“Look at this… the actual umbrella Rishi Sunak didn’t use during the UK 2024 election announcement!”

This suggestion is made as the UK’s economy steadily recovers from the recession caused by the pandemic, while policymakers are dealing with inflationary challenges.

The IMF’s recommendation is grounded in its assessment of the UK’s economic trajectory.

Growth Forecast

The International Monetary Fund has upgraded its growth forecast for the UK in 2024, signaling a positive outlook. It anticipates growth of 0.7% this year and 1.5% in 2025.

Inflation

The IMF anticipates that UK inflation will decline to near the Bank of England’s target of 2% and stabilise at this rate in early 2025, indicating that inflationary pressures are within manageable limits.

Soft Landing

The UK economy is said to be approaching a ‘soft landing‘ following the mild recession of the previous year. Policymakers are focused on finding a balance between fostering growth and managing inflation.

The Bank of England’s Monetary Policy Committee (MPC) has been closely monitoring economic indicators and inflation trends. Here’s why the IMF’s recommendation matters:

Interest Rate Peaks

The Monetary Policy Committee has indicated that interest rates might have reached their peak. The current restrictive monetary policy is having an impact on the actual economy and the dynamics of inflation.

Market Expectations

Analysts anticipate the first interest rate cut by September 2024 at the latest. Market expectations align with this projection, with the base interest rate likely to be lowered to 4% by the end of 2025.

Balancing Act

Policymakers face the delicate task of supporting economic recovery while preventing runaway inflation. The IMF’s suggestion aims to strike this balance.

Variable Rate Mortgages

If you have a variable rate mortgage, a rate cut could reduce your monthly payments. However, keep an eye on your lender’s response to any rate changes.

Fixed Rate Mortgages

Fixed-rate borrowers won’t immediately benefit from rate cuts, but they should still monitor the situation. If rates continue to fall, refinancing might become attractive.

Savings Accounts

Lower interest rates typically lead to diminished returns on savings accounts. It may be wise to diversify your investments to seek potentially higher yields in other areas.

Fixed-Term Deposit

Current fixed-term deposits will remain unaffected; however, new deposits might generate lower yields. It is advisable to carefully assess your alternatives.

The IMF’s recommendation highlights the intricate balance between fostering economic recovery and managing inflation. As the Bank of England considers its next steps, it is crucial for borrowers and savers to remain informed and adjust their financial strategies as needed.

For homeowners, investors, and savers alike, grasping the potential consequences of rate cuts is key to making well-informed choices in an ever-changing economic environment.

Disclaimer: The information provided here is based on current projections and should not be considered financial advice. It is not given as financial advice – it is for discussion and analysis only!

Consult a professional advisor for personalised recommendations.

Remember – always do your careful research first!

RESEARCH! RESEARCH! RESEARCH!

Update

The Bank of England has given its strongest hint yet that interest rates could be cut this summer. This comment was observed in a recent speech given by the deputy governor of the Bank of England.

Shoppers were deterred from the high street, the Office for National Statistics (ONS) said Friday 24th May 2024.

Economists expected a smaller retail sales fall of 0.4%.

Sales volumes declined across multiple sectors, with clothing retailers, sports equipment, games and toys stores, and furniture outlets experiencing a downturn as adverse weather conditions led to a decrease in customer visits, according to the ONS.

March’s figure was revised from flat to a 0.2% decline.

Sales increased by 0.7% over the three months leading up to April, compared to the preceding three months, despite a sluggish December and holiday season. However, there was a 0.8% decline when compared with the same period last year.

Will the Bank of England (BoE) drop interest rates in June now that inflation is down to 2.3% – close to the target of 2%?

Election Date: 4th July 2024 – let the fireworks begin

The Conservative Party, led by Rishi Sunak, is facing significant challenges in opinion polls, trailing behind the opposition Labour Party.

The economy, immigration, health services, and cost of living have been identified as key issues for voters.

Labour, led by Sir Keir Starmer, is considered the clear frontrunner, with a substantial lead in recent polls.

