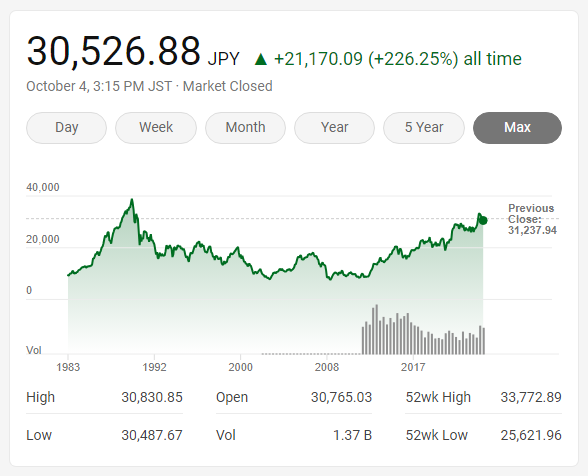

Inflation and interest rate correlation

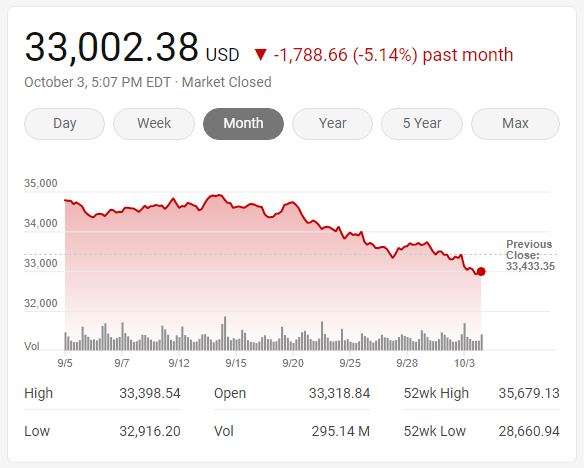

The stock market is influenced by many factors, such as economic data, earnings reports, geopolitical events, investor sentiment, and technical indicators.

Some analysts have suggested that the recent sell-off in the market may have created some oversold conditions that could lead to a relief rally or a bounce back in the near future.

Stochastics oscillation

One of the technical indicators that some traders use to identify buy and sell signals is the stochastics oscillator, which measures the momentum of price movements. The stochastics oscillator consists of two lines: the %K line and the %D line.

The %K line shows the current position of the price relative to its high and low range over a certain period of time, usually 14 days. The %D line is a moving average of the %K line, usually a three-day average. When the %K line crosses above the %D line, it is considered a bullish signal, indicating that the price may be reversing from a downtrend to an uptrend.

When the %K line crosses below the %D line, it is considered a bearish signal, indicating that the price may be reversing from an uptrend to a downtrend.

80/20 analysis

The stochastics oscillator also has two levels: 20 and 80. When the %K line falls below 20, it means that the price is oversold, meaning that it has fallen too much and may be due for a rebound. When the %K line rises above 80, it means that the price is overbought, meaning that it has risen too much and may be due for a pullback.

The FTSE 100 index, which tracks the performance of 100 large companies listed on the London Stock Exchange, has recently fallen below 20 on the stochastics oscillator, indicating that it may be oversold and ready for a bounce back.

No guarantee

However, this is not a guarantee, as other factors may also affect the market direction. Therefore, it is advisable to use stochastics in conjunction with other tools, such as trend lines, support and resistance levels, moving averages, and other technical indicators.

Additionally, some traders use different settings for the stochastics oscillator, such as changing the time period or the smoothing factor, to suit their own trading style and preferences. Always though, long term investing produces far better results over time as it smooths out the ‘ups and downs’.

In summary, there is no definitive answer to whether the stock market is building up to a major buy signal again right now, as different traders will have different opinions and strategies and views. But one possible way to gauge the market sentiment and momentum is to use the stochastics oscillator, which can provide some clues about potential reversals and opportunities in the market.

Note

This indicator should not be used in isolation, but rather in combination with other tools and analysis – it is just that, a tool. Good well-established companies that have good track records over many many years are a good place to look for long term returns. But even then, do your thorough research first.

So, what next?

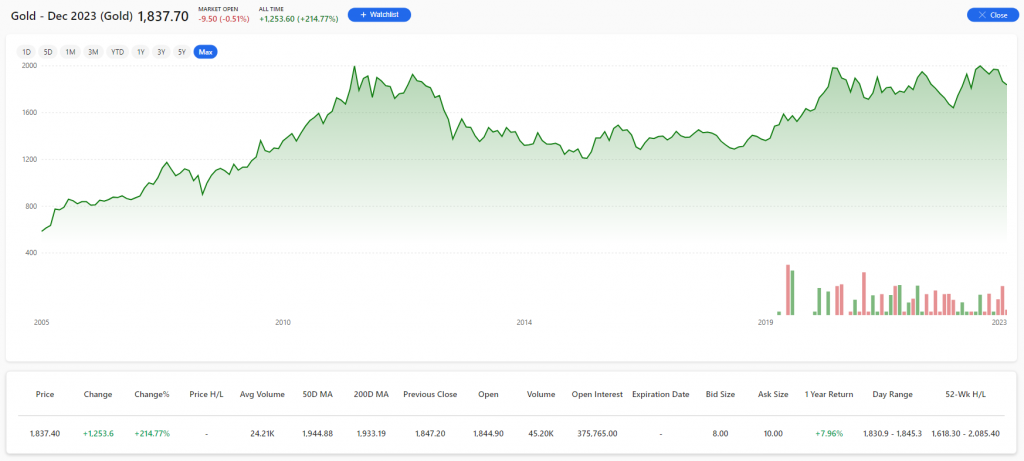

The interest-rate/inflation correlation is crucial, because nominal company earnings grow faster when inflation is higher. That does not mean investors should welcome inflation, since higher inflation also means that future years’ earnings must be discounted at a higher rate.

But for many behavioural reasons, investors place greater weight on the negative impact of the greater discount rate than on the higher nominal earnings-growth rate that typically accompanies higher inflation.

Inflation illusion

Economists refer to this investor error as ‘inflation illusion’. Perhaps the seminal study documenting how this error impacts the stock market was conducted by Jay Ritter of the University of Florida and Richard Warr of North Carolina State University. They found that investors systematically undervalue stocks in the presence of high inflation.

Investors will make the same error, in reverse, when inflation and interest rates start to come down. That’s why the foundation of a likely big buy signal is currently being built.

Maybe the buy signal is about to go green for a quick buying opportunity. But be careful, in this environment it can switch again very quickly.

Remember, always do your own research carefully before buying.

Read: Bull market 1982 -1999 and decline of inflation. Jay Ritter of the University of Florida and Richard Warr of North Carolina State University.

RESEARCH! RESEARCH! RESEARCH!