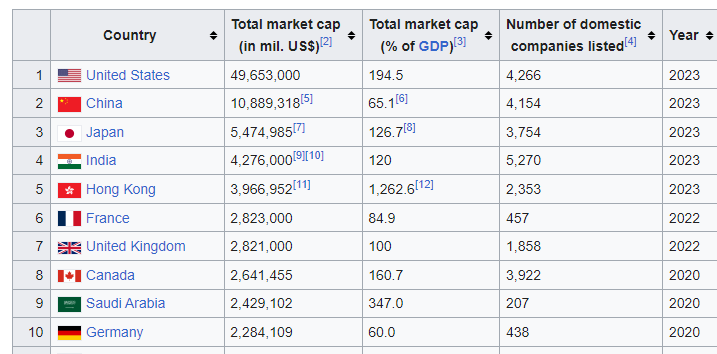

For much of the past three years, the so‑called Magnificent Seven – Apple, Microsoft, Alphabet, Amazon, Meta, Tesla and Nvidia – have powered US equities to repeated record highs.

Their sheer scale, earnings strength and centrality to the AI boom turned them into a market narrative as much as an investment theme.

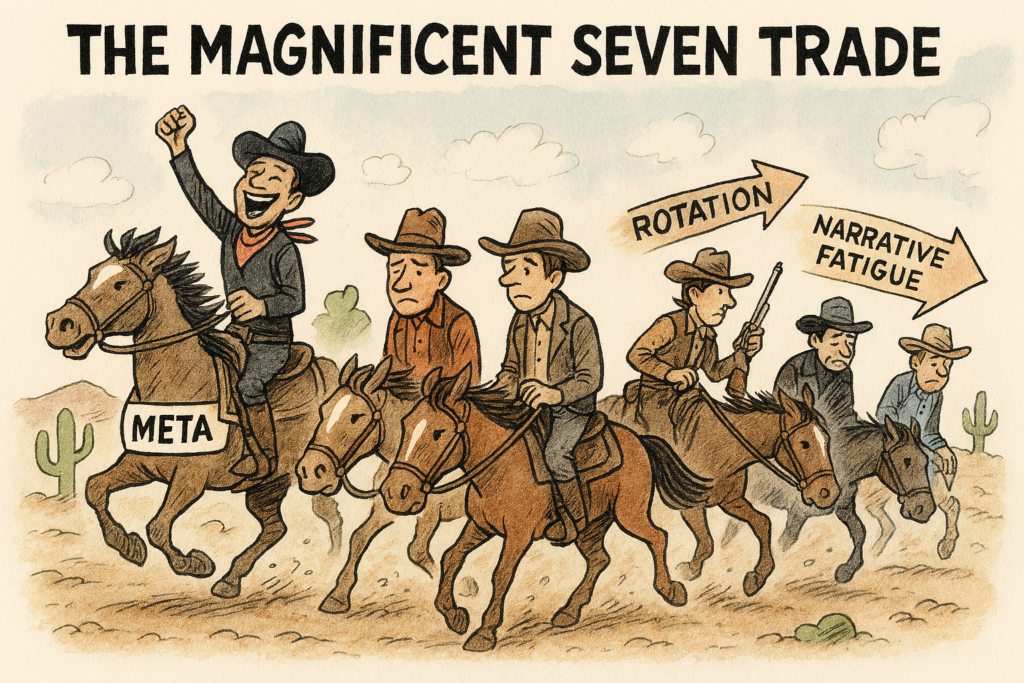

But as 2026 unfolds, the question is no longer whether they can keep leading the market higher, but whether the idea of treating them as a single trade still makes sense.

The short answer is closer to: the trade isn’t dead, but the era of effortless, broad‑based mega‑cap dominance is fading.