Since 2010, the Conservatives have seen five prime ministers: David Cameron, Theresa May, Boris Johnson, Liz Truss, and now Rishi Sunak.

Sir Keir described the past 14 years as “Tory chaos” and emphasised that it’s time for change.

So, the UK is gearing up for an early election, and the outcome will be closely watched both domestically and internationally

Following the agreement, firms from various nations, including the UK, China, Canada, the U.S., France, South Korea, and the United Arab Emirates, have pledged to voluntarily commit to the secure development of their cutting-edge AI models.

AI model developers who have not already done so agreed to issue safety frameworks that detail how they will address the challenges posed by their advanced models, including the prevention of technology misuse by malicious entities.

These frameworks will feature ‘red lines’ that tech companies will establish to delineate the types of risks associated with advanced AI systems that are deemed ‘unacceptable.’ These risks encompass, but are not limited to, automated cyberattacks and the potential for bioweapons.

In the event of such dire scenarios, companies have declared their intention to introduce a ‘kill switch’ that would halt the development of their AI models should they be unable to ensure the mitigation of these risks.

“It is unprecedented for so many prominent AI firms from diverse regions of the world to concur on identical commitments regarding AI safety,” Rishi Sunak, the UK Prime Minister reportedly said on Tuesday 21st May 2024.

He further noted that these commitments would guarantee that the world’s foremost AI companies will maintain transparency and accountability concerning their safe AI development strategies.

This agreement builds upon a prior set of pledges made in November 2023 by entities engaged in the creation of generative AI software.

The involved companies have consented to seek feedback on these standards from ‘trusted actors,’ which include their respective national governments when suitable, prior to their publication in anticipation of the forthcoming AI summit – the AI Action Summit scheduled to take place in France in early 2025.

The headline inflation rate decreased from 3.2% in March, marking the first instance since July 2021 that inflation has fallen below 3%, nearing the Bank of England’s target of 2%.

Contrary to the predictions of economists surveyed by Reuters, who expected a more significant drop to 2.1%, services inflation – a critical indicator monitored by the BOE due to its significance in the UK economy and as a gauge of domestically generated price increases – only fell marginally to 5.9% from 6%, missing the anticipated 5.5% from the BOE.

Core inflation, which excludes energy, food, alcohol, and tobacco, decreased to 3.9% in April from 4.2% in March.

The substantial decline in the headline rate was largely anticipated due to the year-on-year decrease in energy prices. However, investors shifted their attention to core and services inflation following indications from BOE policymakers of a potential interest rate cut later in the summer, contingent on new data.

After the data release, the market-makers probability of a June rate cut plummeted to 15% from 50% and the chance of an August cut also fell to 40% from 70%.

Lingering concerns over underlying inflationary pressures mean a June rate cut is unlikely. However, these figures may convince more rate setters to vote to ease policy, providing a signal that a summer rate cut is still a possibility.

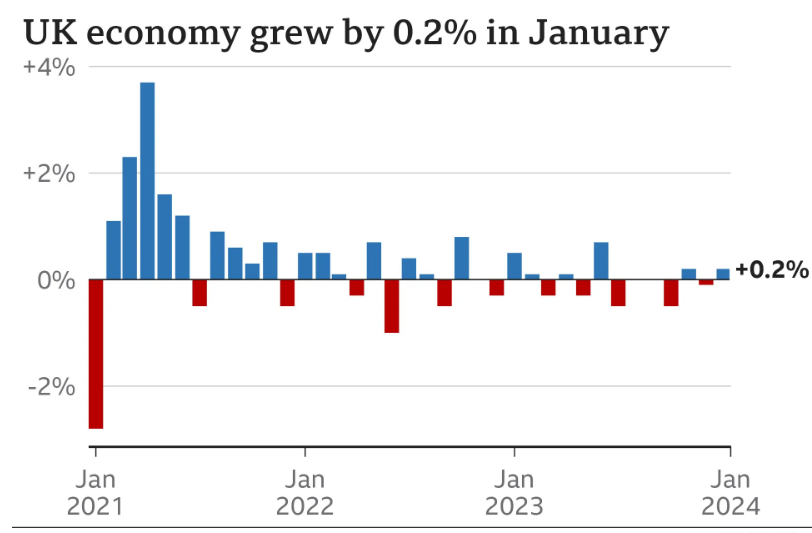

Official figures released on Friday revealed this growth, which exceeded the 0.4% predicted by economists surveyed by Reuters for the previous quarter.

