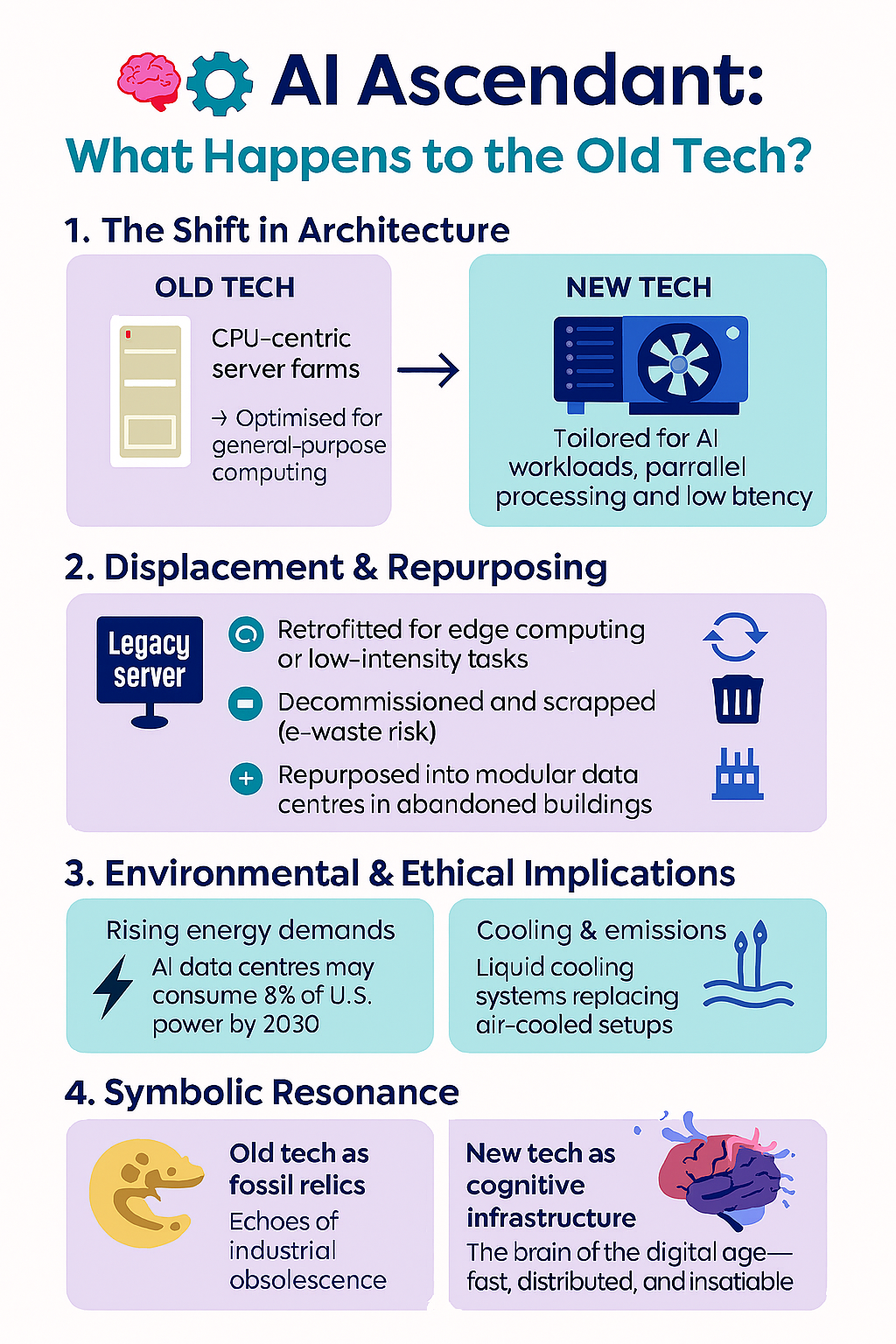

🧠 What’s Happening to the Old Tech?

Shadow in the cloud

🔄 Repurposing and Retrofitting

- Many traditional CPU-centric server farms are being retrofitted to support GPU-heavy or heterogeneous architectures.

- Some legacy racks are adapted for edge computing, non-AI workloads, or low-latency services that don’t require massive AI computing power.

🧹 Decommissioning and Disposal

- Obsolete hardware—especially older CPUs and low-density racks—is being decommissioned.