Mag 7 fatigue

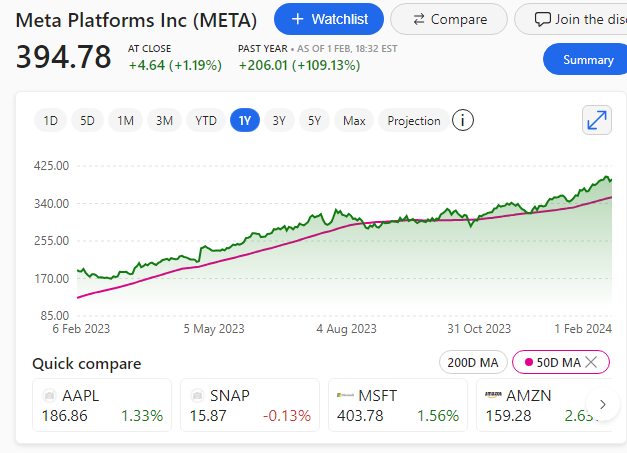

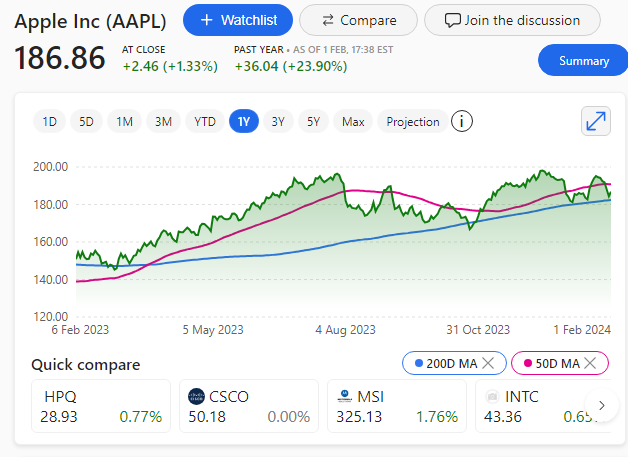

The first sign of fatigue is the breakdown in cohesion. Last year, only a minority of the seven outperformed the wider S&P 500, a sharp contrast to the near‑uniform surges of 2023 and early 2024.