In the latter half of 2023, the U.K. experienced a mild recession due to ongoing inflationary pressures impacting economic performance.

Technically there is no official definition of a recession – however, two straight quarters of negative growth is widely accepted as a technical recession.

The production sector in the U.K. saw an expansion of 0.8% from January to March, whereas the construction sector experienced a decline of 0.9%. The economy witnessed a growth of 0.4% in March on a monthly basis, succeeding a 0.2% increase in February.

According to the Office for National Statistics, the services sector, which is vital to the U.K. economy, grew for the first time since the first quarter of 2023. This growth of 0.7% was primarily propelled by the transport services industry, marking its most significant quarterly growth since 2020.

‘Much Ado About Nothing’ is a comedy by William Shakespeare, written around 1598 – 1599. The play is included in the First Folio, published in 1623, and is set in the Italian city of Messina.

UK airports such as Heathrow, Gatwick, Edinburgh, Birmingham, Bristol, Newcastle, and Manchester have all reported delays in arrivals late on Tuesday 7th May 2024 due to a Border Force issue.

E-gates, which are automated gates utilizing facial recognition technology to verify a person’s identity, allow entry into the country without the need for interaction with a Border Force officer.

According to the government’s website, there are over 270 e-gates installed at 15 air and rail ports across the UK, designed to facilitate faster entry into the country. However, this recent outage has necessitated manual processing of passengers by Border control staff.

The Home Office, responsible for the Border Force, announced in an early Wednesday 8th May 2024 statement: ‘eGates at UK airports resumed operation shortly after midnight.‘

A Home Office spokesperson reportedly attributed the disruptions to a ‘system network issue’ (whatever that means) – initially reported at approximately 19:50 BST, indicating the problems lasted over four hours. They assured that ‘border security was never jeopardized, and there is no evidence of any malicious cyber activity.’

Britain’s automated border gates system experienced a crash in May 2023, leading to extensive queues and delays for passengers lasting several hours.

Additionally, the country’s air traffic system suffered a meltdown in August 2023 due to a technical issue, disrupting the National Air Traffic Service for a prolonged period. The recurring nature of these incidents raises questions about the underlying causes.

Why does it KEEP happening?

The Organisation for Economic Co-operation and Development (OECD) has projected a 1% increase in the UK’s gross domestic product (GDP) for 2025, which lags behind the growth rates of other G7 nations, including Canada, France, Germany, Italy, Japan and the US.

The OECD, a globally recognised think tank, has described the UK’s economic outlook as ‘sluggish‘ for the current year. The organization attributes the lackluster performance to the cumulative effects of consecutive interest rate hikes in the UK.

Additionally, the OECD has cautioned that persistent elements of high inflation and the uncertainty surrounding the Bank of England’s interest rate decisions may deter investment.

The latest forecast for the UK economy predicts a 0.4% growth for this year, a revision downward from the OECD’s earlier estimate of 0.7% growth. Consequently, Germany is the only G7 country projected to have slower growth than the UK this year.

The new all-time high was likely propelled by a weakening pound and reduced tensions in the Middle East. The FTSE 100 has been the laggard for many months.

The index concluded Monday at 8023 points, setting a new record and eclipsing its previous peak of 8012 from February of the preceding year.

At the close, it had risen by 1.62%, with retailers such as, Tesco, Sainsbury’s, M&S and Ocado being among the top gainers of the day.

The shares have gained from the depreciating pound since the London Stock Exchange index includes numerous companies with significant international operations.

A depreciated pound lowers the cost of exported goods for overseas buyers and boosts the value of international business transactions.

On Tuesday morning 23rd April 2024 the FTSE 100 climbed to a new intraday high of: 8080

According to the latest World Economic Outlook released by the IMF, Russia’s economy is projected to expand by 3.2% in 2024.

