In recent months, the S&P 500 has shown signs of evolving from a broad economic barometer into something far more concentrated: a proxy for artificial intelligence optimism.

While traditionally viewed as a diversified snapshot of American corporate health, the index’s current composition and market behaviour suggest it’s increasingly tethered to the fortunes of a handful of AI-driven giants.

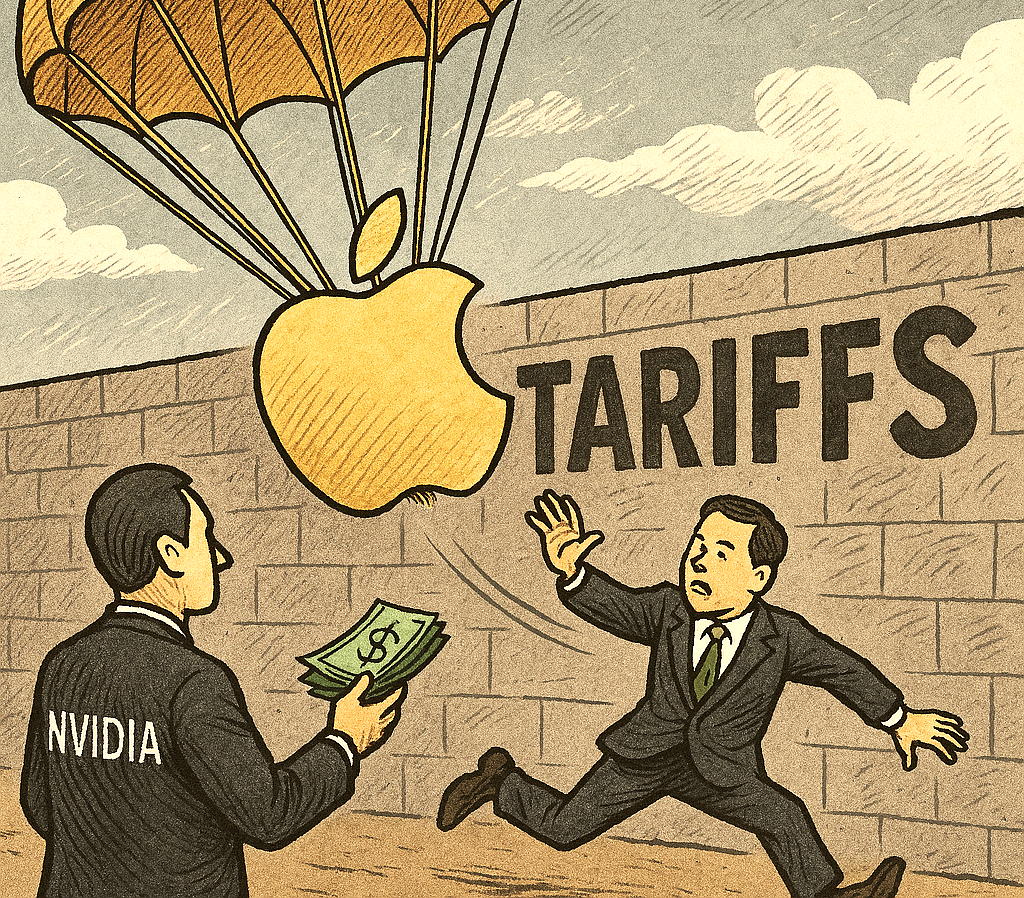

At the heart of this transformation is the dominance of mega-cap tech firms. Microsoft, Nvidia, Alphabet, Amazon, Meta, and Apple now account for a disproportionate share of the index’s total market capitalisation.

As of late 2025 that heady combination of AI led tech represents just over 30% of the S&P 500.

These companies aren’t merely adjacent to AI—they’re building its infrastructure, shaping its software ecosystems, and embedding it into consumer and enterprise products.

Nvidia, for instance, has become synonymous with AI hardware, its valuation soaring on the back of demand for high-performance chips powering generative models and data centres.

Recent analysis reveals that roughly 8% of the S&P 500’s weight is directly tied to AI-related revenue.

An additional 25 companies within the index are actively developing AI technologies, even if those efforts haven’t yet translated into standalone revenue streams. This includes sectors as varied as autonomous vehicles, quantum computing, and predictive analytics.

Investor behaviour has only amplified this shift. The index’s recent rally has been fuelled largely by enthusiasm for AI breakthroughs, with capital flowing into stocks perceived as future beneficiaries of machine learning and automation.

This momentum has led some analysts to warn of valuation bubbles, urging diversification away from AI-heavy names in case of a sector-wide correction.

Narrower narrative

Symbolically, the S&P 500’s identity is shifting. Once a mirror of industrial and consumer strength, it now reflects a narrower narrative—one of technological acceleration and speculative belief in artificial intelligence.

This raises philosophical questions about what the index truly represents: is it still a measure of economic breadth, or has it become a momentum gauge for a single transformative theme?

For editorial observers, this evolution offers fertile ground. The index’s transformation can be read not just as a financial trend, but as a cultural signal—suggesting that AI is no longer a niche innovation, but the dominant lens through which investors, executives, and policymakers interpret the future.

Whether this concentration proves visionary or vulnerable remains to be seen.

But one thing is clear: the S&P 500 is no longer just a mirror of the American economy—it’s increasingly a reflection of our collective bet on intelligent machines.

30% of S&P 500

As of 2025, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Apple—often grouped as part of the ‘Magnificent Seven’—collectively represent approximately 30% of the S&P 500’s total market capitalisation.

That’s a staggering concentration for just six companies in an index meant to reflect the broader U.S. economy.

For context, their combined performance was responsible for roughly two-thirds of the S&P 500’s total gains in 2024—a clear signal that the index’s movement is increasingly tethered to the fortunes of a few dominant tech giants.