Artificial Intelligence: The Hype, The Hangover, and What Comes Next…

For the past two years, artificial intelligence has dominated headlines, boardrooms, and investor portfolios.

From generative models that write poetry to chips that promise to revolutionise data processing, AI has been hailed as the engine of a new industrial age. But as 2025 unfolds, the sheen is beginning to dull.

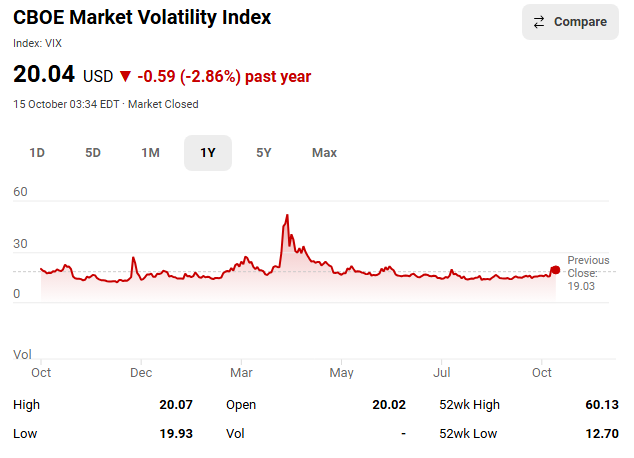

Beneath the surface of record-breaking valuations and breathless media coverage, a more sobering narrative is taking shape: the AI boom may be running out of steam.

Slowing down

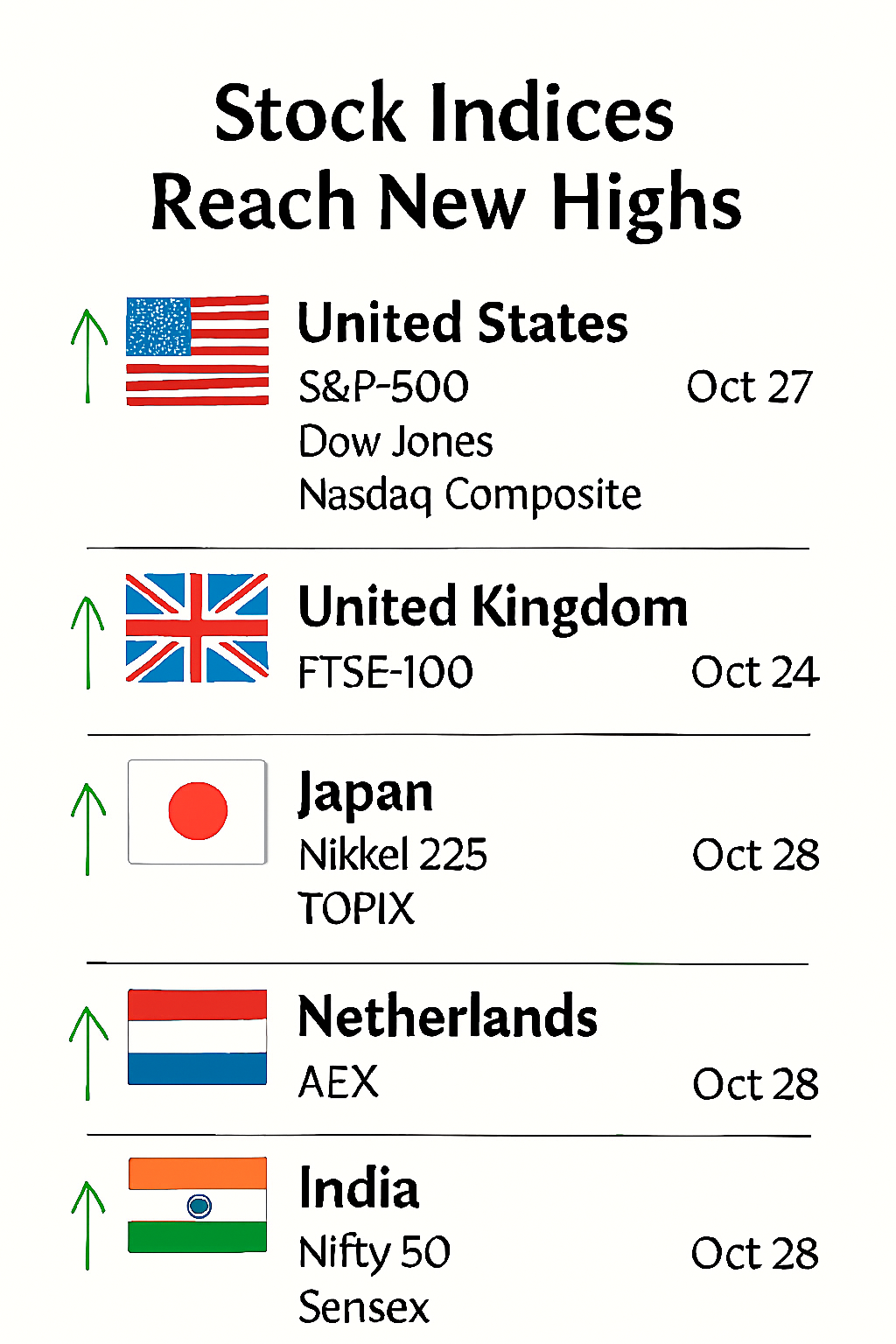

Recent market activity paints a cautionary tale. Despite strong earnings from AI stalwarts like Palantir and AMD, stock prices have faltered a little.