This growth outpaces the anticipated growth rates for the U.S. at 2.7%, the U.K. at 0.5%, Germany at 0.2%, and France at 0.7%.

The forecast may be galling for Western countries that have endeavoured to economically isolate, restrict and punish Russia for its invasion of Ukraine in 2022.

Russia has demonstrated that Western sanctions on its industries have made it more self-sufficient and that private consumption and domestic investment remain resilient.

Oil and commodity exports to nations such as India and China, (two of the largest countries in the world by population) – as well as alleged sanction evasion and high oil prices, have allowed Russia to maintain strong oil export incomes streams.

Outside of Russia, the IMF has revised its forecasts for Europe and the UK, projecting a growth of 0.5% for this year. This positions the UK as the second-lowest performer within the G7 group of advanced economies, trailing behind Germany.

The G7 also includes France, Italy, Japan, Canada and the U.S.

However, UK growth is expected to improve to 1.5% in 2025, placing the UK in the top three best G7 performers, according to the IMF.

The IMF also reported said that interest rates in the UK will remain higher than other advanced nations, close to 4% until 2029.

Modernising the Bank of England’s forecasting system has become a critical necessity. A recent independent review has cast a spotlight on the ‘serious deficiencies’ within its economic forecasting system, calling for an urgent modernisation.

What have they all been doing for all these years to not have updated their systems?

The review, led by Dr. Ben Bernanke, a former chair of the U.S. Federal Reserve, paints a picture of an institution grappling with outdated systems and under-investment in critical infrastructure. The Bank’s staff, the report suggests, are hindered by software that is not just out-of-date but also complicates the already intricate task of economic forecasting.

This revelation comes at a time when accurate economic forecasting is more vital than ever. The world is still reeling from the effects of the pandemic, the 2008/2009 financial crisis and the UK faces unique challenges post-Brexit. The Bank’s ability to predict economic trends accurately is paramount in crafting policies that safeguard the nation’s financial health.

The deficiencies highlighted are not just a matter of outdated software; they reflect a deeper need for a paradigm shift in how economic data is handled and analysed. The report recommends a complete overhaul of the system, emphasizing the need for automation of tasks that are currently performed manually.

Governor Andrew Bailey’s reportedly responded to the review by acknowledging the gravity of the situation, stating that updating the Bank’s systems is a ‘high priority’. This commitment to modernisation is a step in the right direction, but it should be followed by swift and decisive action, surely.

The Bank of England’s forecasting system is more than a tool; it is the compass by which the nation navigates its economic future. Modernising this system is not just a recommendation; it is an imperative. As the UK charts its course in a rapidly changing global economy, the reliability and sophistication of its economic forecasting are not just beneficial but essential for continued prosperity.

In conclusion, the Bank of England’s economic forecasting system is at a crossroads. The call to modernise is clear, and the path forward must be paved with innovation, investment, and a steadfast commitment to excellence in economic stewardship.

The future of the UK’s economy depends on it.

The unemployment rate has seen a slight uptick to 4.2%, a rise from the previous 3.9%. This increase, which is more than anticipated, suggests a softening in the labour market.

Conversely, wage growth appears to be resilient in the face of rising unemployment. Although core wage growth has decelerated, it remains in the region of 6%. This could indicate that employers are maintaining competitive wages to attract and retain skilled workers, even amidst a slowing labour market.

The ONS said employment rate dipped to 74.5% between December and February and the percentage of 16 to 64 year-olds defined as economically inactive rose from 21.8% to 22.2%, which equates to 9.4 million people.

In February 2024, the average weekly earnings were estimated at £677 for total earnings and £633 for regular earnings. This equates to an annual growth in regular earnings (excluding bonuses) of 6.0%, and annual growth in employees’ average total earnings (including bonuses) of 5.6%.

However, when adjusted for inflation using the Consumer Prices Index including owner occupiers’ housing costs (CPIH), the real terms growth for regular pay was 1.9%, and for total pay was 1.6%. This implies that while nominal wages are increasing, the real purchasing power of these wages may not be keeping up with inflation.

