The latest inflation data for the month of July 2025 shows a mixed picture for the U.S. economy, as price pressures remain persistent despite signs of cooling in some sectors.

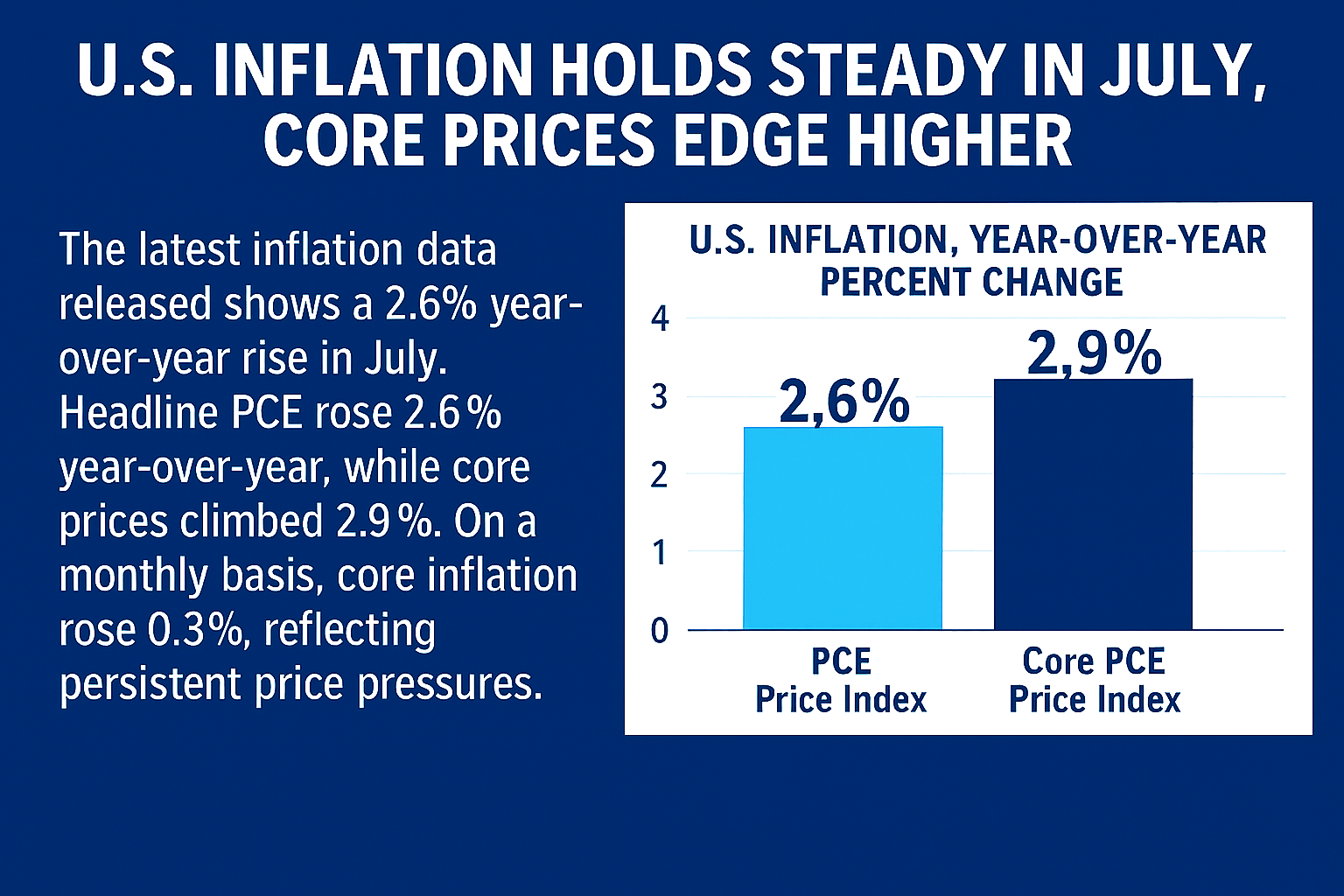

According to the Bureau of Economic Analysis, the headline Personal Consumption Expenditures (PCE) Price Index rose 2.6% year-over-year, unchanged from June, while the core PCE index—which excludes volatile food and energy costs—ticked up to 2.9%, marking its highest annual rate since February.

On a monthly basis, core prices increased 0.3%, in line with expectations, while consumer spending rose 0.5%, suggesting households are still resilient despite elevated costs. Personal income also climbed 0.4%, reinforcing the narrative of steady wage growth.

The Federal Reserve, which uses the PCE index as its preferred inflation gauge, faces a delicate balancing act.

With inflation still above its 2% target and labor market data showing signs of softening, markets are increasingly betting on a rate cut at the Fed’s September meeting.

Fed Chair Jerome Powell, speaking at Jackson Hole, reportedly acknowledged the risks to employment but maintained a cautious tone on policy shifts.

Investors and traders alike now see an 80% chance of a quarter-point cut, keeping all eyes on upcoming jobs data.