As BIG tech poaches top AI talent, these companies are stripped to the bone as the tech talent is being hollowed out!

In the race to dominate artificial intelligence, America’s tech giants are vacuuming up talent at an unprecedented pace.

But behind the headlines of billion-dollar acquisitions and flashy AI demos lies a quieter crisis. The creation of ‘zombie companies’ — startups left staggering and soulless after their brightest minds are poached by Big Tech.

These zombie firms aren’t dead, but they’re no longer truly alive either. They continue to operate, maintain websites, and pitch to investors, yet their core innovation engine has stalled. The problem isn’t just brain drain — it’s brain decapitation.

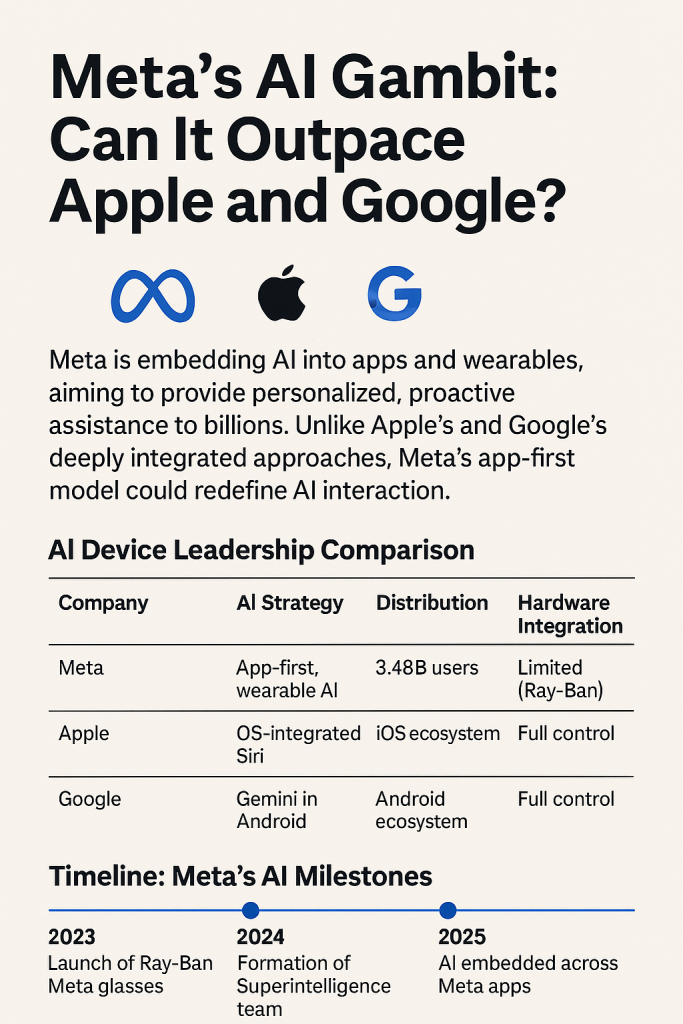

When a startup loses its founding engineers, lead researchers, or visionary product designers to the likes of Google, Meta, or Microsoft, what remains is often a shell with no clear path forward.

The allure is understandable. Big Tech offers salaries that dwarf startup equity, access to massive compute resources, and the prestige of working on frontier models. But the downstream effect is corrosive.

Startups, once the lifeblood of AI experimentation, are now struggling to retain talent long enough to reach product maturity. Some pivot to consultancy, others limp along with outsourced development, and many quietly fold — their IP absorbed, their vision diluted.

This phenomenon is particularly acute in the U.S., where venture capital encourages rapid scaling but rarely protects against talent attrition. The result is a growing class of companies that exist more for optics than output — kept alive by inertia, legacy funding, or the hope of acquisition.

They clutter the innovation landscape, making it harder for truly disruptive ideas to gain traction.

Ironically, Big Tech’s hunger for talent may be undermining the very ecosystem it depends on. By stripping startups of their creative lifeblood, it risks turning the AI sector into a monoculture. This culture is then dominated by a few players, with fewer voices and less diversity of thought.

The solution isn’t simple. It may require new funding models, stronger incentives for retention, or even regulatory scrutiny of talent acquisition practices.

But one thing is clear: if the U.S. wants to remain the global leader in AI, it must find a way to nurture its startups — not just harvest them.

Otherwise, the future of innovation may be haunted by the walking dead.