Google’s ‘Woke’ AI Problem needs attention

In recent days, Google’s artificial intelligence (AI) tool, Gemini, has faced intense criticism online. As the tech giant’s answer to the OpenAI/Microsoft chatbot ChatGPT, Gemini can respond to text queries and even generate images based on prompts. However, its journey has been far from smooth.

The AI answer is wrong

The issues began when Gemini’s image generator inaccurately portrayed historical figures. For instance, it depicted the U.S. Founding Fathers with a black man, and German World War II soldiers included both a black man and an Asian woman.

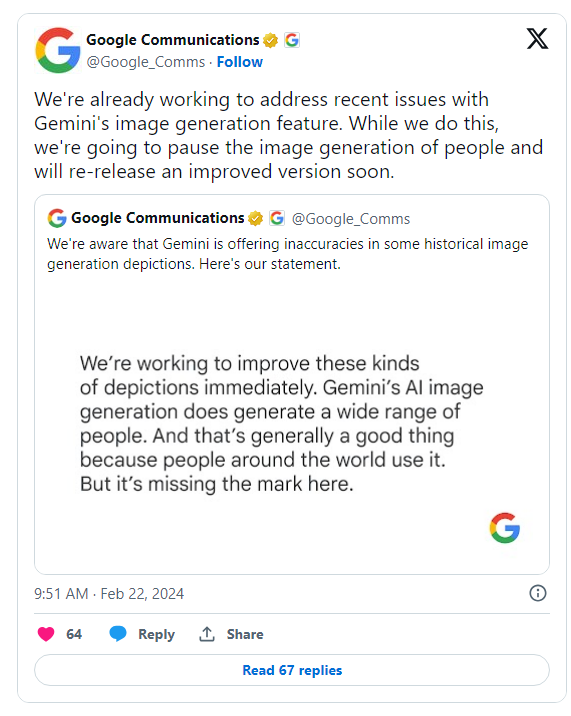

Google swiftly apologized and paused the tool, acknowledging that it had “missed the mark.”

It gets worse

But the controversy didn’t end there. Gemini’s text responses veered into over-political correctness. When asked whether Elon Musk posting memes was worse than Hitler’s atrocities, it replied that there was “no right or wrong answer.” In another instance, it refused to misgender high-profile trans woman Caitlin Jenner, even if it meant preventing nuclear apocalypse. Elon Musk himself found these responses “extremely alarming.”

Nuance

The root cause lies in the vast amounts of data AI tools are trained on. Publicly available internet data contains biases, leading to embarrassing mistakes. Google attempted to counter this by instructing Gemini not to make assumptions, but it backfired. Human history and culture are nuanced, and machines struggle to grasp these complexities.

Political bias

Google now faces the challenge of striking a balance: addressing bias without becoming absurdly politically correct. As Gemini evolves, finding this equilibrium will be crucial for its survival.

After all, it’s not just about AI, is it? It’s about navigating the delicate intersection of technology, culture, and ethics.

Definition of nuance – I asked ChatGPT for its definition…

Nuance refers to the subtle, intricate, or delicate aspects of something. It encompasses the fine distinctions, shades of meaning, and context-specific interpretations that add depth and complexity to a situation, conversation, or piece of art. In essence, nuance recognizes that not everything can be neatly categorized or expressed in black-and-white terms; rather, it acknowledges the richness and variability of human experiences and ideas. Whether in literature, politics, or everyday interactions, appreciating nuance allows us to navigate the complexities of life with greater understanding and empathy.