Has the Fed over-cooked it this time by waiting too long to reduce interest rates?

U.S. stock markets threw a wobbly after the latest employment data and after the Fed delayed its first rate cut… again. September 2024 now looks likely for that first cut – but by how much: 0.25% or as high as 0.50%?

The latest batch of bad news for the U.S. economy has actually became bad news for stocks this time. For too long the ‘bad news’ has been taken as ‘good news’, especially regarding the likelihood of a Fed interest rate cut – and for the markets in general.

The Federal Reserve (Fed) is grappling with several challenges, including inflation, interest rates, and the broader U.S. and global economies.

Inflation

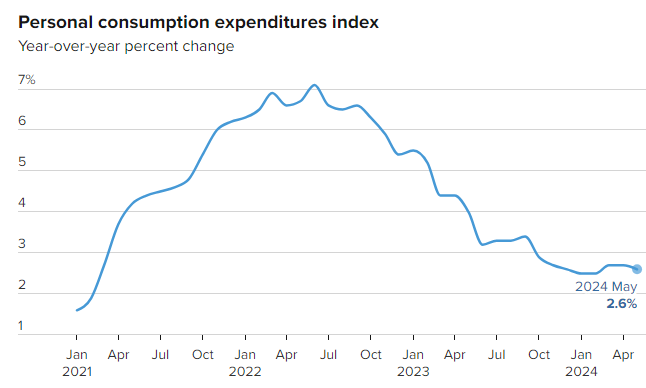

The Fed has been trying to control high inflation rates, which have been a significant concern. To combat inflation, the Fed has raised interest rates multiple times. Higher interest rates can help reduce inflation by slowing down borrowing and spending, but they can also slow economic growth.

Interest rates

By increasing interest rates, the Fed aims to make borrowing more expensive, which can help cool down an overheated economy. However, this can also lead to higher costs for consumers and businesses, potentially leading to reduced investment and spending.

Economic growth

The Fed’s policies are a balancing act. While they aim to control inflation, they also need to ensure that the economy doesn’t slow down too much. This balancing act can be challenging, especially when external factors like global economic conditions and geopolitical events come into play.

In essence, the Fed’s efforts to manage these issues can sometimes feel like ‘fighting its own shadow,’ as the consequences of their actions can create new challenges.

The timing of interest rate adjustments by the Federal Reserve is a topic of much debate among economists and policymakers.

Inflation control

The Fed’s primary goal in raising interest rates has been to control inflation. If inflation remains high, the Fed might be cautious about reducing rates too quickly to avoid a resurgence of inflation.

Economic indicators

The Fed closely monitors various economic indicators, such as employment rates, consumer spending, and GDP growth. If these indicators suggest that the economy is still strong, the Fed might delay reducing rates to ensure that inflation is fully under control.

Market reactions

Rapid changes in interest rates can cause volatility in financial markets. The Fed often aims for a gradual approach to avoid sudden shocks to the economy.

Global factors

The Fed also considers global economic conditions. For example, if other major economies are experiencing slow growth or financial instability, the Fed might be more cautious in adjusting rates.

Ultimately, the decision to reduce interest rates involves balancing the need to support economic growth with the risk of reigniting inflation. It’s a complex decision with significant implications for the U.S. and global economies.

Looks like the Fed overcooked it this time – but by how much?