The unloved rally: A paradox

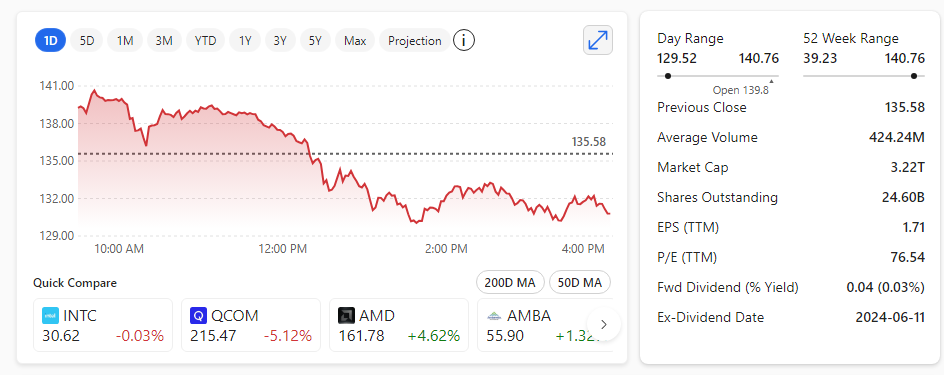

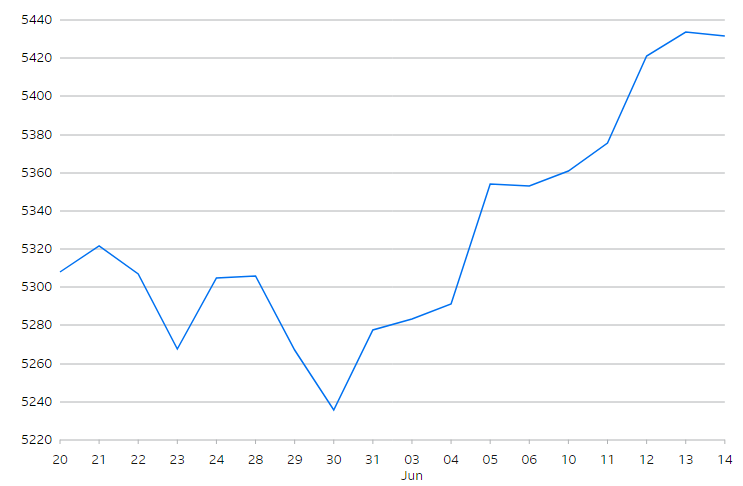

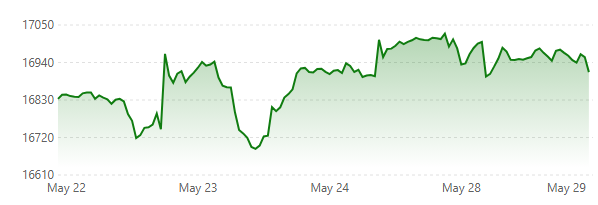

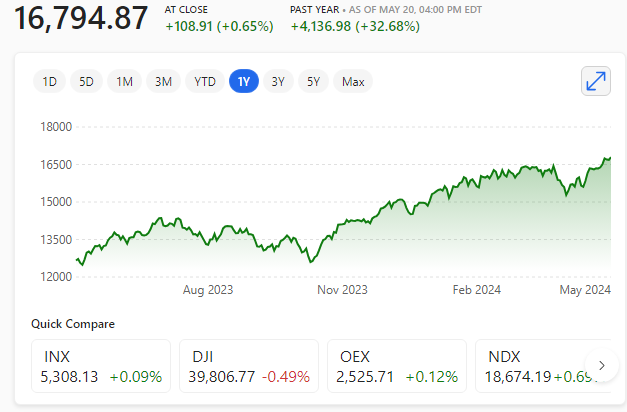

The S&P 500 and Nasdaq have been reaching all-time highs with remarkable frequency, notching nearly thirty record days in 2024, including four in the past week. Despite this stellar performance, a considerable number of investors remain hesitant. Let’s explore the reasons behind this paradox.

Lingering recession fears

The recollection of the 2022 bear market continues to trouble investors. The swift escalation of monetary policy by the Federal Reserve at that time generated widespread uncertainty and apprehension. This has led many investors to maintain a cautious stance, concerned that the past may repeat, even amidst a surging market. Maybe less of us expected the AI driven stock buying frenzy to scale such highs so quickly?

Scepticism

Investors are inherently sceptical. Amidst a relentless market rally, uncertainty emerges. Can this be sustained? Is a correction looming? This scepticism may hinder investors from wholeheartedly participating in a bull market, despite what the statistics indicate.

Emotional baggage

Investment isn’t solely a game of numbers; it’s equally a matter of emotions (although it shouldn’t be). Investors bearing the scars of past losses may find their emotional baggage weighing heavily on their decisions. The fear of experiencing another market crash can cloud rational judgement, leading them to forgo opportunities for potential gains.

The ‘easy money’

The stock market’s significant rise from the lows of 2022 has convinced some that the phase of ‘easy money’ is over. Investors who did not capitalize on the early stages of the rally might think they have missed out, causing hesitation to engage fully. That’s where I am right now – but waiting for a ‘pullback’.

Navigating the dilemma

For individuals caught between caution and the fear of missing out (FOMO), the following strategies could be considered.

Diversification

Distribute your investments among various asset classes. Diversification serves to reduce risk and acts as a safeguard against the unpredictability of the market.

Long-term perspective

Keep in mind that investing is akin to a marathon, not a sprint. It’s important to concentrate on long-term objectives instead of short-term market movements.

Education

Inform yourself about market cycles, historical patterns, and the effects of monetary policy. This should empower more informed decision-making.

Professional advice

Consult a financial advisor who can guide you based on your individual circumstances and risk tolerance.

Conclusion

The current stock market rally, though not widely embraced, offers both opportunities and challenges. Investors are tasked with finding the right balance between exercising caution and capitalizing on potential growth. As the market climbs, it’s essential to be aware of our biases and emotions. Only then can we approach the rally with a more informed viewpoint.

Disclaimer: This article provides general insights and should not be considered personalised financial advice. Always consult a professional before making investment decisions.

Remember: Always do your own diligent and careful research.

RESEARCH! RESEARCH! RESEARCH!