‘Unfair fare!’ ‘I don’t want to buy the train; I just want a ticket!’

Rolls-Royce, the British manufacturer of aircraft engines, amongst many other products announced on Tuesday 16th October 2023, that it plans to axe up to 2,500 jobs worldwide. The company said that the decision is part of its plans for a simpler, more streamlined, and more efficient organisation.

The job cuts are expected to affect mostly non-engineering roles across its global operations, and are likely to impact UK staff.

The restructuring is one of the most significant steps taken by the new chief executive, who took over at the start of the year.

He has described the company as ‘a burning platform‘ and said one of its main subsidiaries had been ‘grossly mismanaged‘.

The news comes as Rolls-Royce faces a challenging business environment due to the COVID-19 pandemic, which severely affected the aviation industry.

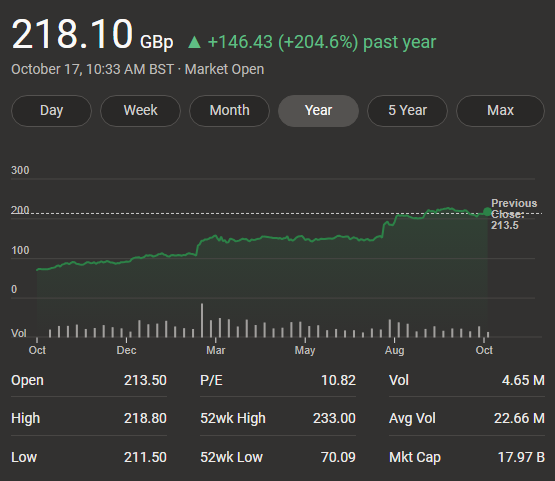

The company has already cut 9,000 jobs and raised capital from shareholders during the crisis. However, its share price has recovered in the last year, thanks to a resurgence in aviation demand and the early results of its transformation plan.

The company, which makes engines for aircraft, is based in Derby. It employs 42,000 people around the world with about half based in the UK.

It employs 13,700 people in Derby, and a further 3,400 people in Bristol.

Rolls-Royce is a company that does more than just making aircraft engines. It also develops and delivers complex power and propulsion solutions for safety-critical applications in the air, sea and on land.

Pioneering innovation for sustainable flight. Pushing the boundaries of possibility for large commercial and business aviation engines, delivering new levels of efficiency and sustainability, supported by flexible and innovative services that maximise aircraft availability.

Protecting our planet and exploring the universe. Market leaders in military air and naval power solutions, and supplier of nuclear propulsion for all UK Royal Navy submarines. They also provide maintenance, repair, overhaul, helicopter services, and customer training.