- Disposal is a growing concern: e-waste regulations are tightening, and sustainability targets mean companies must recycle or repurpose responsibly.

🏭 Secondary Markets and Resale

- Some older servers are sold into secondary markets—used by smaller firms, educational institutions, or regions with less AI demand.

- There’s also a niche for refurbished hardware, especially in countries where AI infrastructure is still nascent.

🧊 Cold Storage and Archival Use

- Legacy systems are sometimes shifted to cold storage roles—archiving data that doesn’t require real-time access.

- These setups are less power-intensive and can extend the life of older tech without compromising performance.

⚠️ Obsolescence Risk

- The pace of AI innovation is so fast that even new data centres risk early obsolescence if they’re not designed with future workloads in mind.

- Rack densities are climbing—from 36kW to 80kW+—and cooling systems are shifting from air to liquid, meaning older infrastructure simply can’t keep up.

🧭 A Symbolic Shift

This isn’t just about servers—it’s about sovereignty, sustainability, and the philosophy of obsolescence. The old tech isn’t just being replaced; it’s being relegated, repurposed, or ritually retired.

There’s a tech history lesson unfolding about digital mortality, and how each new AI cluster buries a generation of silicon ancestors.

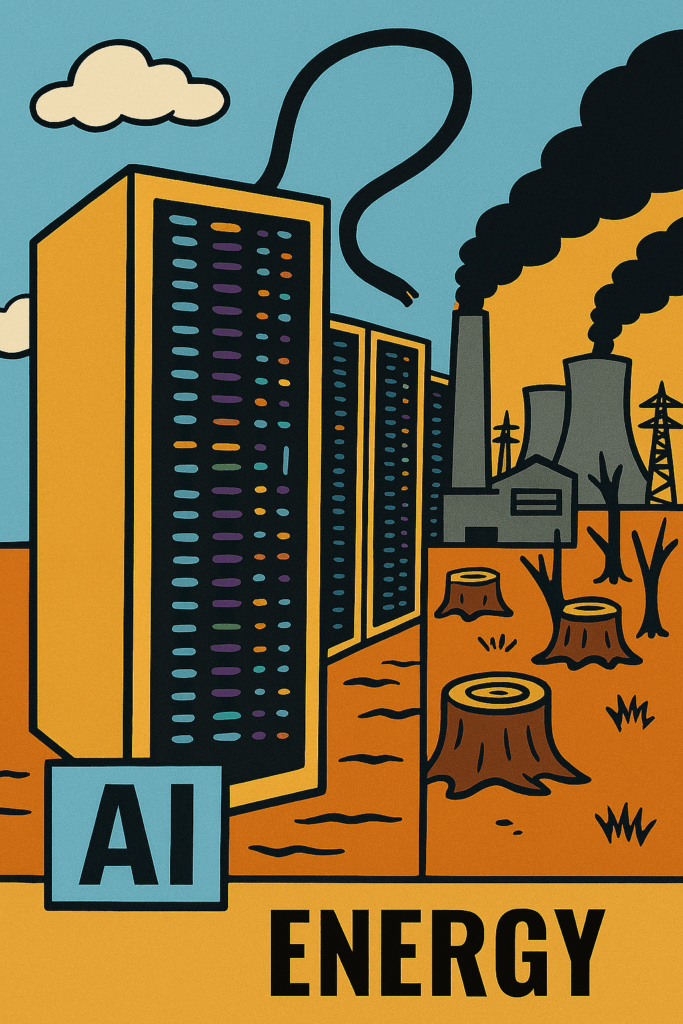

🌍 The Green Cost of the AI Boom

⚡ Energy Consumption

- AI data centres are power-hungry beasts. In 2023, they consumed around 2% of global electricity—a figure expected to rise by 80% by 2026.

- Nvidia’s H100 GPUs, widely used for AI workloads, draw 700 watts each. With millions deployed, the cumulative demand is staggering.

💧 Water Usage

- Cooling these high-density clusters often requires millions of litres of water annually. In drought-prone regions, this is sparking local backlash.

🧱 Material Extraction

- AI infrastructure depends on critical minerals—lithium, cobalt, rare earths—often mined in ecologically fragile zones.

- These supply chains are tied to geopolitical tensions and labour exploitation, especially in the Global South.

🗑️ E-Waste and Obsolescence

- As new AI chips replace older hardware, legacy servers are decommissioned—but not always responsibly.

