Tory HQ – what are we going to do?

OpenAI has developed a new AI tool named Sora that can generate highly detailed videos of up to 60 seconds from descriptive text prompts.

The tool has raised concerns about its potential misuse, particularly in the creation of deepfakes and disinformation.

On the other hand, it is a remarkable achievement in the current AI arena and created in such a short space of time.

OpenAI has stated that it is working with experts in areas like misinformation, hateful content, and bias, who are testing Sora.

This is a problem for Japan as it has a growing elderly population. It means Japan has one older person for every three citizens. 33% of the population is elderly and not part of its workforce.

If this trend continues Japan is on course to lose around 40% of its workforce and that is a massive problem for Japan’s economy.

According to a survey conducted by Rakuten Insight in 2023, dogs were the most popular pets in Japan, followed by cats and fish.

The Office for National Statistics said U.K. gross domestic product shrank by 0.3% in the final three months of the year, giving the second consecutive quarterly decline.

That follows a fall between July and September 2023. The UK is considered to be in recession if GDP falls for two successive three-month periods.

All three main sectors of the economy contracted in Q4, with declines of 0.2% in services, 1% in production and 1.3% in construction output, the ONS reported.

A technical recession is a term used to describe two consecutive quarters of decline in output. It is measured by the Gross Domestic Product (GDP), which is the overall output of goods and services in a country.

A ‘technical’ recession is usually caused by slowing growth or an isolated event rather than a major underlying cause.

High inflation affected domestic demand and private consumption in what’s now the world’s fourth-largest economy.

Provisional gross domestic product contracted 0.4% in the fourth quarter compared with a year ago, after a revised 3.3% slump in the July-September period. This was below the estimate of a 1.4% growth.

The Japanese economy also contracted 0.1% in the fourth quarter from the previous quarter, after shrinking a revised 0.8% in the Q3. This was also weaker than the expected 0.3% expansion.

Japan has lost its spot as the world’s third-largest economy to Germany, as the country unexpectedly slipped into recession.

A technical recession is a term used to describe two consecutive quarters of decline in output. It is measured by the Gross Domestic Product (GDP), which is the overall output of goods and services in a country.

A technical recession is usually caused by slowing growth or an isolated event rather than a major underlying cause.

Bitcoin also broke through the 51000 level, marking the first time it has hit this value since December 2021.

The price rise continues a rally that began in January 2023. Bitcoin is up more than 21% in 2024 so far.

January U.K. inflation held steady at 4% year-on-year benefitting from easing prices for furniture and household goods, food and non-alcoholic beverages.

According to the latest figures from the Office for National Statistics (ONS), prices for food and non-alcoholic beverages fell on a monthly basis by 0.4%, marking the first decrease since September 2021.

The core CPI figure excluding volatile food, energy, alcohol and tobacco prices annual reading was 5.1%, below the 5.2% estimate – but only a micro 0.1% difference.

The latest inflation data is a reflection of what is happening in the labour market: a tight labour supply is sustaining high wage growth and thus underlying inflationary pressure.

Inflation still sits double the BoE target of 2%.

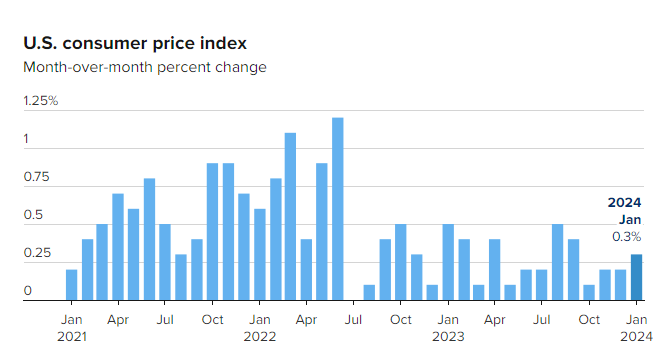

The new inflation figure raised doubts that the Federal Reserve would be able to cut rates several times this year, a key part of the equity market bull run case.