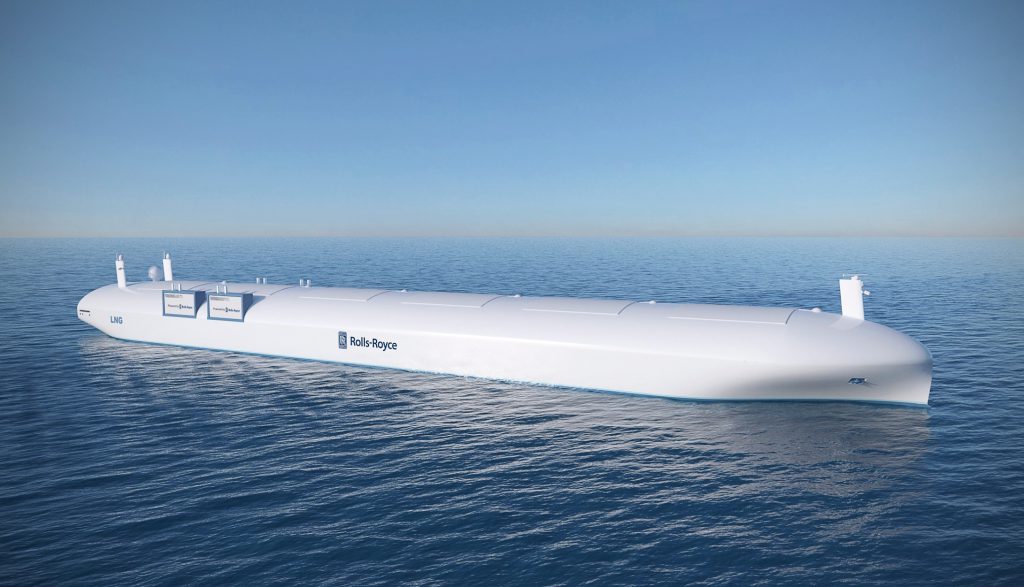

Futuristic concept projects are also under potential development such as the ‘drone’ ship.

Powering sustainability in propulsion and energy. Their MTU brand products contribute to the energy transition – as emergency power supplies for safety-critical installations and as integrated propulsion systems for ships and heavy land vehicles.

Clean, sustainable, safe and silent. Leaders in advancing all-electric and hybrid-electric power and propulsion systems, focused on the opportunities offered by the net zero transition for the Advanced Air Mobility Market and beyond. They develop complete power and propulsion systems for all-electric and hybrid-electric applications.

Rolls-Royce is developing a nuclear power plant system called the Small Modular Reactor (SMR). It is a type of pressurised water reactor (PWR) that can generate up to 470 megawatts of electricity, enough to power a million homes. The SMR is designed to be factory-built, modular, scalable, and cost-competitive. It can also support various applications such as grid and industrial electricity production, hydrogen and synthetic fuel manufacturing, and desalination.

Rolls-Royce has been a nuclear reactor plant designer since the start of the UK nuclear submarine programme in the 1950s. The company has experience in developing PWRs for the Royal Navy’s submarines, such as the PWR1 and PWR2 series. The SMR is a new generation of PWR that aims to meet the global demand for clean and reliable energy sources.

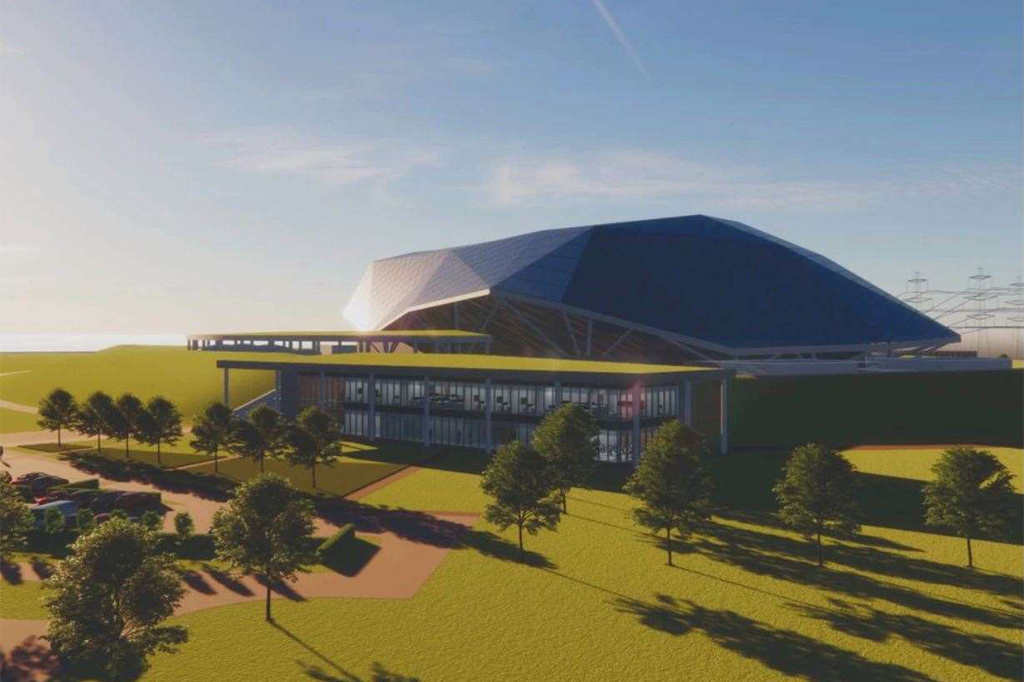

The SMR project is supported by the UK government, which has allocated £215 million for its development.

