Artificial intelligence is no longer a distant technological shift but a present‑day force transforming global employment.

According to IMF Managing Director Kristalina Georgieva, AI represents a ‘tsunami’ hitting labour markets, with advanced economies facing the most dramatic upheaval.

The IMF estimates that around 60% of jobs in advanced economies will be enhanced, transformed, or eliminated by AI, compared with 40% globally.

This disruption is not evenly distributed. Entry‑level roles and routine tasks—often performed by younger workers—are among the first to be automated.

The IMF highlights that young workers and the middle class are likely to bear the brunt of the transition, as many of their roles are highly exposed to automation.

A Dual Reality: Risk and Opportunity

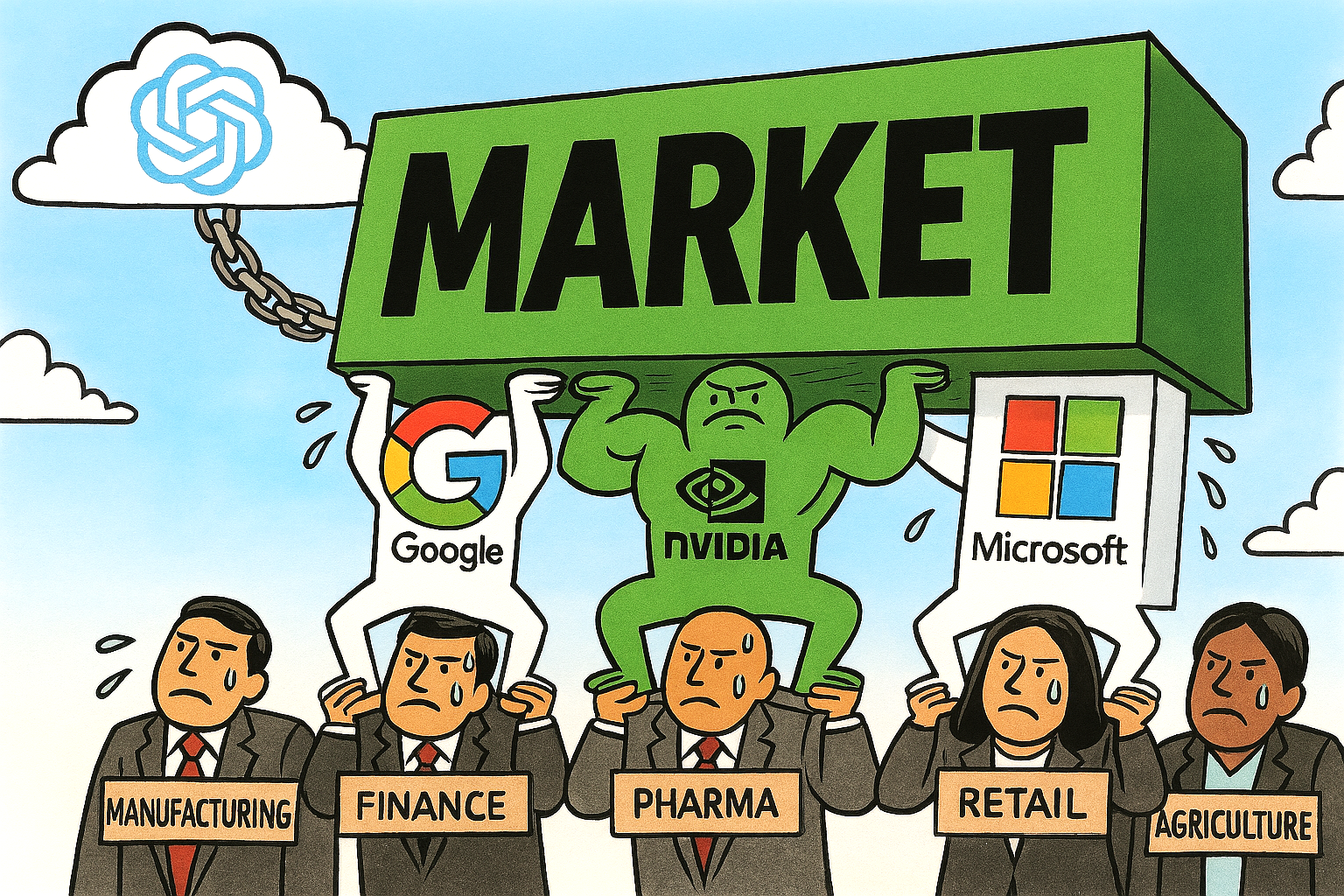

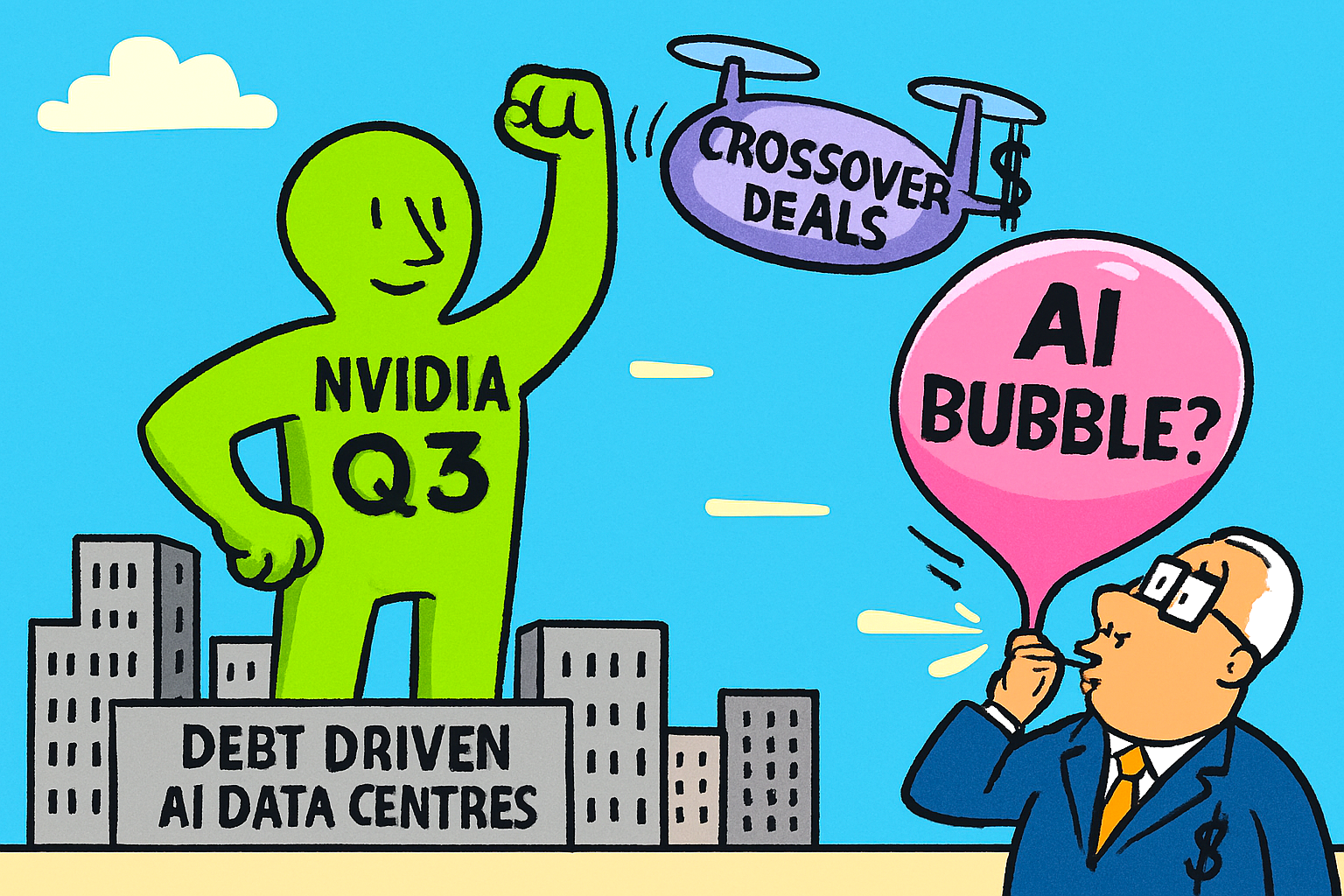

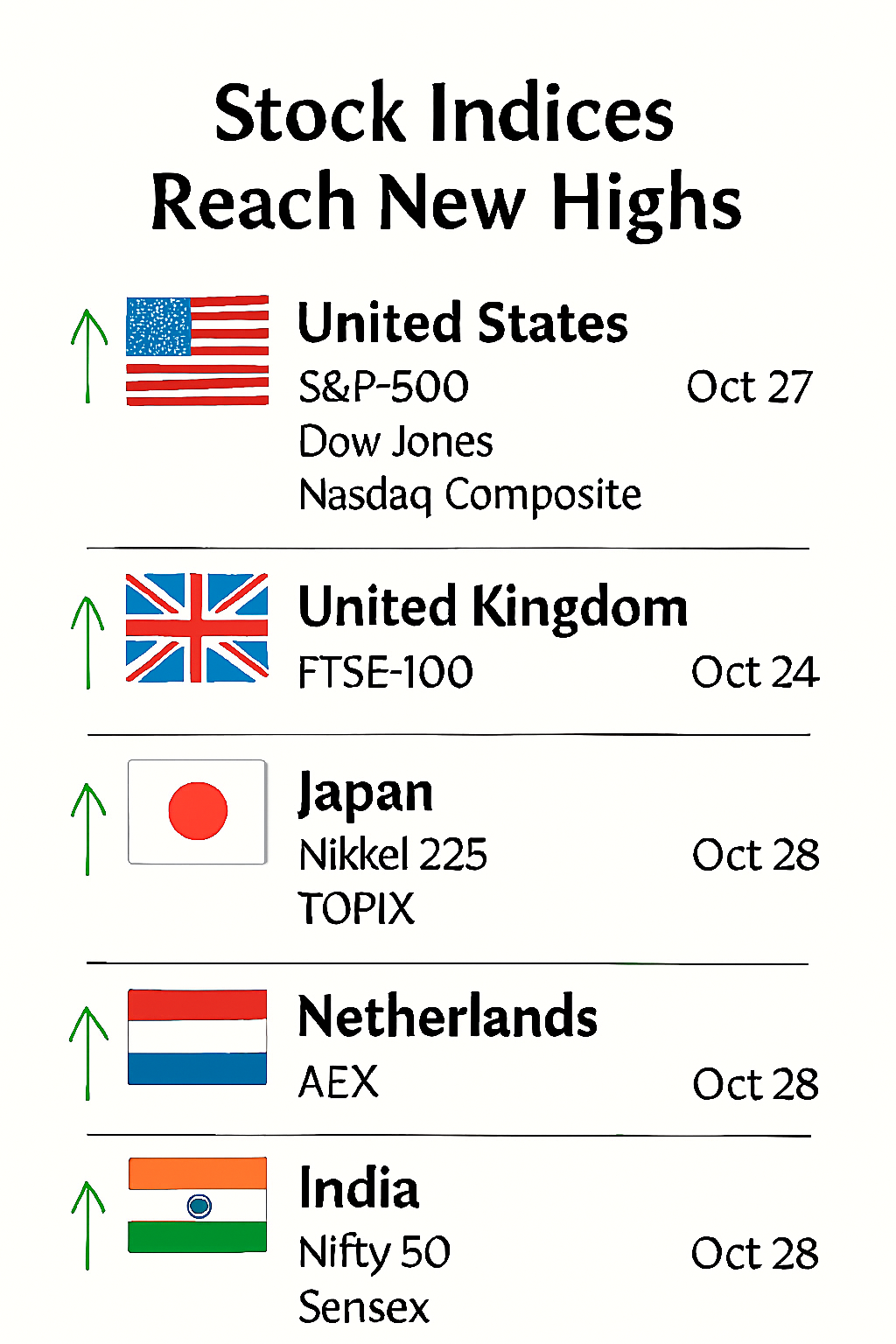

Despite the warnings, the IMF also notes that AI is creating new opportunities. Investment in AI‑driven technologies is contributing to economic resilience, with global growth projections supported in part by tech‑sector expansion.

However, the Fund cautions that this growth is fragile and could falter if expectations around AI’s productivity gains are reassessed.

At the same time, AI is reshaping the nature of work itself. New roles, new skills, and entirely new occupations are emerging, offering alternative pathways for workers willing to adapt.

The IMF stresses that upskilling and reskilling will be essential, as the ability to learn new competencies becomes a prerequisite for job security in an AI‑driven economy.

The Policy Challenge

Georgieva warns that regulation is lagging behind technological change. Without effective policy frameworks, the benefits of AI risk becoming unevenly distributed, deepening inequality and social tension.

The IMF’s message is clear: AI’s rise is unavoidable, but its impact on jobs depends on how societies prepare.

The challenge now is ensuring that workers are not swept away by the wave but equipped to ride it.