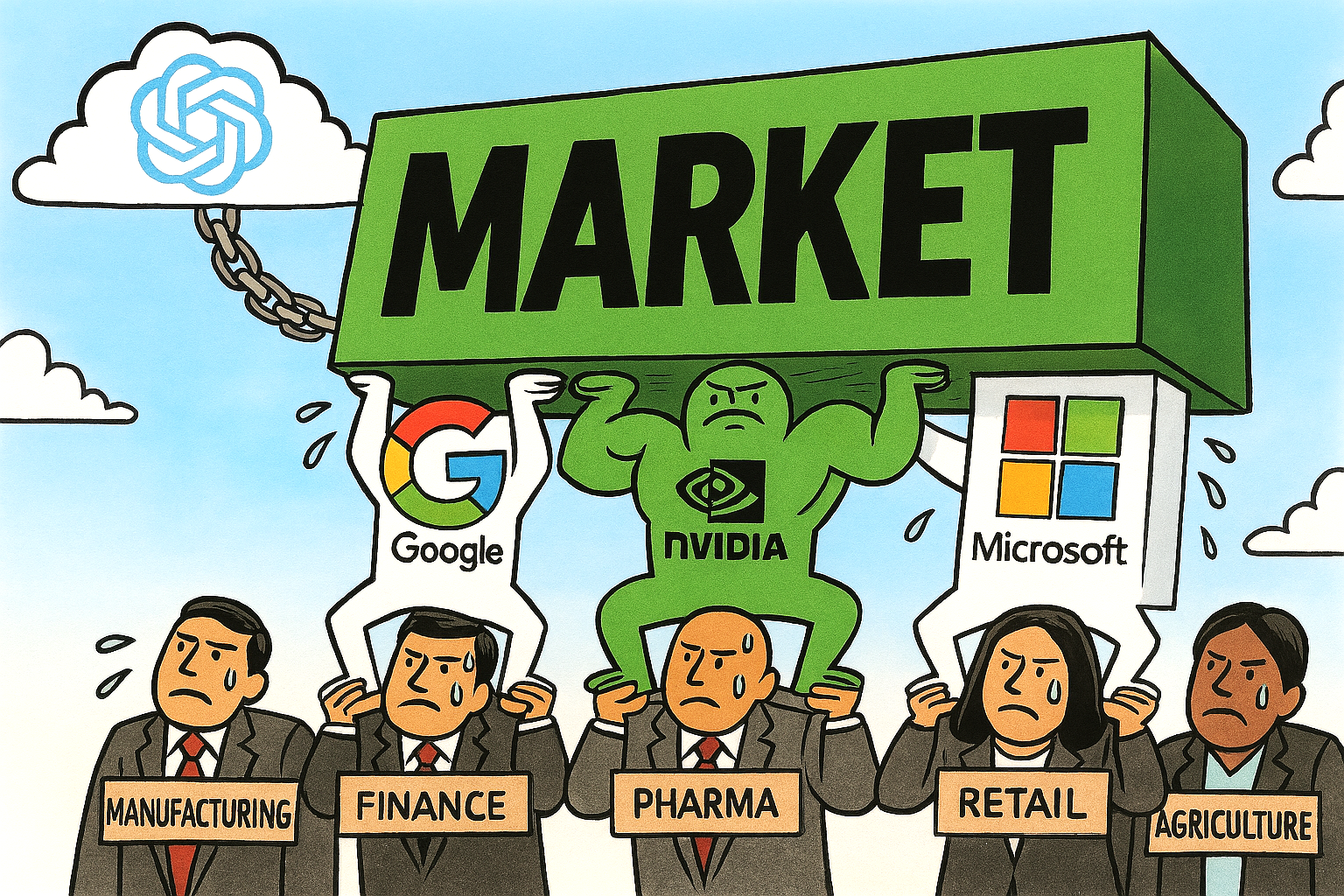

Nvidia and Alphabet continue to benefit from the structural demand for AI infrastructure and cloud‑driven productivity gains. Others, however, appear to be wrestling with slower growth, regulatory pressure or strategic resets.

Apple faces a maturing hardware cycle, Tesla is contending with intensifying global competition, and Meta’s spending plans continue to divide investors.

Divergence

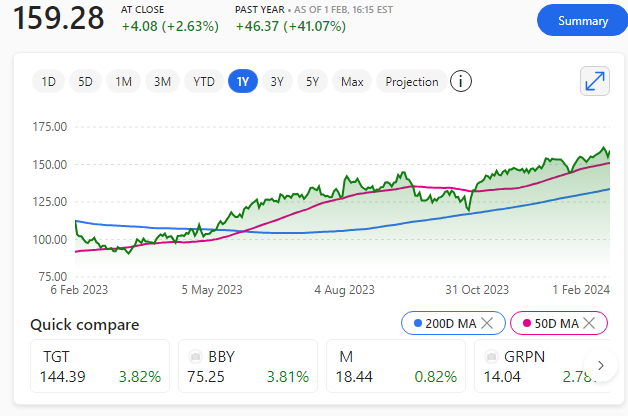

This divergence matters. For years, investors could simply buy the group and let the rising tide of AI enthusiasm and index concentration do the work.

That simplicity has evaporated. Stock‑picking is back, and the market is finally distinguishing between companies with accelerating earnings power and those relying on past momentum.

At the same time, market breadth is improving. Capital is rotating into industrials and defensive sectors as investors seek exposure to areas that have lagged the mega‑cap rally. However, AI is affecting software stocks, law and financial sectors.

Healthy future

This broadening is healthy: it reduces concentration risk and signals that the U.S. economy is no longer dependent on a handful of tech giants to sustain equity performance.

Yet it would be premature to declare the Magnificent Seven irrelevant. Their combined earnings growth is still expected to outpace the rest of the index, and their role in AI, cloud computing and digital infrastructure remains foundational.

Change

What has changed is the nature of the trade. These are no longer seven interchangeable vehicles for tech exposure; they are seven distinct stories with diverging trajectories.

The Magnificent Seven haven’t left the stage. They have likely stopped performing in unison – and for investors, that marks the beginning of a more nuanced, more selective chapter.