Warren Buffett, renowned as one of history’s most successful investors, has imparted invaluable insights that can help steer you on your investment path.

Rule No. 1 is never lose money. Rule No. 2 is never forget Rule No. 1

This straightforward statement has significant connotations. Although the aim of investing is to make a profit, it is just as important to avoid losses.

By reducing choices that put your portfolio at risk, you enhance the chance of earning profits. Consider it protecting your capital before pursuing returns. In contrast to those who gamble on the stock market, Buffett prioritizes careful risk management.

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price

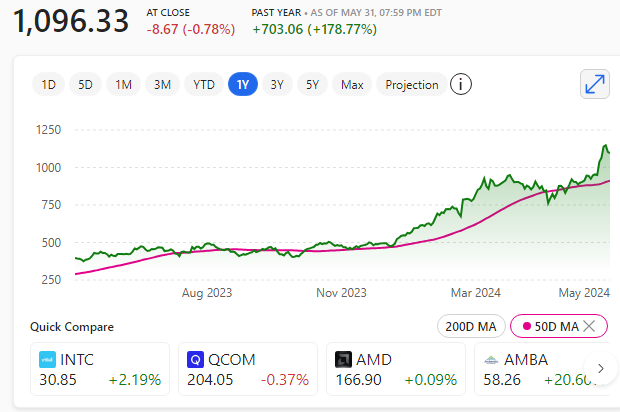

Rather than concentrating only on low-priced stocks, it’s wise to invest in outstanding companies with robust economic foundations and competitive edges. Although top-notch companies seldom seem inexpensive, their enduring profitability may warrant a fair premium. Notable firms that Buffett has backed include Apple, American Express, Coca-Cola.

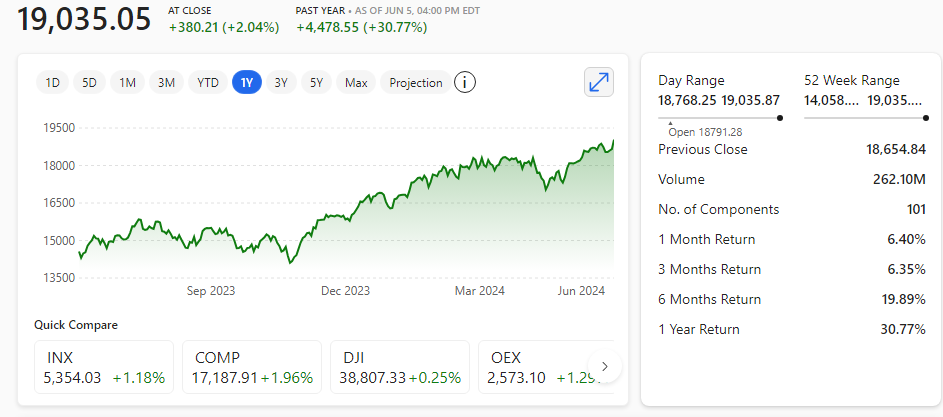

Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble

Be ready to grasp opportunities as they come. Instead of a small thimble, arm yourself with a bucket to gather the metaphorical riches. That is, capitalize on favorable market conditions and make smart investments when suitable chances emerge.

Invest in yourself

Buffett advocates for self-improvement, highlighting the importance of effective communication, both written and verbal. Developing this skill can greatly enhance your value.

Diversify

Diversify your investments among various assets to mitigate risk. Look into index funds and exchange-traded funds (ETFs) – unit trusts, stocks and shares, gold and hold cash to achieve widespread diversification.

Start early

The effectiveness of compounding is maximized when you start investing early. Being consistently invested over time is more beneficial than attempting to predict market movements.

Automate

Establish automatic contributions to your investment accounts. Regular investments over time can result in significant growth.

The principles that capture the influence of fear and greed on investing were articulated by Warren Buffett.

Buffet advises: ‘Be fearful when others are greedy, and greedy only when others are fearful.‘

Fear and Greed

Fear

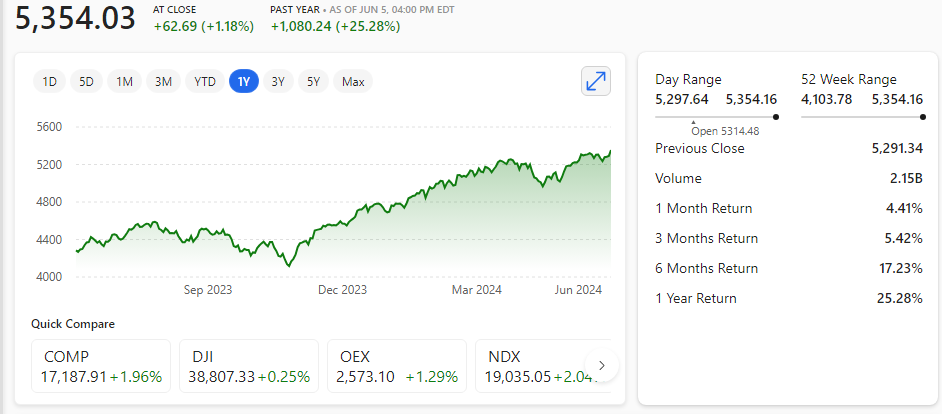

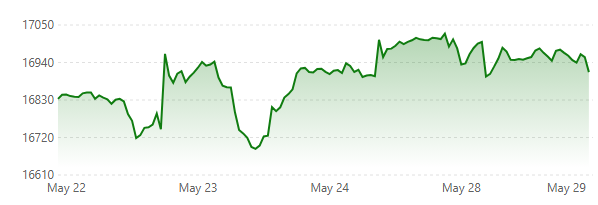

When investors collectively succumb to fear from ongoing stock market declines, they often resort to selling their shares, which in turn exacerbates the fall in prices.

Greed

In bull markets, it’s common for investors to exhibit excessive greed, pursuing rapid wealth and speculative trends.

Buffett’s wisdom

Warren Buffett, often referred to as the ‘Oracle of Omaha’, is known for his disciplined, long-term approach to investing. He specializes in value investing, which involves purchasing companies that seem to be undervalued by the market.

The rule

When others exhibit greed (buying aggressively), it’s prudent to exercise caution. On the flip side, when others are fearful (selling in a panic), it may be an opportune time to be greedy (buying at reduced prices).

Application

Fearful times

In times when fear prevails in the market, prices might plummet as a result of panic selling. Buffett advises exercising caution in these situations.

Greedy times

When others display excessive optimism (greed), it presents an opportunity to acquire undervalued assets.

Successful investing requires maintaining balance, adhering to fundamental principles, and steering clear of emotional extremes.

Investing is a marathon, not a sprint; hence, patience, discipline, and ongoing education are crucial.

Remember… ALWAYS do your own careful research! Or better still, take professional financial advice. Actually – just do both!

RESEARCH! RESEARCH! RESEARCH!

Disclaimer: this article is for informative purposes only! Do not trade nor invest unless you FULLY understand what you are doing – even then it is wise to take qualified financial advice.

Possible read: Buffet – The Biography (Amazon listing – other good outlets available)

Wikipedia: Warren Buffet