The Bank of England will likely approach this data with caution. The combination of increasing unemployment and slowing wage growth could be indicative of a weakening economy, potentially prompting the Bank to contemplate rate cuts.

The response of the Bank of England to these trends will be pivotal in the forthcoming months.

In summary, the UK labour market is exhibiting signs of cooling with an increase in unemployment and a slowdown in wage growth. However, wages continue to grow at a relatively high rate. The real impact on workers will hinge on how these wage increases stack up against inflation.

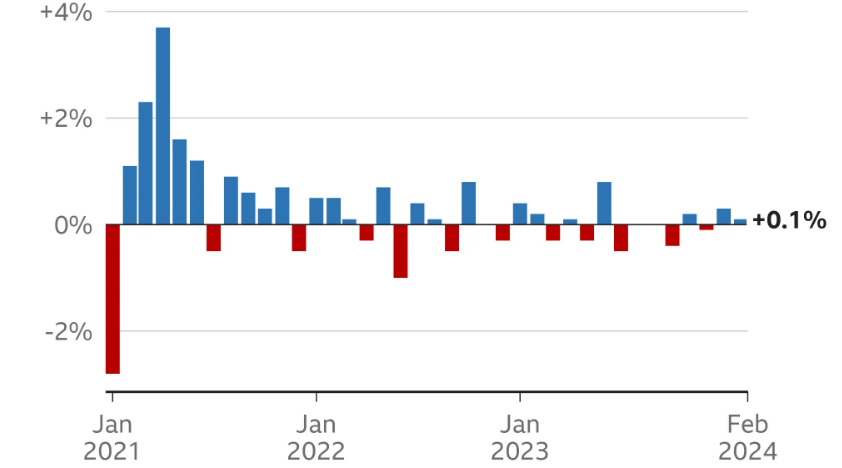

The economy grew by 0.1%, figures show, boosted by production and manufacturing in areas such as the car sector. The Office for National Statistics (ONS) said that construction was dampened by wet weather.

The official ONS statistics also revised its previous estimate for January 2024 from 0.2% growth up to 0.3%.

Chancellor Jeremy Hunt reportedly suggested that the new figures were a “welcome sign that the economy is turning a corner”. “We can build on this progress if we stick to our plan,” he added.

That’s good then Jeremy – well done you, nice plan!

The Office for National Statistics (ONS) has released updated UK GDP figures, confirming that the UK entered a technical recession in the last six months of the previous year.

The new data shows the economy contracted by 0.1% in the three months from June to August 2023, with a further decline of 0.3% in the subsequent financial quarter from September to December 2023. The overall economy grew by 0.1% throughout 2023.

However, early signs suggest that the UK began to recover in January 2024, with initial data indicating some growth, and surveys suggesting this trend may have gained momentum into February and March 2024.

This reduction signifies that the cost of living is increasing at its least rapid rate since September 2021, when it was recorded at 3.1%.

Since reaching a peak of 11.1% in October 2022, the highest in 40 years, inflation has been on a steady decline. In the big inflation picture, that’s a pretty good result.

It has only taken around 16 months to move the rate from 11.1% (a 40-year high) down to just 1.4% above the BoE’s target of 2%.

The primary factor contributing to this decrease, as reported by the Office for National Statistics (ONS), is the deceleration of food price inflation.

The economic inactivity rate during the period from November 2023 to January 2024 stood at 21.8%, a slight increase compared to the previous year. This means that approximately 9.2 million people aged between 16 and 64 are neither employed nor actively searching for jobs. The total figure has risen by over 700,000 since before the onset of the coronavirus pandemic.

Long-Term Illness: Approximately one-third of the working-age population not participating in the labour force cite long-term illness as the primary reason for their inactivity. Health-related issues have kept a significant portion of the population away from work.

The pandemic: of 2020 caused work flight. 700,000 extra out of the workplace since the coronavirus pandemic Covid 19 hit the UK in 2020.

