Asia-Pacific markets witnessed highs on Tuesday 8th July 2024, mirroring the gains on Wall Street where the S&P 500 and the Nasdaq Composite ended at record highs. India’s Nifty 50 index also hit an all-time high of 24401.2

Investors are anticipating the forthcoming U.S. consumer price index release to discern the Federal Reserve’s direction on interest rates.

Pundits

Pundits have moved this year from four 0.25% rate reductions to one and now maybe to two with the first in September 2024. The Fed trickles decisions out from its fickle stance and each time the markets move in anticipation like a lap dog eagerly awaiting a pat. It almost doesn’t matter what the Fed does – markets want to go up. However, a rate reduction and good economic and earnings news will drive the markets even higher, for a while.

Fickle Fed

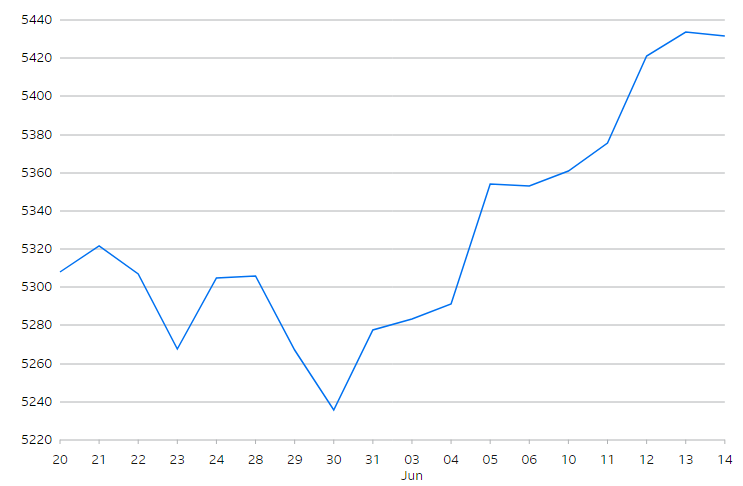

Markets are currently anticipating earnings reports. The Federal Reserve, having considered the latest economic reports, has influenced the markets with a mix of indifferent decisions. AI and technology have significantly shifted the stock market landscape, with the potential for further growth – provided that earnings sustain the pace of AI investments and expenses.

Both the S&P 500 and the Nasdaq Composite achieved record highs again overnight, alongside Japan’s Nikkei and Topix reaching new highs too.

The Nikkei 225 climbed to settle at 41580.17 after hitting a new high of 41769.35. The Topix also gained, closing at 2895.55, having touched a peak of 2907.21.

Nikkei

Topix

S&P 500

Nasdaq Composite