The consumer price index rose 0.3% in January 2024 from December 2023. CPI was up 3.1% year-to-year. Economists expected CPI to have increased by 0.2% month over month in January and 2.9% from a year earlier.

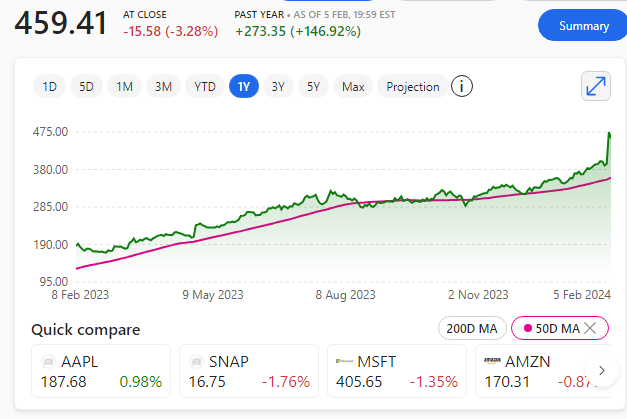

The Amazon executive chairman notified the U.S. SEC – Securities and Exchange Commission of the sale of 11,997,698 shares of common stock on the 7th and 8th February 2024.

The collective value of the shares of Amazon, which is based in Seattle where he founded the company in a garage around thirty years ago, was about $2.04 billion.

In a separate SEC filing, Bezos listed the proposed sale of 50 million Amazon shares on or around 7th February 2024 with an estimated market value of $8.4 billion.

Jeff Bezos moved from Seattle to Miami in November 2023, shortly before he announced his plan to sell up to 50 million Amazon shares by January 2025.

Florida does not have a capital gains tax, unlike Washington state, which imposes a 7% tax on any gains of more than $250,000 from the sale of stocks and bonds. Therefore, by moving to Florida, Bezos could save up to $600 million in taxes on his stock sale – more than enough for a luxury yacht and 2 or 3 more luxury properties.

But, of course, we do not know if this was the real reason for his move.

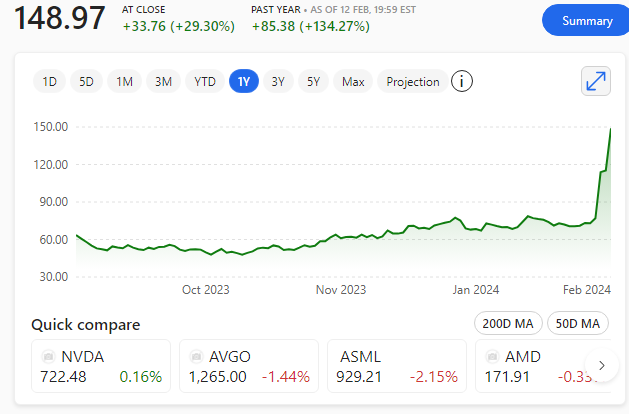

Arm shares soared 29% on Monday, extending last week’s rally as investors continue to applaud the chipmaker’s better-than-expected third-quarter earnings and its position in the artificial intelligence boom.

Arm is now up 93% since it reported quarterly figures on 8th February 2024. There is no obvious reason for the 29% climb on Monday. The fear of missing out (FOMO) could be playing a part in the meteoric share price move.

The stock has almost tripled since Arm’s initial public offering in September 2023, closing at $148.97 and is now worth almost $153 billion, that’s a little more than $30 billion below Intel’s market cap.

Last week, Arm said it could double the price for its latest instruction set, which accounts for 15% of the company’s royalties, suggesting it can expand its margin and make more money off new chips. It also said it was breaking into new markets, such as cloud servers and automotive, due to AI demand.

Its royalty strength combined with Arm’s optimistic growth forecast has made the company the latest AI darling among investors, despite a higher earnings multiple than Nvidia or AMD.

