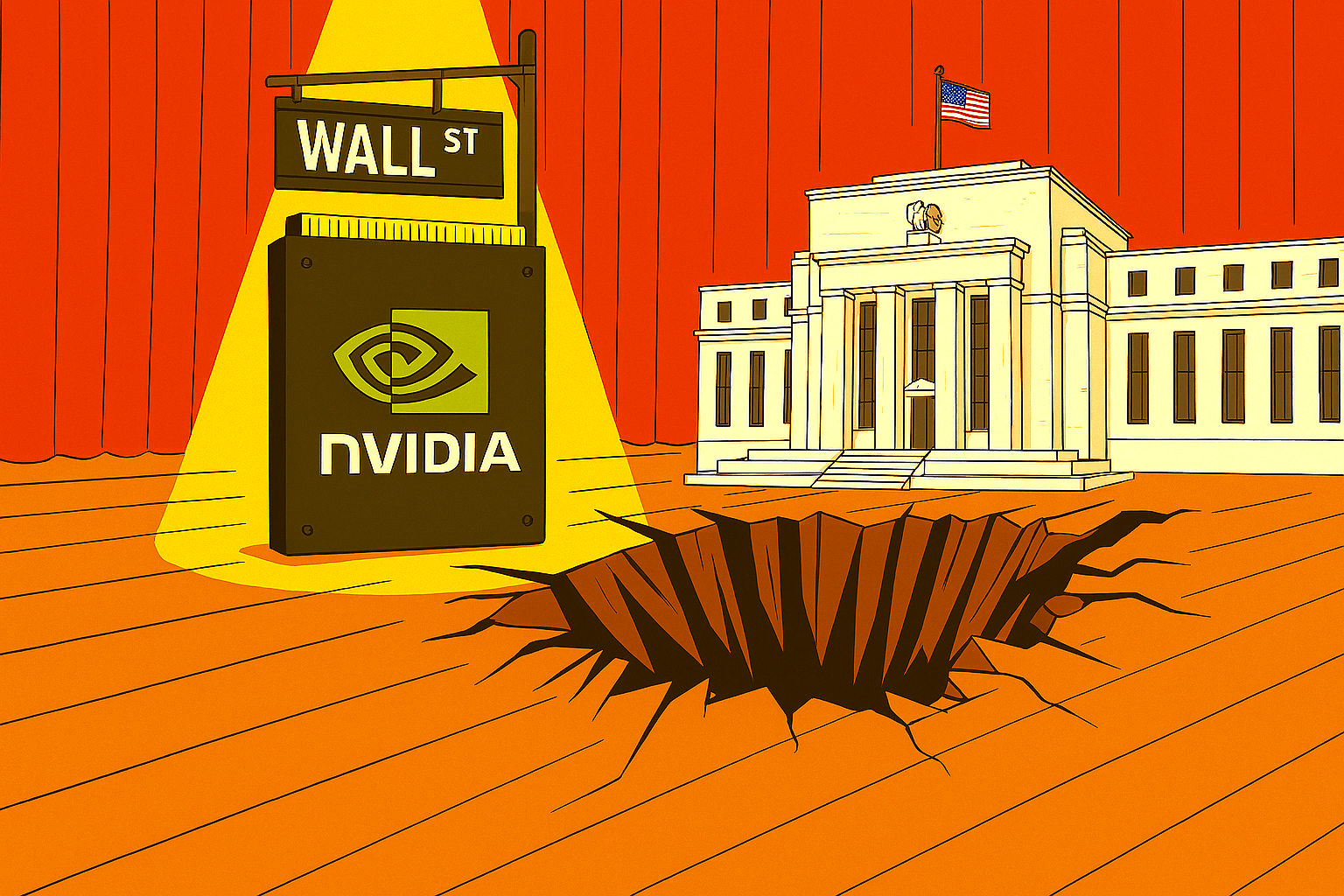

The current squeeze coincides with rising tensions over semiconductor access and military technology, suggesting a broader strategy of resource weaponisation.

For investors, the message is clear: rare earths are no longer just a niche commodity—they’re a geopolitical flashpoint. Expect increased volatility in sectors reliant on high-performance magnets, batteries, and advanced optics.

Countries like the US, Australia, and Canada are accelerating domestic mining initiatives, but scaling up remains a long-term play.

In the short term, China’s grip on rare earths is tightening—and markets are reacting accordingly.

As the global economy pivots toward electrification and AI-driven infrastructure, the battle over these elemental building blocks is only just beginning. The stocks may rise and fall, but the strategic stakes are climbing ever higher.

China’s sweeping export restrictions on rare earths have triggered a sharp rally in related stocks, especially among U.S.-based producers and processors.

The market is interpreting Beijing’s move as both a supply threat and a strategic opportunity for non-Chinese firms to gain ground.

📈 Some companies in the spotlight

- USA Rare Earth surged nearly 15% in a single day and is up 94% over the past five weeks, buoyed by speculation of a potential U.S. government investment and its vertically integrated magnet production pipeline.

- NioCorp Developments, Ramaco Resources, and Energy Fuels all posted gains of approximately between 9–12%.

- MP Materials, the largest U.S. rare earth miner, rose over 6% following news of tighter Chinese controls. The company recently secured a strategic equity deal with the U.S. Department of Defence.

- Albemarle, Lithium Americas, and Trilogy Metals also saw modest gains, reflecting broader investor interest in critical mineral plays.

| Company / Sector | Stock Movement | Strategic Note |

|---|---|---|

| MP Materials (US) | ↑ +6% | DoD-backed, key US supplier |

| USA Rare Earth | ↑ +15% | Magnet pipeline, gov’t investment buzz |

| NioCorp / Ramaco / Energy Fuels | ↑ +9–12% | Domestic mining surge |

| European Defence Stocks | ↓ 2–4% | Supply chain fears |

| Chinese Magnet Producers | ↔ / ↓ | Export permit uncertainty |

China’s new rules, effective December 1st, require export licences for any product containing more than 0.1% rare earths or using Chinese refining or magnet recycling tech. This has intensified scrutiny on global supply chains and elevated the strategic value of domestic alternatives.

🧭 Investor sentiment is shifting toward companies that can offer secure, non-Chinese sources of rare earths—especially those with downstream capabilities like magnet manufacturing. The rally suggests markets are pricing in long-term geopolitical risk and potential government backing.

Weekend update

Is President Trump in control of the stock market? A comment on TruthSocial suggesting that more China tariffs might be introduced in response to China’s restrictions on rare earth materials reportedly wipes out around $2 trillion from U.S. stocks.

Then it reverses as Trump says, ‘All will be fine’. Stocks climb back up. What’s going on?

It’s just a game.

But who is the game master?