Rolls-Royce has also shortlisted six sites for a major new factory building nuclear reactors, which could create up to 6,000 jobs in the UK.

The company expects to have its first SMR operational by the early 2030s.

The chief executive of JP Morgan Chase told investors recently that he was concerned about the risks to the economy from rising geo-political tensions. He said wars in Ukraine and Israel could hit energy and food prices, and global trade.

Thousands have been killed in Israel and Gaza after an unprecedented attack by Palestinian militant group Hamas. Mr Dimon, who leads America’s biggest bank, was speaking as the firm revealed its latest quarterly results.

The bank reported $13 billion (£10.7 billion) in profit over the three months to September 2023, up 35% from the same period in 2022.

Dimon said the bank had benefited from U.S. households and business in healthy financial shape but warned that he remained cautious about the state of the global economy, given the many risks emerging. What about the effect of interest rate increases on profits the bank has benefitted from too?

‘My caution is that we are facing so many uncertainties out there,‘ he reportedly said. So helpful Mr. Dimon. He told investors they should be prepared to face higher interest rates, persistent inflation, as well as fallout from the violent conflicts.

I wouldn’t necessarily call his comments very intuitive – interest, inflation and conflict is there for all to see.

Shame he didn’t use his super magical powers of detection to get ahead of the inflation problem earlier.

The company claims that it is already powered by 100% renewable energy across its global operations, including its data centres, offices, and retail stores. It also plans to become carbon neutral across its entire supply chain by 2030. Apple has invested in various renewable energy projects, such as solar farms in China, wind turbines in Denmark, and biogas fuel cells in the U.S.

The company has been matching its annual electricity consumption with renewable energy purchases since 2017, and aims to run on carbon-free energy 24/7 by 2030. Google has also been investing in renewable energy projects, such as offshore wind farms in Europe, solar plants in Chile, and geothermal power in Nevada .

The company has committed to reaching net-zero carbon emissions by 2040, and to power its operations with 100% renewable energy by 2025. Amazon has also been investing in renewable energy projects, such as solar rooftops in India, wind farms in Ireland, and hydroelectric plants in Sweden.

The global electricity energy demand is the amount of electricity that the world needs in a given day. It can be calculated by multiplying the average global electricity demand in GW by 24 hours. According to the International Energy Agency (IEA), the average global electricity demand in 2020 was about 3 TW or 3 000 GW. This means that the global electricity energy demand in 2020 was about 72000 GWh or 72 TWh per day.

However, this is an average value, and the actual demand may vary depending on the season, time of day, weather, and other factors.

The global electricity energy demand is expected to increase in the future, as population grows and living standards improve. The IEA projects that the average global electricity demand will reach 3.8 TW or 3 800 GW by 2030 and 5.2 TW or 5 200 GW by 2050 in the Announced Pledges Scenario, which reflects the full implementation of net-zero emissions targets by some countries and regions. This implies that the global electricity energy demand will reach 91 200 GWh or 91.2 TWh per day by 2030 and 124 800 GWh or 124.8 TWh per day by 2050.

The sources of electricity generation will also change in the future, as renewable technologies such as solar PV and wind become more dominant and coal use declines. The IEA reports that the main sources of electricity generation in 2020 were coal (34%), natural gas (23%), hydropower (16%), nuclear (10%), wind (8%), solar PV (4%), biofuels and waste (3%), and other renewables (2%). In the Announced Pledges Scenario, renewables in electricity generation rise from 28% in 2021 to about 50% by 2030 and 80% by 2050.

