Chinese firms are reportedly intensifying their efforts to develop a competitive alternative to Nvidia’s AI chips, as part of Beijing’s ongoing initiative to reduce its reliance on U.S. technology.

China faces several challenges that are impeding its technological progress, including U.S. export restrictions that limit domestic semiconductor production. The lack of technical expertise is also reported to be a problem.

Analysts have identified companies including Huawei as the principal competitors to Nvidia in China

China’s counterparts to Nvidia, such as Huawei, Alibaba, and Baidu, are actively developing AI chips to compete in the same market. Huawei’s HiSilicon division is known for its Ascend series of data centre processors.

Huawei’s HiSilicon division is known for its Ascend series of data centre processors, and Alibaba’s T-Head has produced the Hanguang 800 AI inference chip. Other significant players include Biren Technology and Cambricon Technologies.

Alibaba’s T-Head has developed the Hanguang 800 AI inference chip. Other significant players include Biren Technology and Cambricon Technologies.

These Chinese firms are intensifying their efforts to create alternatives to Nvidia’s AI-powering chips. This is a big part of Beijing’s broader initiative to reduce its reliance on U.S. technology.

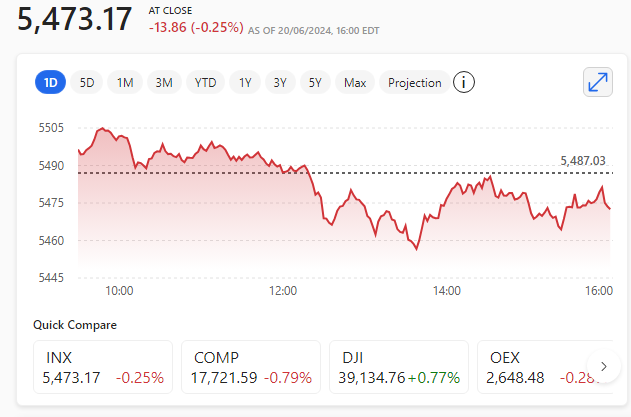

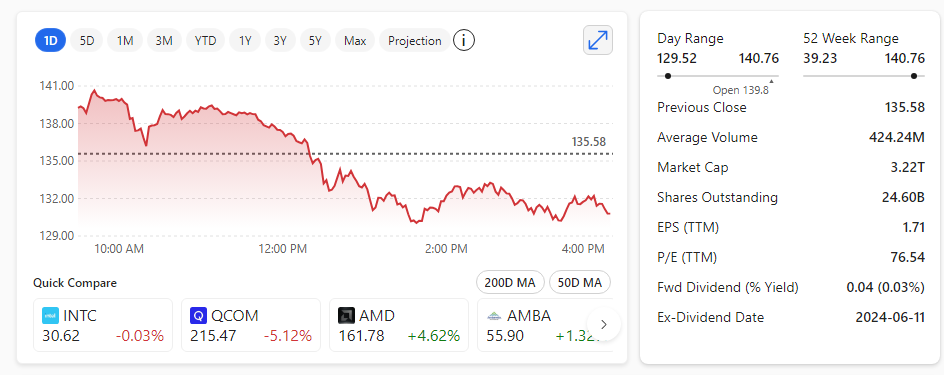

Nvidia’s surge in growth is attributed to the demand from major cloud computing companies for its server products, which incorporate graphics processing units, or GPUs.

These GPUs are crucial for entities like OpenAI, the creator of ChatGPT, which requires substantial computational power to train extensive AI models on large datasets.

AI models are crucial for chatbots and other AI applications

Since 2022, the U.S. has limited the export of Nvidia’s top-tier chips to China, with further restrictions imposed last year.

The U.S. sanctions and Nvidia’s market dominance pose significant obstacles to China’s ambitions, particularly in the short term, according to analysts. The U.S. has curbed the export of Nvidia’s most sophisticated chips to China since 2022, with increased restrictions implemented last year.

China’s GPU designers rely on external manufacturers for chip production. Traditionally, this role was filled by Taiwan Semiconductor Manufacturing Co. (TSMC). However, due to U.S. restrictions, many Chinese firms are now unable to procure chips from TSMC.

As a result, they have shifted to using SMIC, China’s largest chipmaker, which is technologically several generations behind TSMC. This gap is partly due to Washington’s limitations on SMIC’s access to essential machinery from the Dutch company ASML, necessary for producing the most advanced chips.

Huawei is driving the development of more sophisticated chips for its smartphones and AI, which occupies a significant portion of SMIC’s capacity.

Nvidia has achieved success not only through its advanced semiconductors but also via its CUDA software platform. The system enables developers to build applications for Nvidia’s hardware. This has fostered an ecosystem around Nvidia’s designs, which will be challenging for competitors to emulate.

Huawei leading the pack for China

Huawei is at the forefront as a leading force in China for its Ascend series of data centre processors. The current generation, named Ascend 910B, is soon to be succeeded by the Ascend 910C. This new chip may come to rival Nvidia’s H100.