The U.S. economy is on a rip, with employers adding around 303,000 jobs in March 2024 – the largest increase in almost a year.

As the world’s largest economy continues to surge, questions arise about the Federal Reserve’s next move regarding interest rates.

Stronger-than-expected Job Growth

The unemployment rate fell to 3.8%, indicating strong job growth in several sectors such as health care, construction, and government. While economists had predicted job gains of approximately 200,000, the actual numbers have easily exceeded those expectations.

The labour market’s surprising resilience has caught analysts off guard, leading to speculation about the timing of interest rate cuts.

Fed’s Dilemma

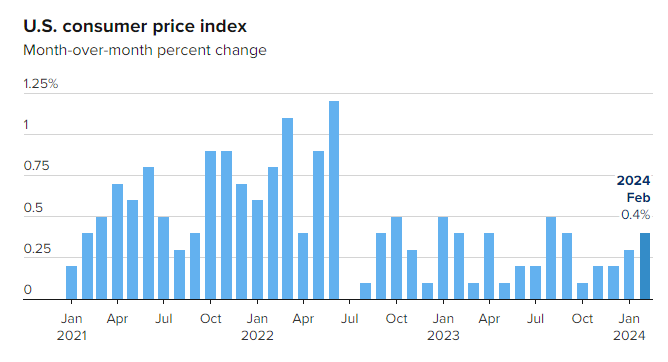

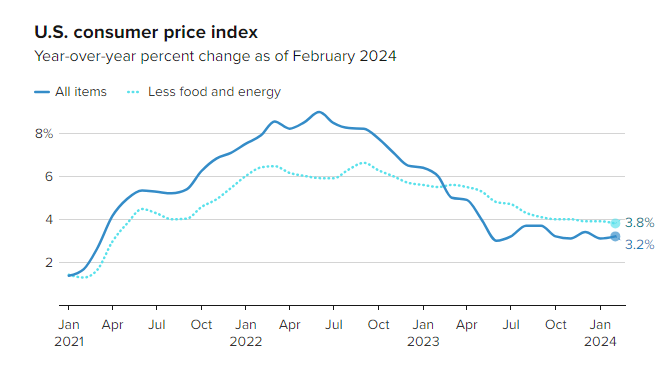

The Federal Reserve has held interest rates in a range of 5.25%-5.5%, the highest level in over two decades. Initially, the Fed raised rates sharply in 2022 to curb inflationary pressures. However, the subsequent cooling of price inflation (down to 3.2% in February) without a significant spike in unemployment has complicated matters. The central bank now faces a delicate balancing act.

Delayed Rate Cuts?

The significant increase of 303,000 in non-farm payrolls for March 2024 reinforces the Federal Reserve’s stance that the robustness of the economy permits a gradual approach to interest rate reductions.

The Fed had been expected to initiate rate cuts this year to mitigate the impact of high borrowing costs. However, the stronger-than-anticipated economic performance suggests that rate cuts may not occur until the second half of this year.

Labour Market Dynamics

U.S. government spending in areas like high-tech manufacturing and infrastructure has bolstered the labor market. Additionally, an influx of more than three million immigrants last year has expanded the workforce, potentially keeping wage pressures in check. In March, average hourly pay rose by 4.1% year-on-year, consistent with expectations and near a three-year low.

America’s Comeback

President Joe Biden hailed the latest job figures as a “milestone in America’s comeback.” However, some market analysts argue that the strong jobs growth could complicate efforts to return inflation to the Fed’s 2% target. Some analysts even speculate that rate cuts may not materialize until 2025.

Global Implications

Higher U.S. interest rates have ripple effects worldwide, enticing investors to shift capital toward America. While the Fed’s in-tray still has some warnings, the delay in rate cuts reflects the economy’s underlying strength.

The U.S. jobs boom presents a conundrum for policymakers. Balancing economic vitality with inflation control remains a delicate task, and the Fed’s decisions will reverberate far beyond its borders.