According to a study, installing large-scale wind and solar farms in the Sahara desert could increase rainfall and vegetation in the region. The researchers simulated the effects of covering 20% of the Sahara with solar panels and wind turbines and found that it would trigger a feedback loop of more monsoon rain and more plant growth.

This could have benefits for the local environment and the global climate, as well as providing a huge amount of clean energy for the world.

The desert project would produce 10.5 GW of solar power and 3 GW of wind power. However, there are also challenges and uncertainties involved, such as the cost, feasibility, and environmental impacts of such a massive undertaking.

The Sahara is a desert on the African continent. With an area of 9,200,000 square kilometres, it is the largest hot desert in the world and the third-largest desert overall, smaller only than the deserts of Antarctica and the northern Arctic.

The global electricity energy demand is the amount of electricity that the world needs in a given day. It can be calculated by multiplying the average global electricity demand in GW by 24 hours. According to the International Energy Agency (IEA), the average global electricity demand in 2020 was about 3 TW or 3 000 GW. This means that the global electricity energy demand in 2020 was about 72 000 GWh or 72 TWh per day. However, this is an average value, and the actual demand may vary depending on the season, time of day, weather, and other factors.

The global electricity energy demand is expected to increase in the future, as population grows and living standards improve. The IEA projects that the average global electricity demand will reach 3.8 TW or 3 800 GW by 2030 and 5.2 TW or 5 200 GW by 2050 in the Announced Pledges Scenario, which reflects the full implementation of net-zero emissions targets by some countries and regions. This implies that the global electricity energy demand will reach 91 200 GWh or 91.2 TWh per day by 2030 and 124 800 GWh or 124.8 TWh per day by 2050.

The sources of electricity generation will also change in the future, as renewable technologies such as solar PV and wind become more dominant and coal use declines. The IEA reports that the main sources of electricity generation in 2020 were coal (34%), natural gas (23%), hydropower (16%), nuclear (10%), wind (8%), solar PV (4%), biofuels and waste (3%), and other renewables (2%).

In the Announced Pledges Scenario, renewables in electricity generation rise from 28% in 2021 to about 50% by 2030 and 80% by 2050.

John Lennon was an English singer, songwriter, musician and peace activist who gained worldwide fame as the founder, co-songwriter, co-lead vocalist and rhythm guitarist of the Beatles.

Lennon’s work included music, writing, drawings, and film. His songwriting partnership with Paul McCartney remains the most successful in history.

The Internal Revenue Service (IRS) has been auditing how the firm allocates profits among countries and jurisdictions. Microsoft reportedly said, ‘the issues raised by the IRS are relevant to the past but not to our current practices‘.

There have long been concerns that the biggest corporations do not pay enough tax in developed nations. Big tech’ giants have been criticised for reporting lower profits in high-tax countries and higher profits in lower-tax jurisdictions to minimise their tax burden.

Microsoft reportedly said the IRS was seeking an additional tax payment of $28.9 billion plus penalties and interest. The company said it had ‘always followed the IRS’s rules and paid the taxes we owe in the U.S. and around the world‘. It said it believed that any taxes owed after the audit would be reduced by up to $10 billion based on tax laws passed by the former U.S. President.

This year, Microsoft has also come under scrutiny from other U.S. authorities. In June, it agreed to pay $20m to the Federal Trade Commission (FTC) after the company was found to have illegally collected data on children who had started Xbox accounts.

Other American tech’ firms such as Amazon and Facebook have also faced similar calls to pay more taxes.

Microsoft’s $69 billion revised offer to buy Call of Duty-maker Activision Blizzard has been approved by UK regulators.

The Competition and Markets Authority (CMA) said the deal addressed its concerns, after the watchdog blocked the original $69bn (£59bn) bid in April 2023. The green light marks the culmination of a near two-year fight to secure the gaming industry’s biggest-ever takeover.

After the competition watchdog blocked the takeover earlier this year, Microsoft’s president hit out at the CMA’s decision which it said was ‘bad for Britain’.