Students and Education: Students pursuing education are often classified as economically inactive. Their focus on studies and lack of job-seeking activity contribute to this category.

Care Responsibilities: Individuals who care for family members or manage household responsibilities fall into this bracket. Caring duties can be time-consuming and prevent active job hunting.

People with Disabilities: Those with disabilities may face barriers in accessing employment opportunities. Accommodations and inclusive policies are essential to address this issue.

Early Retirement: Some adults choose early retirement, and once retired, they rarely express a desire to return to work. This group contributes significantly to the inactive population.

Discouraged Workers: Individuals who have given up on job searches due to discouragement or lack of suitable opportunities are also part of this category.

Gender Gap: Historically, more women have been classified as economically inactive compared to men. However, this gap has narrowed over the years as more women have entered the workforce.

Age Trends: Recent data indicates that while the number of economically inactive individuals due to illness has decreased, there has been an increase among those aged 16 to 34. Mental health issues are believed to be a contributing factor in this age group.

The persistently high level of economic inactivity poses challenges for the UK economy. As the country emerges from the pandemic, addressing workforce shortages becomes crucial. Measures such as reducing National Insurance Contributions and extending free childcare services aim to encourage people to seek employment or increase their working hours.

More effort is needed to further incentivise workforce participation, if not, the UK economy will suffer for many more years than would otherwise be necessary.

Oxford University, founded in the 12th century, stands as a beacon of scholarship and tradition. Its roots trace back to 1096 during William II’s reign. The university is approximately 230 years older than the Aztec Empire.

Teaching would have likely existed in some form within its hallowed halls. Imagine those early scholars, their minds ablaze with curiosity, gathering under the ancient spires.

Now, let’s compare this age to another remarkable entity: the Aztec civilization. The Aztecs flourished around the 14th century. Their vibrant culture, intricate temples, and awe-inspiring pyramids came some 230 years after the university was established.

Imagine the scene: while Oxford’s dons debated philosophy, the Aztecs were constructing Tenochtitlan, their magnificent capital. As Oxford’s colleges took shape, the Aztecs were creating intricate codices and performing sacred rituals.

Oxford University, with its nine centuries of continuous existence, predates the Aztec Empire by several lifetimes: a testament to the enduring quest for knowledge across civilizations.

Hopefully this means the UK is on its way out of recession.

The Office for National Statistics (ONS) said the services sector led the bounce back.

This is an early dataset, but demonstrates how the UK, which entered recession at the end of 2023, is faring.

UK chancellor Jeremy Hunt revealed the British ISA as part of the Spring Budget 2024.

The British ISA aims to boost demand for UK businesses and encourage investment in UK-focused assets.

The British ISA provides a separate £5,000 annual allowance in addition to the existing £20,000 ISA allowance.

Like other ISAs, investors in the British ISA will not pay tax on capital gains or income.

While it’s not yet clear whether the new ISA will be exclusively for UK shares, it is expected to support UK-focused funds and investment trusts.

The inclusion of UK gilts or UK corporate bonds remains uncertain.

The consultation period for the British ISA runs until June 6, 2024.

The British ISA aims to revive interest in the UK stock market, which has faced challenges since the Brexit vote in 2016.

By providing tax-free savings opportunities, the ISA encourages investment in UK businesses.

Fund management firms, including Premier Miton, lobbied for the British ISA’s creation.

The British ISA draws parallels with its predecessor, the personal equity plan (PEP), which focused on UK shares and funds.

ISAs replaced PEPs in 1999.

In summary, the British ISA introduces an additional allowance for UK-focused investments, supporting savers and UK companies alike. Its impact on the stock market and investor sentiment remains to be seen, but it represents a step toward bolstering the UK’s economic landscape

By ensuring that companies are valued fairly, a stronger stock market will facilitate the capital raising process for companies that seek to grow and attract more listings. This will have a positive impact on the economy and employment and is ultimately in everyone’s interest.

It has been sold to developer MCR Hotels for £275 million ($346.6 million).

The 189-meter structure has loomed over the capital city’s central Fitzrovia since 1965, when it opened as the Post Office tower.