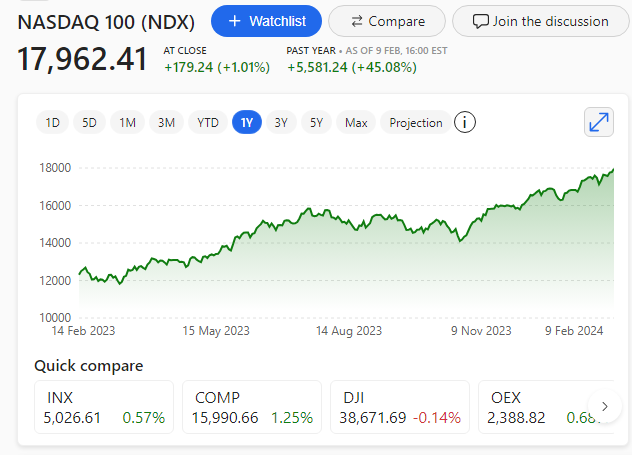

A solid earnings season, easing inflation data and a resilient economy have charged 2024′s market rally. It has helped propel the Nasdaq 100 to close at these new highs!

We are enjoying good news at an economic and earnings level, and the market is reacting positively. The longer the good news story plays out, the more likely it will be that the market will hold from here.

FOMO or the fear of missing out is likely playing its part here too.

Stocks rose on Friday 9th February 2024 after December’s revised inflation reading came in lower than first reported, and the S&P 500 closed above the key 5,000 level as strong earnings and economic news came in.

A solid earnings season, easing inflation data and a resilient economy have charged 2024′s market rally. It propelled the S&P 500 to close above the 5,000 level after first touching the milestone during the trading week. The index first crossed 4,000 in April 2021.

We are enjoying good news at an economic and earnings level, and the market is reacting positively. The longer the good news story plays out, the more likely it will be that the market will hold from here.

But it won’t take much to spoil the party, right now I don’t know what that might be…?

FOMO or the fear of missing out is likely playing its part here too.

After a decade-long bull run throughout the 1980’s, the Nikkei 225 index reached an all-time high of 38,915 on December 29, 1989, the last trading day of the year.

Few could have imagined, on New Year’s Eve of 1989, that the index would be lower 34 years later. As the New Year arrived, the bubble burst.

And now, Japan’s stock markets are on a tear and closing in on that elusive 38195 high of 1989 – but there’s a catch – the Zombies are coming.

Zombie firms are businesses that are unprofitable and struggling to keep afloat. They don’t have excess capital to invest and grow the business, or to pay down the loan capital.

Concerns about zombie firms are coming into focus as the Bank of Japan is tipped to raise interest rates in 2024 for the first time since 2007.

Japan’s stock markets have been on a meteoric run since the start of 2023, repeatedly breaching 33-year highs and outperforming the rest of Asia.

However, there are rising concerns that so called ‘zombie’ firms, which are unprofitable and struggling to keep afloat, could cut short that rally. The Bank of Japan is widely expected to raise interest rates this year, and that could easily tip many of these firms into bankruptcy, which could have a broader impact on the economy and stock market,

Zombie firms are nothing new in Japan. They first emerged after the stock ‘bubble’ and subsequent crash of the 1990s, when banks continued to support companies that would have otherwise gone bankrupt.

The pandemic of 2020 accelerated the problem of zombie businesses, with the number of zombie firms in Japan reportedly jumping by around 33% between 2021 and 2022.

Some experts argue that zombie firms are a drag on Japan’s productivity, innovation, and growth, as they occupy resources and crowd out more efficient firms. The debate on how to deal with zombie firms is ongoing and may have implications for Japan’s economic recovery and future prospects.

Others suggest that zombie firms may have a positive effect, such as preserving employment, social stability, and industrial diversity.

Surely, there is no room for inefficiently run businesses making little or no profit in any economy.

Watch out for the Zombies!

Many major indices have recorded double-digit gains. However, some analysts have warned that the rally may not last, as it has been driven by a few large-cap technology and growth stocks, while many other sectors and regions have lagged behind.

A stock market rally is a broad and rapid rise in share prices, often defined as a 20% increase from a recent low.

This could indicate a lack of breadth and sustainability in the rally, and potentially signal a market pullback, correction or even a crash in the future.