The CMA chief executive reportedly said: ‘Businesses and their advisors should be in no doubt that the tactics employed by Microsoft are no way to engage with the CMA. Microsoft had the chance to restructure during our initial investigation but instead continued to insist on a package of measures that we told them simply wouldn’t work. Dragging out proceedings in this way only wastes time and money’.

The CMA also said the revised deal would ‘preserve competitive prices’ in the gaming industry and provide more choice and better services.

Prior to the approval, the deal, which makes Microsoft the owner of Call of Duty, World of Warcraft, Overwatch and Candy Crush, could not be finalised globally.

Under the restructured transaction, Microsoft will not acquire cloud rights for existing Activision PC and console games, or for new games released by Activision during the next 15 years. Instead, these rights will be divested to Ubisoft Entertainment before Microsoft’s acquisition of Activision, according to the CMA.

‘We’re grateful for the CMA’s thorough review and decision today. We have now crossed the final regulatory hurdle to close this acquisition, which we believe will benefit players and the gaming industry worldwide’.

Go count the money!

A rise in the cost of borrowing comes at a difficult time for the chancellor, Jeremy Hunt, as he prepares for the autumn statement on 22nd November 2023. The chancellor has already made clear that tax cuts will not be announced in the autumn statement.

The total amount the UK government owes is called the national debt and it is currently about £2.59 trillion – £2,590,000,000,000.

The government borrows money by selling financial products called bonds. A bond is a promise to pay money in the future. Most require the borrower to make regular interest payments over the bond’s lifetime.

UK government bonds – known as ‘gilts’ – are normally considered very safe, with little risk the money will not be repaid. Gilts are mainly bought by financial institutions in the UK and abroad, such as pension funds, investment funds, banks and insurance companies.

The Bank of England (BoE) has also bought hundreds of billions of pounds’ worth of government bonds in the past to support the economy, through a process called quantitative easing or QE.

A higher rate of interest on government debt will mean the chancellor will have to set aside more cash, to the tune of £23 billion to meet interest payments to the owners of bonds. This in-turn means the UK government may choose to spend less money on public services like healthcare and schools at a time when workers in key industries are demanding pay rises to match the cost of living.

The current level of debt is more than double what was seen from the 1980s through to the financial crisis of 2008. The combination of the financial crash in 2007/8 and the Covid pandemic pushed the UK’s debt up from those historic lows to where it stands now. However, in relation to the size of the economy, today’s debt is still low compared with much of the last century.

The U.S, German and Italian borrowing costs also hit their highest levels for more than a decade as markets adjusted to the prospect of a long period of high interest rates and the need for governments around the world to borrow.

It follows an indication from global central banks, including the United States Federal Reserve and the Bank of England (BoE), that interest rates will stay ‘higher for longer’ to continue their jobs of bringing down inflation.

During the last financial year, the government spent £111 billion on debt interest – more than it spent on education. Some economists fear the government is borrowing too much, at too great a cost. Others argue extra borrowing helps the economy grow faster – generating more tax revenue in the long run.

The Office for Budget Responsibility (OBR), has warned that public debt could soar as the population ages and tax income falls. In an ageing population, the proportion of people of working age drops, meaning the government takes less in tax while paying out more in pensions, welfare and healthcare services.

U.K. Gross Domestic Product (GDP) grew by 0.2% in August, the Office for National Statistics (ONS) reported Thursday 12th October 2023, slightly recovering from a downwardly revised 0.6% contraction in July 2023.

Services output was the main contributor to growth in August 2023, adding 0.4% on the month to offset a fall in production output of 0.7% and a decline in construction output by 0.5%.

This data shows early signs of a cooldown in the labour market and thus, lower inflation further down the economic road.

The data and outlook for the Bank of England (BoE) suggests that Bank rate increases do not have much upside from here and will most likely remain at current levels, but for a longer period.