Palantir plunged nearly 8% after a blowout quarter, and even Nvidia—long considered the crown jewel of AI hardware—has seen pullbacks.

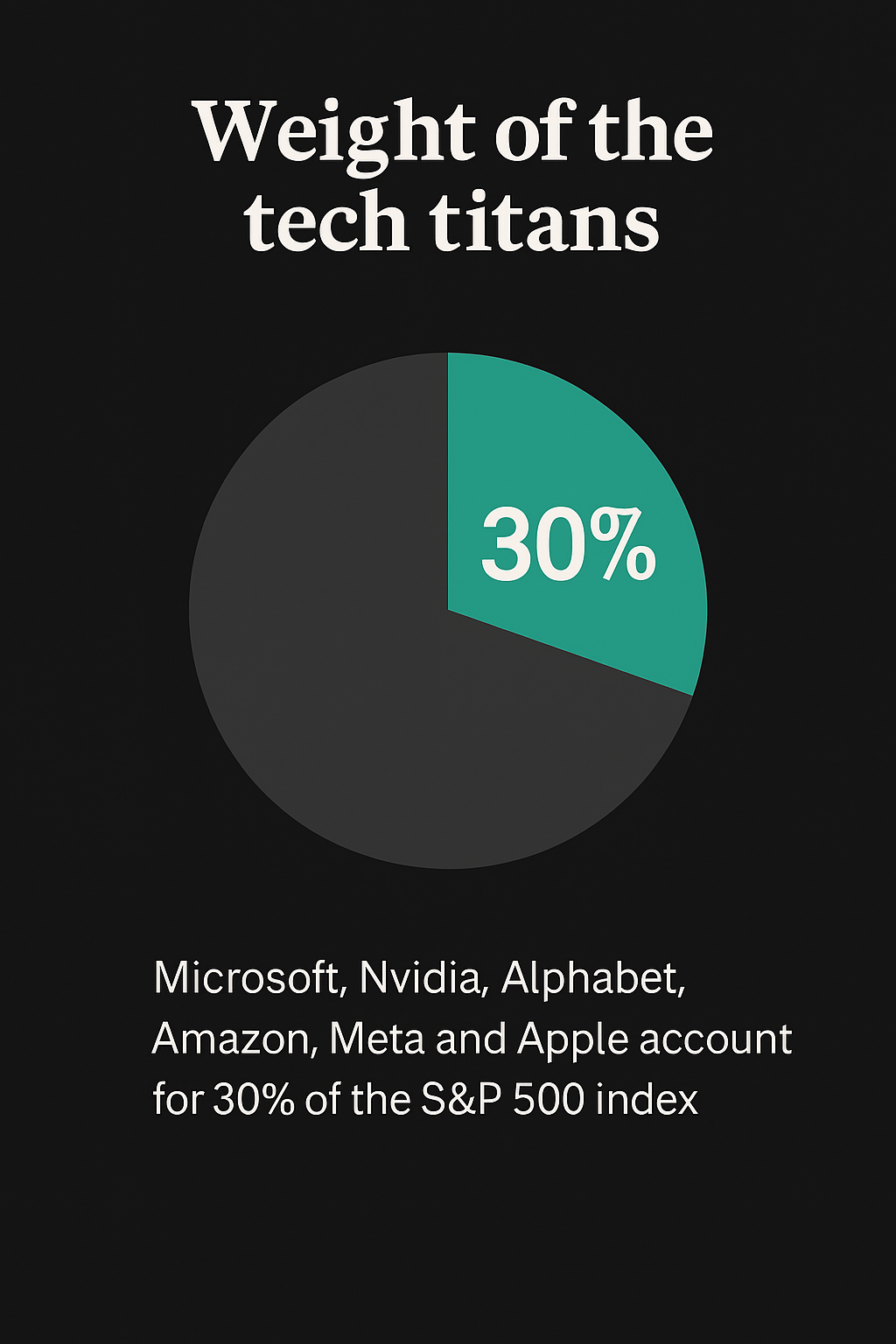

Analysts warn that Wall Street’s tunnel vision on AI is creating distortions, with capital flooding into a narrow set of companies while broader market fundamentals weaken.

