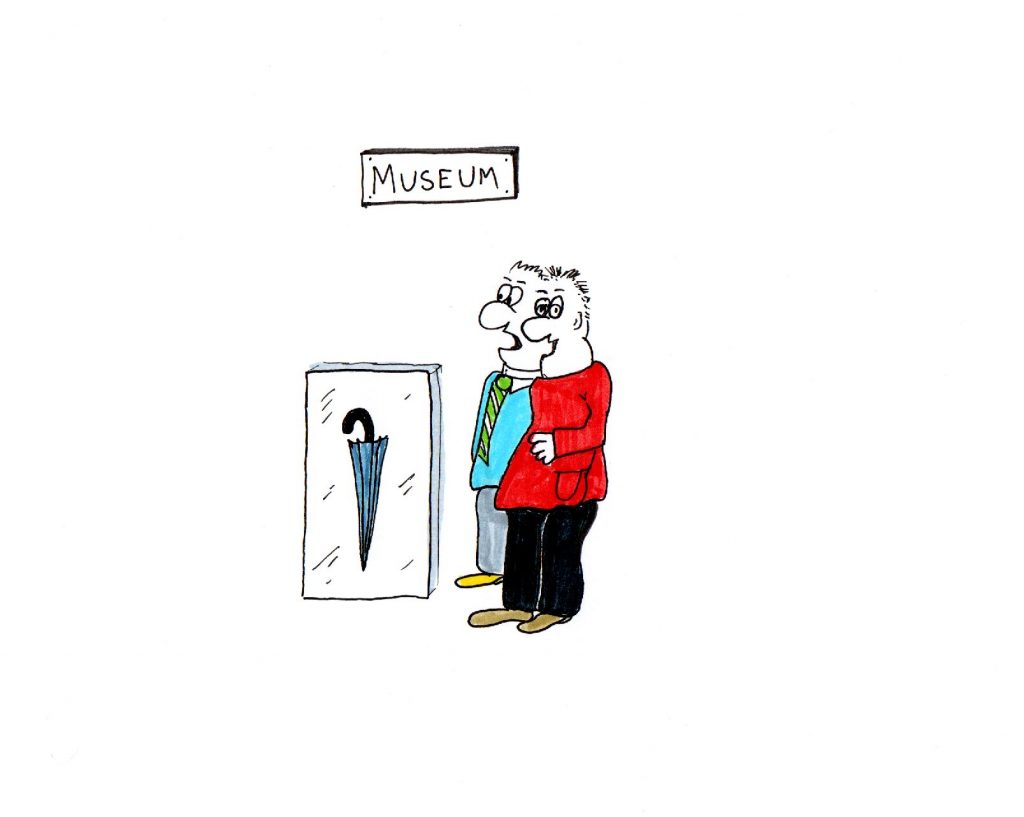

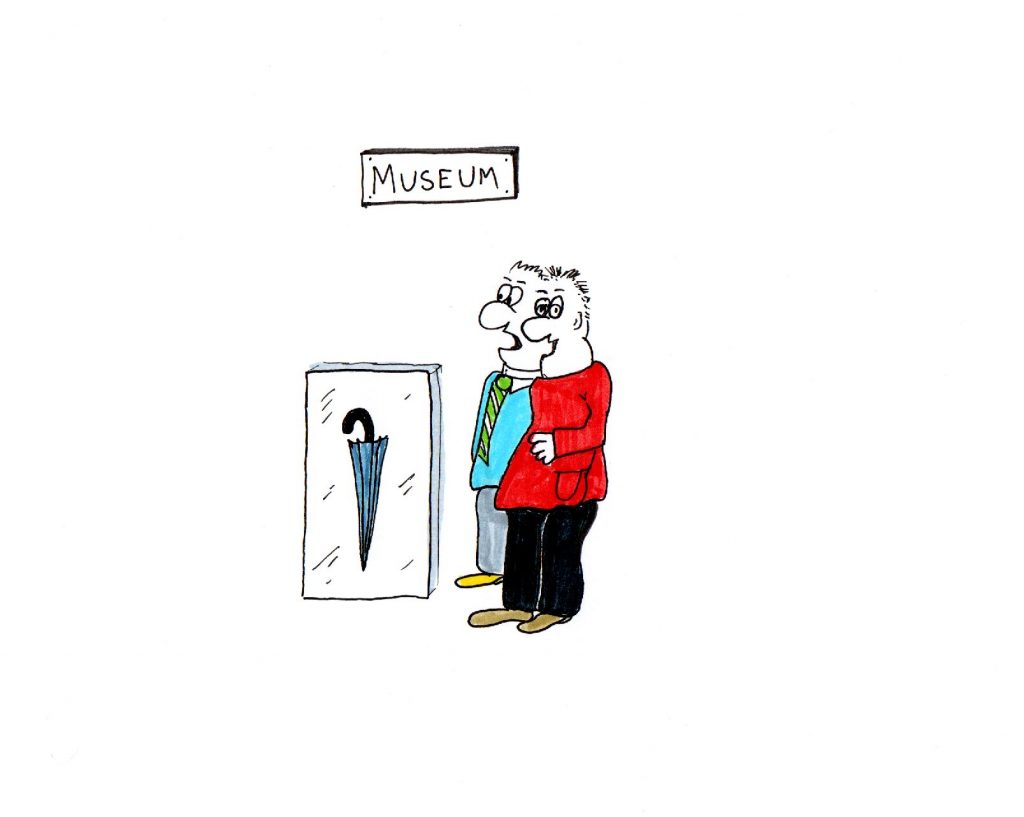

“Look at this… the actual umbrella Rishi Sunak didn’t use during the UK 2024 election announcement!”

It measures the percentage of new 52-week highs and lows against a set reference percentage. The simultaneous occurrence of new highs and lows suggests a statistical anomaly from the norm, potentially foreshadowing a stock market downturn.

Once the criteria are satisfied, the Hindenburg Omen remains active for 30 trading days, and any subsequent signals within this time frame should be disregarded.

Confirmation of the Hindenburg Omen occurs if the McClellan Oscillator (MCO) stays negative throughout this period, while a positive MCO invalidates it.

Traders typically employ this indicator alongside other technical analysis methods to determine optimal selling times. However, it’s crucial to remember that the Hindenburg Omen is not infallible and should be used in conjunction with other market factors.

This feature, known as Recall, is a component of the Copilot+ suite and aims to take encrypted snapshots of a user’s laptop screen at intervals, storing them on the device. The ICO is examining the feature to determine the privacy protections in place.

Recall is designed to enable users to search their computer usage history using natural language, effectively creating a type of photographic memory of their activity. Concerns have been voiced about the feature’s potential to become a ‘privacy nightmare’ due to its ability to capture sensitive information. Microsoft has clarified that Recall is a voluntary feature, giving users the choice over the snapshots it collects. The data is kept on the local device and is inaccessible to Microsoft or others without access to the device.

The ICO’s investigation aims to ensure that companies thoroughly evaluate and address any risks to individual rights and freedoms prior to launching new technologies. Microsoft has reiterated its dedication to privacy and security, noting that these principles were integral to the development of Recall. The company has also indicated that users can specify the snapshots collected by Recall and that Microsoft Edge’s private browsing mode is not included.

Awareness of software features and privacy settings is crucial for users, particularly regarding personal data handling. The ICO’s inquiries represent a move towards addressing privacy concerns and safeguarding user data.

This revision reportedly came after the IMF’s routine evaluation visit to China. The institution now predicts that China’s economy will expand by 4.5% in 2025, an increase from the earlier estimate of 4.1%.

However, by 2029, the IMF expects China’s growth to slow to 3.3%, influenced by an aging demographic and a decline in productivity growth. This is a decrease from the previous medium-term growth forecast of 3.5%.

China’s economy experienced a stronger-than-anticipated growth of 5.3% in the Q1, bolstered by robust exports. Meanwhile, April’s data indicated that consumer spending continued to be weak, although there was a resurgence in industrial activity.