The UK economy returning to growth in August 2023 has re-kindled expectations that interest rates will be left unchanged again in Novemeber 2023.

The economy grew marginally by 0.2% in August following a sharp fall in July 2023.

Wholesale U.S. prices rose more than expected in September 2023, according to latest data released indicating that inflation remains a problem for the U.S. economy.

The producer price index (PPI), which measures costs for finished goods that producers pay, increased 0.5% for the month, higher than estimated for a 0.3% rise, the U.S. Labor Department reported Wednesday 11th October 2023.

Excluding food and energy, core PPI was up 0.3%, versus the forecast for 0.2%.

Warren Buffet is one of the most successful investors and business owners in the world, and he has shared many of his insights and wisdom on money and investing.

This quote is just one of many…

The IMF believes Bank of England rates will peak at 6% and stay around 5% until 2028. Rates are currently 5.25%.

Buying the dip means purchasing an asset, usually a stock, when its price has dropped. The expectation is that the drop is a short-term anomaly, and the asset’s price will soon go back up. It is a strategy that some traders and investors use to take advantage of price fluctuations and profit from market rebounds.

However, buying the dip can also be risky, as there is no guarantee that the price will recover or that the asset is not in a long-term downtrend. Therefore, it is important to do your research, use indicators, and have a risk management plan before buying the dip.

The S&P 500 is still ‘buy the dip’ for the next six months,’ some analysts suggest.

In some reports, it is expected that the profit cycle will be positive over the next six months and for data to improve before a consumer-spending led downturn leads to a selloff in U.S. stocks! That’s the ‘general’ readout.

Corporate profit expectations are behind much of that forecast for stocks. Analysts expect profit growth to accelerate over the next two quarters and see the S&P 500 in a range of 4,050 to 4,750. A mild recession in early or middle 2024 should lead to a higher risk premium, pushing the S&P 500 back close to 3,800. This is all conjecture.

Other analysts doubt the earnings uplift potential and anticipate stocks to fall back sooner as PE ratios sit at an already high level.

My view, for what it’s worth, is for stocks to climb for the time being through into the New Year and then to face pullback.

Truth is, no one knows. We can all make educated guesses.

Just watch the markets and be ready for the fall – that is coming for sure!

Bitstamp has reportedly disclosed its ongoing discussions with a number of European banks about assisting them in launching cryptocurrency services. These discussions are expected to come to fruition in early 2024.

Bitstamp’s Negotiations with Top European Banks

Bitstamp’s negotiations underscore the growing acceptance of digital assets within the European financial sector.

This news comes at a time when the European Union is actively advancing its regulatory framework for cryptocurrencies, known as Markets in Crypto Assets (MiCA).

It aims at facilitating the entry of traditional financial institutions into the digital asset space.

Cyberattacks will all have malicious intent, such as accessing, changing, or destroying sensitive information; extorting money from users via ransomware; or interrupting normal business processes.

Cybersecurity aims to prevent or mitigate these attacks by using various technologies, measures, and practices.

There are many types of cybersecurity, depending on the domain or layer of IT infrastructure that needs to be protected.

This protects the computer systems, applications, networks, data and digital assets that a society depends on for national security, economic health and public safety. For example, the power grid, the water supply, the transportation system, the health care system, etc.

In the United States, there are some guidelines and frameworks for IT providers in this area, such as the NIST cybersecurity framework and the CISA guidance.

This prevents unauthorized access to network resources and detects and stops cyberattacks and network security breaches in progress. For example, firewalls, antivirus software, encryption, VPNs, etc. Network security also ensures that authorized users have secure access to the network resources they need, when they need them.

This protects applications from cyberattacks by ensuring that they are designed, developed, tested, and maintained with security in mind. For example, code reviews, vulnerability scanning, penetration testing, secure coding practices, etc. Application security also involves educating users about safe and responsible use of applications.

There are many more types of cybersecurity, such as cloud security, endpoint security, data security, identity and access management (IAM), etc. Each type of cybersecurity has its own challenges and solutions.