Chartists with their technical analysis might see a pattern that points to a substantial upside, but they should not get too carried away with their own observations, right now would be a sensible time for markets to find level ground, if only temporarily.

The bullish view is that the ‘laggards’ should catch up the ‘mega cap’ stalwarts once again. The bearish view is that the ‘mega cap’ stocks’ will realise they’ve gone too far and need to ride back to the rest of the market. Too few stocks in the same sector hold the balance of power – go check out the Magnificent 7 or even the old FANG stocks.

Either way, there ought to be an opportunity for underrepresented sectors and industries to gain lost ground.

The question is, will there be a pause to allow laggards to catch-up, or will the mega caps simply continue on their march?

The index, which first breached the 4,000 level in April 2021, added around 0.82% to close at 4,995.06. During session highs, the S&P hit 4,999.89. Quarterly results signalled a thriving U.S. economy.

Are investors getting swept away with the latest wave of AI related tech results? Quite possibly, as some of what we’re seeing could be based on FOMO (fear of missing out) as traders/investors don’t want to be left behind like they were last year.

However, one undeniable fact is that the U.S. economy isn’t facing as recession any time soon as predicted by many.

.

The U.S. economy added 353,000 jobs and average hourly pay jumped, while the unemployment rate held steady at 3.7%, the Labour Department said.

The report extended more job gains that has surprised economists, who have expected a jump in interest rates since 2022 to slow the economy. It hasn’t. No recession or slowdown in the economy so far.

Analysts now say the job market gain and strength make an early interest rate cut less likely.

The U.S. employment data delivered quite a shock, easily beating expectations, with earnings much higher than expected. Stock markets gained and are at elevated levels for the Dow, Nasdaq and the S&P 500. Record highs have been set – are the highs?

Market analysts said these numbers show the U.S. economy is strong and will change the mindsets of those expecting an early interest rate cut.

Expectations of a recession are off the table too, for now.

It’s not going to end well; economists warn with global borrowings hitting a record of $307.4 trillion in September 2023.

Both emerging markets and high-income countries have seen a substantial rise in their debt levels. These levels have grown by a some $100 trillion from 10 years ago. The debt has been fueled in part by a higher interest rate environment.

Initially, with borrowing costs at historic lows, countries have benefitted from very low interest rate for the debt. That’s changed.

The next 10 years will likely become known as the ‘Decade of Debt.’

As a share of the global gross domestic product, debt has risen to 336%. This compares to an average debt-to-GDP ratio of 110% in 2012 for advanced economies, and 35% for emerging economies. It was 334% in the fourth quarter of 2022, according to the most recent global debt monitor report by the Institute of International Finance.

To meet debt payments, it is estimated that around 100 countries will have to cut spending on critical infrastructure including health, education and social projects.

Countries that manage to improve their fiscal situation could benefit by attracting capital, labour and investment. However, those that do not could lose talent and revenue and further increase their debt burden.

$307.4 trillion of world debt, and counting!

Our nearest galaxy is the Milky Way and, in a year, it moves 17 billion kilometres from where it was one a year ago.

So, by virtue of this fact, we have never been in the same place twice. Earth moves with the Milky Way.

The Milky Way galaxy is moving through space at around 550km/s – now that’s fast!

Founded by Mark Zuckerberg and his fellow Harvard students in 2004, Facebook has grown from a college network to a global phenomenon, with over 3 billion monthly users and counting.

Facebook has also changed the way we communicate, share, and connect with each other online, enabling us to keep in touch with friends and family, discover new content and communities, and express ourselves freely.

Controversy

However, Facebook has also faced many controversies and challenges over the years, such as privacy issues, misinformation, child safety, and political scrutiny. Facebook has been accused of violating user data, spreading fake news and hate speech, enabling cyberbullying and online abuse, and influencing elections and public opinion.

Facebook has also faced competition from other platforms, such as TikTok, Snapchat, and X, as well as regulatory pressure from governments and activists.