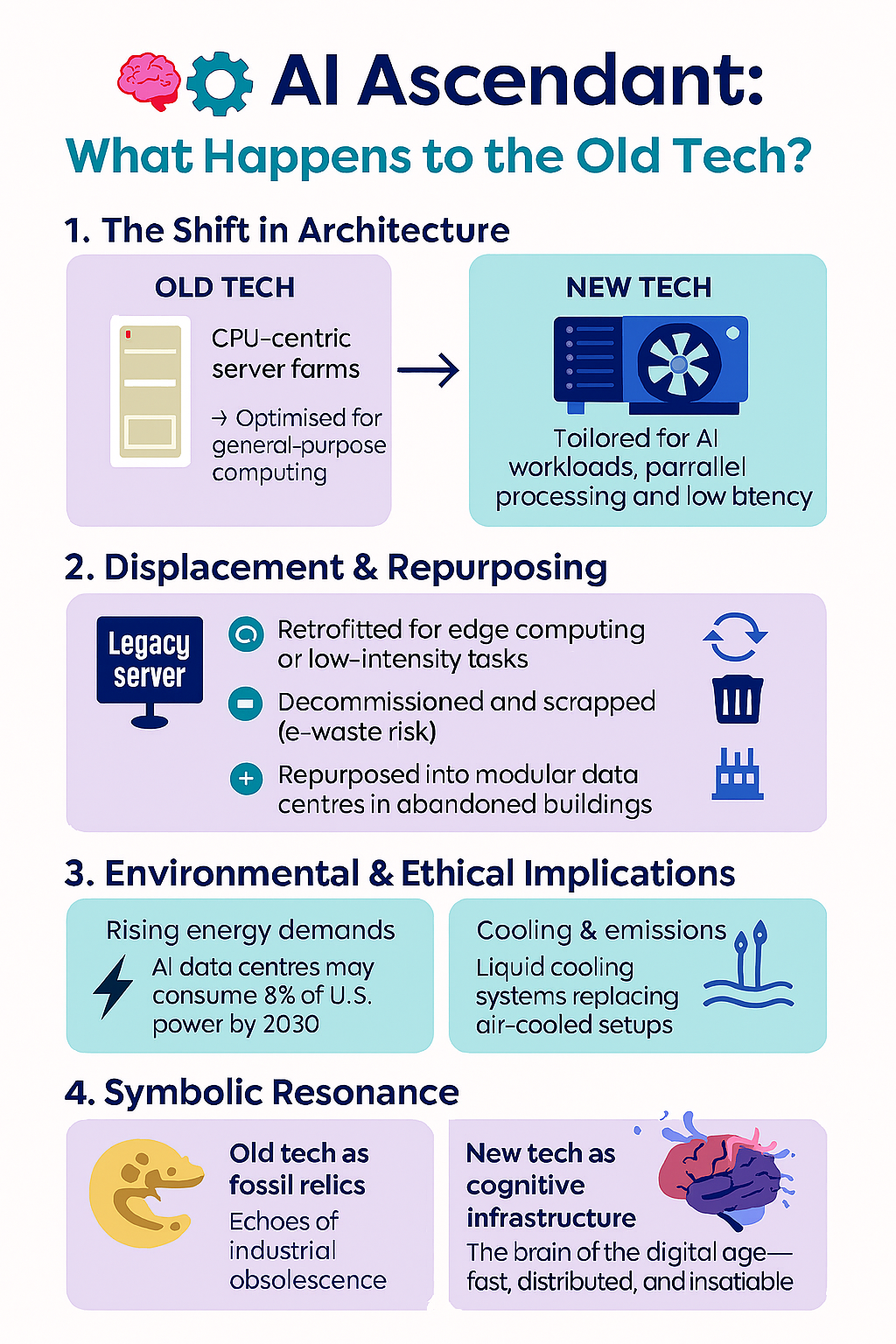

One major concern is overcapacity in data centres. Billions have been poured into infrastructure to support AI workloads, but growth in consumer-facing applications—particularly chatbots and virtual assistants—appears to be plateauing.

Businesses are also grappling with the reality that integrating AI into operations is far more complex than anticipated. From regulatory hurdles to ethical dilemmas, the promise of seamless automation is proving elusive.

Bubble?

The spectre of an ‘AI bubble‘ looms large. Comparisons to the dot-com crash are no longer whispered—they’re openly debated by investors and tech executives alike.

While AI is undoubtedly transformative, the pace of investment may be outstripping the technology’s current utility. As OpenAI’s CEO Sam Altman noted, ‘When bubbles happen, smart people get overexcited about a kernel of truth’.

That kernel remains potent. AI will continue to reshape industries, but the narrative is shifting from euphoric disruption to measured integration. The mania is not over—but it’s maturing.

Investors, developers, and policymakers must now navigate a more nuanced landscape, where realism replaces hype, and long-term value trumps short-term spectacle.

In short, the AI revolution isn’t collapsing—it’s sobering up. And that may be the best thing for its future.