Cybersecurity companies such as CrowdStrike, Okta, Zscaler and Palo Alto Networks are valuable assets with businesses willing to pay good money to protect against hackers.

NOTE: Always do your own very careful research – none of these ‘suggestions’ are ‘recommendations’.

Remember: RESEARCH! RESEARCH! RESEARCH!

The UK covid fraud amount is not a single figure, but rather a sum of various losses due to fraud and error across different government schemes and programmes.

£21bn of public money lost in fraud since COVID pandemic began and most will never be recovered.

£34.5m stolen in pandemic scams by more than 6,000 cases of Covid-related fraud and cyber-crime.

£16bn lost due to fraud and error in Covid loans schemes.

£4.5bn in Covid-19 support lost to error and fraud since 2020.

These figures are based on the reports and audits by the National Audit Office, the Action Fraud team, the HMRC, and other sources. However, they may not reflect the full extent of the problem, as some fraud cases may not be reported or detected.

The UK government has taken some measures to tackle fraud and recover the losses, such as creating the Public Sector Fraud Authority, the taxpayer protection taskforce, and the Dedicated Card and Payment Crime Unit.

The incompetence shown by the UK government is utterly breathtaking.

The U.S. economy added 336,000 jobs in September 2023, the Labour Department said. Economists expected 170,000 jobs.

Stocks posted a surprise turnaround on Friday, 6th October 2023 after initially falling on a hotter-than-expected jobs report. At its session low, the Dow had fallen some 270 points, then surged by more than 400 points at in intraday trading. The Nasdaq and the S&P 500 also lost ground too only but then quickly recovered the losses.

Traders were unclear as to the reason for the intraday reversal. Some noted it could be the softer wage number in the jobs report that made investors rethink their earlier bearish stance. Others noted the pullback in yields from the day’s highs.

The rally may just be because the market had been extremely oversold with the S&P 500 at one point in the week down more than 8% from its high earlier this year.

Yields initially surged after the report, with the 10-year Treasury rate trading near its highest level in 16 years. The benchmark rate later eased from those levels, but was still up around 6 basis points at 4.78%.

Extreme market movements maybe here for a while yet.

The U.S. economy added 336,000 jobs last month, much more than expected, despite the Federal Reserve’s struggle to cool the world’s largest economy.

The unemployment rate was 3.8%, in line with August 2023. The data lifted hopes that the central bank will manage to guide the U.S. economy to a ‘soft landing’, where a recession is avoided. Bear in mind the Fed were late in dealing with the initial rise in inflation – so this battle has become harder and prolonged.

The job gains were the largest monthly rise since January 2023, and almost twice what economists had anticipated. Government and healthcare added the most jobs. The labour market still appears solid.

However, not all indicators were positive. The ADP’s national employment report showed that private-sector employers added only 89,000 jobs in September, far fewer than expected. Some factors outside the Fed’s control, such as the autoworker strike and the threat of a government shutdown, could yet damage the U.S. economy.

The labour force participation rate also remained low at 63.2%, indicating that many workers have yet to return to the labour market since the Covid19 pandemic of 2020.

In Athens, Plato founded a philosophical school where he taught the philosophical doctrines that would later become known as Platonism.

The stock market is influenced by many factors, such as economic data, earnings reports, geopolitical events, investor sentiment, and technical indicators.

Some analysts have suggested that the recent sell-off in the market may have created some oversold conditions that could lead to a relief rally or a bounce back in the near future.

One of the technical indicators that some traders use to identify buy and sell signals is the stochastics oscillator, which measures the momentum of price movements. The stochastics oscillator consists of two lines: the %K line and the %D line.

The %K line shows the current position of the price relative to its high and low range over a certain period of time, usually 14 days. The %D line is a moving average of the %K line, usually a three-day average. When the %K line crosses above the %D line, it is considered a bullish signal, indicating that the price may be reversing from a downtrend to an uptrend.

