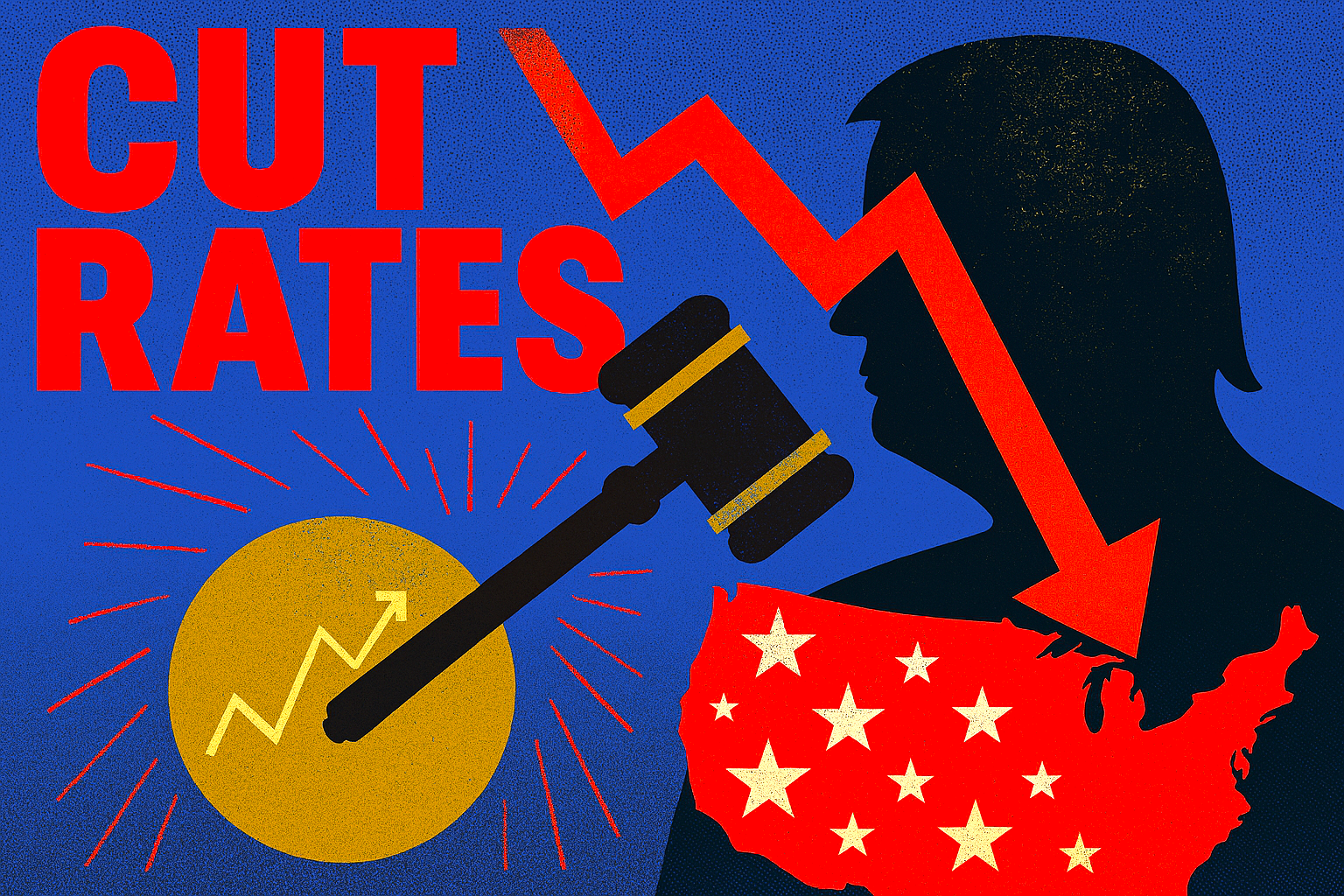

On 17th September 2025, the U.S. Federal Reserve announced its first interest rate cut of 2025, lowering the benchmark federal funds rate by 0.25% to a range of 4.00%–4.25%.

The decision follows nine months of monetary policy stagnation and comes amid mounting evidence of a weakening labour market and persistent inflationary pressures.

Fed Chair Jerome Powell described the move as a ‘risk management cut’, citing slower job growth and a rise in unemployment as key drivers.

While inflation remains elevated—partly due to tariffs introduced by the Trump administration—the Fed opted to prioritise employment support, signalling the possibility of two further cuts before year-end.

The decision was not without controversy. New Fed Governor Stephen Miran, recently appointed by President Trump, reportedly dissented, advocating for a more aggressive half-point reduction. Political tensions have escalated, with Trump publicly urging Powell to ‘cut bigger’.

Markets responded with mixed signals: the Dow rose modestly, while the S&P 500 and Nasdaq slipped slightly. However, each improved in after-hours trading.

Analysts remain divided over the long-term impact, with some warning that easing too quickly could reignite inflation.

The Fed’s next move will be closely watched as it balances economic fragility with political crosswinds.

The next U.S. Federal Reserve meeting is scheduled for 29th–30th October 2025, with the interest rate decision expected on Wednesday, 30th October at 2:00 PM ET.