- Without strict recycling protocols, this leads to mountains of e-waste, much of which ends up in landfills or exported to countries with lax regulations.

The Cloud Has a Shadow

This isn’t just about silicon—it’s about digital colonialism, resource extraction, and the invisible costs of intelligence. AI may promise smarter sustainability, but its infrastructure is anything but green unless radically reimagined.

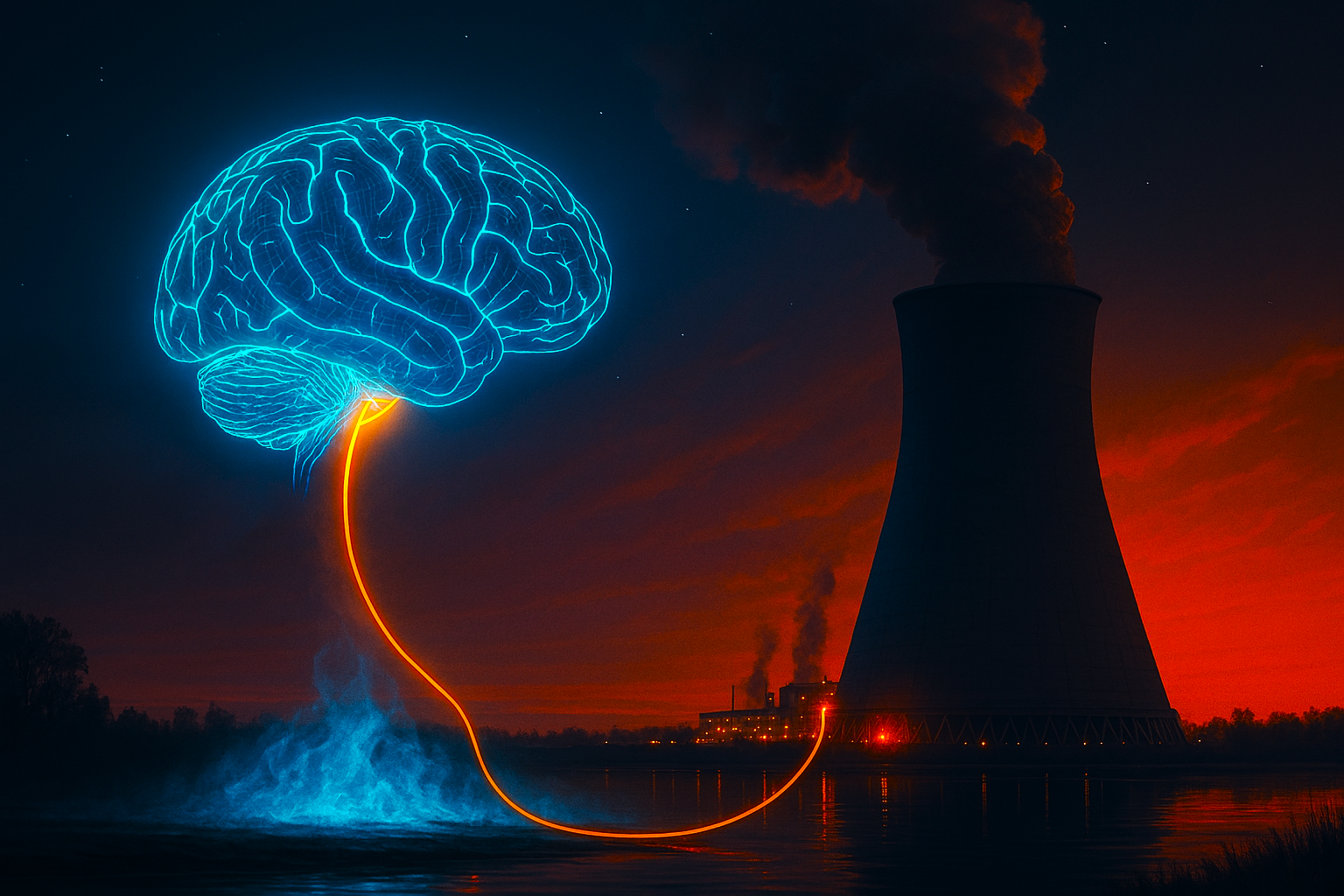

⚡ The Energy Cost of Intelligence

🔋 Surging Power Demand

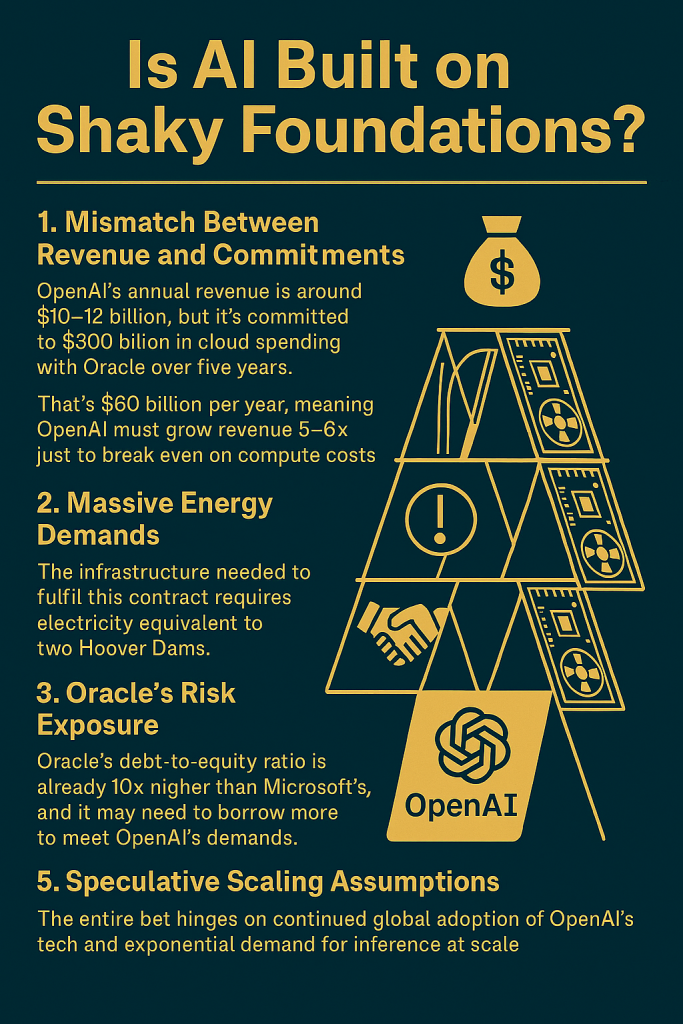

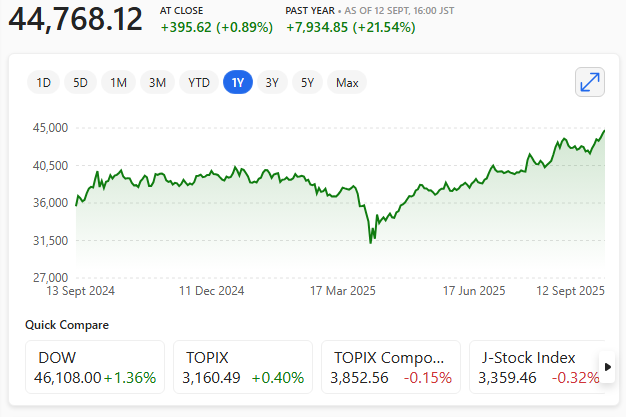

- AI data centres are projected to drive a 165% increase in global electricity consumption by 2030, compared to 2023 levels.

- In the U.S. alone, data centres could account for 11–12% of total power demand by 2030—up from 3–4% today.

- A single hyperscale facility can draw 100 megawatts or more, equivalent to powering 350,000–400,000 electric vehicles annually.

🧠 Why AI Is So Power-Hungry

- Training large models like OpenAI Chat GPT or DeepSeek requires massive parallel processing, often using thousands of GPUs.

- Each AI query can consume 10× the energy of a Google search, according to the International Energy Agency.

- Power density is rising—from 162 kW per square foot today to 176 kW by 2027, meaning more heat, more cooling, and more infrastructure.

🌍 Environmental Fallout

- Cooling systems often rely on millions of litres of water annually. For example, in Wisconsin, two AI data centres will consume 3.9 gigawatts of power, more than the state’s nuclear plant.

- Without renewable energy sources, this surge risks locking regions into fossil fuel dependency, raising emissions and household energy costs. We are not ready for this massive increase in AI energy production.

The Intelligence Tax

This isn’t just about tech—it’s about who pays for progress. AI promises smarter cities, medicine, and governance, but its infrastructure demands a hidden tax: on grids, ecosystems, and communities.

AI is a hungry beast, and it needs feeding. The genie is out of the bottle!