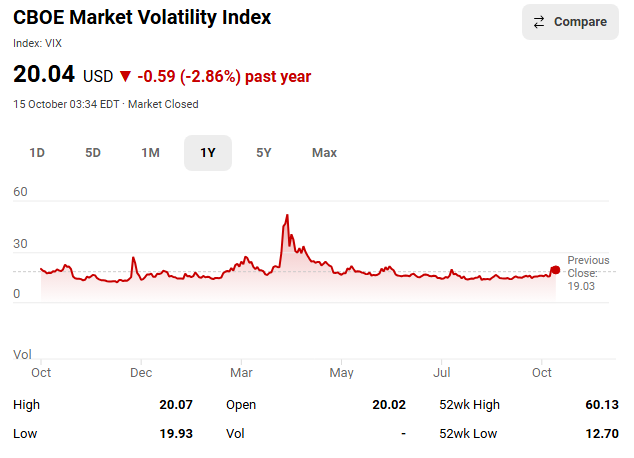

Wall Street’s so-called ‘fear gauge’—officially known as the CBOE Volatility Index (VIX)—has surged to its highest level since April 2025, jolting investors out of a months-long lull and reigniting concerns about market stability.

On 14th October 2025, the VIX briefly spiked above 22.9 before settling near 19.70, a sharp rise from recent lows that had hovered below 14.

The VIX is a real-time market index that reflects investors’ expectations for volatility over the next 30 days. Often dubbed the ‘fear gauge’, it’s derived from S&P 500 options pricing and tends to rise when traders seek protection against sharp market declines.

A reading above 20 typically signals heightened anxiety and increased demand for hedging strategies.

This latest spike was triggered by renewed tensions between the U.S. and China, including Beijing’s announcement of sanctions against American subsidiaries of South Korean shipbuilder Hanwha Ocean.

The move, widely seen as retaliation for Washington’s export controls, sent shockwaves through tech-heavy indices. The Dow dropped over 500 points, while the Nasdaq slid nearly 2%.

For months, markets had basked in a rare stretch of calm, buoyed by AI-driven optimism and resilient earnings. But the VIX’s resurgence suggests that investors are now recalibrating their risk assessments.

It’s not just about trade wars—concerns over interest rates, geopolitical instability, and tech sector overvaluation are converging.

While a rising VIX doesn’t guarantee a crash, it often precedes periods of turbulence. For editorial observers, it’s a symbolic pulse check on investor psychology—a reminder that beneath euphoric rallies, fear never fully disappears.

As Wall Street braces for further shocks, the fear gauge is once again flashing caution. Whether it’s a tremor or a tremor before the quake remains to be seen.