Evolving

As Facebook turns 20, it is still evolving and expanding under its parent company Meta, which also owns Instagram and WhatsApp. Meta’s vision is to create a metaverse, a virtual reality where people can interact and experience immersive digital worlds. Meta also aims to invest in artificial intelligence, blockchain, and cloud computing, as well as social good initiatives, such as connectivity, education, and health.

Facebook’s future is uncertain, but it is undeniable that it has shaped the history and culture of the internet and the world, for good and bad.

See BIG tech results here as Meta share price gains 20% after positive earnings impress Wall Street.

Mark Zuckerberg is currently the third richest person in the work coming with a wealth of $161 billion. Not a bad income for 20 years’ work.

Whatever happened to myspace?

It is recorded on a blockchain, which is a type of digital ledger that stores information in a secure and decentralised way.

A NFT is used to certify authenticity and ownership of a specific digital asset and specific rights relating to it, such as an artwork, music, a game, or a sports event.

A NFT can be bought and sold on digital markets and may also contain smart contracts that give the creator a share of any future sale of the token. NFTs are different from cryptocurrencies, which are fungible, meaning they can be exchanged for other units of the same value.

NFTs are also different from regular digital files, which can be easily and endlessly duplicated. NFTs are one-of-a-kind assets in the digital world that have value based on their scarcity, uniqueness, and verifiability.

According to Statista, the annual market cap of NFT transactions worldwide reached 30.7 billion U.S. dollars in 2021, but lost value from this high as the market drifted.

NFTs are also expanding into various segments and industries, such as art, music, gaming, sports, real estate, and more. Some of the top NFT trends to watch in the future may include artificial intelligence, fractional NFTs, music NFTs and NFT ticketing token. NFTs are also facing some challenges, such as regulation, legal battles, environmental impact, and market volatility. NFTs are a new way of creating, owning, and exchanging digital assets. But will it last?

People may have different opinions on the future of NFTs. Some people may think that NFTs are here to stay, as they offer a new way of creating, owning, and exchanging digital assets that are unique, scarce, and verifiable. They may also see NFTs as a way of supporting artists, creators, and innovators, as well as a way of expressing themselves and their values. Some people may also believe that NFTs have a lot of potential to transform various industries and sectors, such as art, music, gaming, sports, real estate, and more.

However, some people may think that NFTs are not here to stay, as they face many challenges and risks, such as regulation, legal battles, environmental impact, and market volatility. They may also see NFTs as a hype, a bubble, or a scam, that are driven by speculation, greed, and FOMO (fear of missing out). Some people may also question the value and utility of NFTs, as they do not confer any ownership rights, benefits, or guarantees to the buyers. These same people likely thought cryptocurrency such a Bitcoin was also a fad.

Ultimately, the future of NFTs may depend on how they evolve, adapt, and innovate, as well as how they are perceived, accepted, and regulated by the society.

NFTs may be here to stay, or they may fade away, but they have certainly made an impact on the digital world.

AI trading bots are becoming more popular among investors who want to take advantage of the speed, accuracy, and efficiency of AI technology. But is this a good thing for the future of investing?

AI ‘trading bots’ could transform the world of investing

AI ‘trading bots’ also pose some challenges and risks

AI ‘trading bots’ are not a mystical ‘get rich quick solution’ that can guarantee success in the world of investing. They are tools that require careful selection, evaluation, and supervision by human input and for the human trader to maintain ultimate control.

We should always be aware of the benefits and limitations of AI technology.

Year-on-year inflation hit nearly 65%, according to the Turkish Central Bank’s figures released Monday 5th January 2024

The consumer price index (CPI) for the country of 85 million people increased by 64.86% annually, up slightly from the 64.77% of December.

Sectors with the largest monthly price rises were health at 17.7%, hotels, cafes and restaurants at 12%, and miscellaneous goods and services at just over 10%. Clothing and footwear were the only sectors showing a monthly price decrease, with -1.61%.

Food, beverages and tobacco, as well as transportation, all increased between roughly 5% and 7% month-on-month, while housing was up 7.4% since December 2024.

Interest rate hike to 45%, see report here.