It carried telecommunications signals from London to the rest of the country, but its microwave aerials were made redundant more than a decade ago.

It was also known for a revolving restaurant on its 34th floor, which took 22 minutes to complete a rotation.

MCR Hotels owns 150 properties, including the TWA Hotel located in the former TWA Flight Centre at JFK International Airport in New York, USA.

The Office for National Statistics noted that the country’s public finances usually run a surplus in January, unlike during other months, as receipts from annual self-assessment tax returns come in.

Combined self-assessment income and capital gains tax receipts totaled £33 billion in January, the ONS noted, down £1.8 billion from the same period of last year.

Total government tax receipts came in at a record £90.8 billion, up £2.9 billion compared to January 2023.

Government borrowing during the financial year spanning to the end of January 2024 was £96.6 billion, £3.1 billion lower than over the same 10-month period a year ago and £9.2 billion lower than the £105.8 billion previously forecast by the independent Office for Budget Responsibility.

The twenty companies have signed an accord committing them to fighting voter-deceiving content. They say they will deploy technology to detect and counter the material.

The Tech Accord to Combat Deceptive Use of AI in 2024 Elections was announced at the Munich Security Conference on Friday 16th February 2024.

The issue has come into sharp focus because it is estimated up to four billion people will be voting this year in countries such as the U.S., UK and India.

Among the accord’s pledges are commitments to develop technology to mitigate risks related to deceptive election content generated by AI, and to provide transparency to the public about the action firms have taken.

Other steps include sharing best practice with one another and educating the public about how to spot when they might be seeing manipulated content.

Signatories include social media platforms X, Snap, Adobe and Meta, the owner of Facebook, Instagram and WhatsApp.

However, the accord has some shortcomings, according to computer scientist Dr Deepak Padmanabhan, from Queen’s University Belfast, who has co-authored a report on elections and AI.

But he reportedly said they needed to take more proactive action instead of waiting for content to be posted before then seeking to take it down.

That could mean that realistic AI content, that may be more harmful, may stay on a platform for longer compared to obvious fakes which are easier to detect and remove, he suggested.

The accord’s signatories say they will target content which deceptively fakes or alters the appearance, voice, or actions of key figures in elections.

It will also seek to deal with audio, images or videos which provide false information to voters about when, where, and how they can vote.

We have a responsibility to help ensure these tools don’t become weaponised in elections, Brad Smith, the president of Microsoft is reported to have said.

These measures, in my opinion, are a sticking plaster and will not stop the spread of dishonest and fake news!

January U.K. inflation held steady at 4% year-on-year benefitting from easing prices for furniture and household goods, food and non-alcoholic beverages.

According to the latest figures from the Office for National Statistics (ONS), prices for food and non-alcoholic beverages fell on a monthly basis by 0.4%, marking the first decrease since September 2021.

The core CPI figure excluding volatile food, energy, alcohol and tobacco prices annual reading was 5.1%, below the 5.2% estimate – but only a micro 0.1% difference.

The latest inflation data is a reflection of what is happening in the labour market: a tight labour supply is sustaining high wage growth and thus underlying inflationary pressure.

Inflation still sits double the BoE target of 2%.

It is the fourth time in a row the Bank has held rates at 5.25%.

The Bank of England had previously raised rates 14 times in a row to curb inflation, leading to increases in mortgage rates but also creating better rates for savers.

There is a noticeable shift in opinion as the committee entertained the possibility of discussing the feasibility of cuts.

There was a three-way split, with two members of the Monetary Policy Committee (MPC) voting to increase the bank rate to 5.5%; one to reduce it to 5%; and six were in favour of sticking with 5.25%.

With inflation falling it is very likely the interest rates will be reduced by 0.25% by March 2024. Just take a look at the reduction in savers rates that have already occurred.

The anticipation is for a rate reduction soon.

The clue is that savers rates are being cut.

The Bank of England Governor, Andrew Bailey, has made clear that for him the key question is: ‘For how long should we keep rates at the current level?’

There may be disappointment ahead then – but a rate cut is next and I still expect it by Easter.