When the %K line crosses below the %D line, it is considered a bearish signal, indicating that the price may be reversing from an uptrend to a downtrend.

The stochastics oscillator also has two levels: 20 and 80. When the %K line falls below 20, it means that the price is oversold, meaning that it has fallen too much and may be due for a rebound. When the %K line rises above 80, it means that the price is overbought, meaning that it has risen too much and may be due for a pullback.

The FTSE 100 index, which tracks the performance of 100 large companies listed on the London Stock Exchange, has recently fallen below 20 on the stochastics oscillator, indicating that it may be oversold and ready for a bounce back.

However, this is not a guarantee, as other factors may also affect the market direction. Therefore, it is advisable to use stochastics in conjunction with other tools, such as trend lines, support and resistance levels, moving averages, and other technical indicators.

Additionally, some traders use different settings for the stochastics oscillator, such as changing the time period or the smoothing factor, to suit their own trading style and preferences. Always though, long term investing produces far better results over time as it smooths out the ‘ups and downs’.

In summary, there is no definitive answer to whether the stock market is building up to a major buy signal again right now, as different traders will have different opinions and strategies and views. But one possible way to gauge the market sentiment and momentum is to use the stochastics oscillator, which can provide some clues about potential reversals and opportunities in the market.

This indicator should not be used in isolation, but rather in combination with other tools and analysis – it is just that, a tool. Good well-established companies that have good track records over many many years are a good place to look for long term returns. But even then, do your thorough research first.

The interest-rate/inflation correlation is crucial, because nominal company earnings grow faster when inflation is higher. That does not mean investors should welcome inflation, since higher inflation also means that future years’ earnings must be discounted at a higher rate.

But for many behavioural reasons, investors place greater weight on the negative impact of the greater discount rate than on the higher nominal earnings-growth rate that typically accompanies higher inflation.

Economists refer to this investor error as ‘inflation illusion’. Perhaps the seminal study documenting how this error impacts the stock market was conducted by Jay Ritter of the University of Florida and Richard Warr of North Carolina State University. They found that investors systematically undervalue stocks in the presence of high inflation.

Investors will make the same error, in reverse, when inflation and interest rates start to come down. That’s why the foundation of a likely big buy signal is currently being built.

Maybe the buy signal is about to go green for a quick buying opportunity. But be careful, in this environment it can switch again very quickly.

Remember, always do your own research carefully before buying.

Read: Bull market 1982 -1999 and decline of inflation. Jay Ritter of the University of Florida and Richard Warr of North Carolina State University.

RESEARCH! RESEARCH! RESEARCH!

The average rate on the popular 30-year fixed mortgage rose to 7.72% on Tuesday 3rd October 2023, according to latest data

Mortgage rates follow loosely the yield on the 10-year Treasury, which has been climbing this week following strong economic data. Rates have not been this high since the end of 2000.

At the beginning of this year, the 30-year fixed rate dropped mortgage to around 6%, creating a short-lived burst of activity in the spring 2023. But it began rising steadily again over the summer months, causing sales to drop, despite strong demand. The current trend appears to be even higher, with the possibility of rates reaching over 8%.

U.S. mortgage rates, which are close to 8% according to some sources. This is a very high level compared to the recent years, and it may have significant implications for the housing market and the economy.

Some experts believe that rates could reach 8% later by the end of October, and possibly stay at that level for the remainder of the year. Others, however, think that rates may stabilize or decline slightly if the economic growth slows down or inflation eases.

The average rate on the popular 30-year fixed mortgage rose to 7.72% as of Oct. 3, according to Mortgage News Daily. This is the highest rate since 2000.

Rates are rising as more economic indicators point to a strong U.S. economy, which increases the likelihood of the Federal Reserve to hike rates further. The 10-year Treasury yield, which closely tracks the mortgage rates, reached 4.8% on Tuesday, the highest level since August 2007.

Hitting 8% will be like crossing a psychological barrier for many buyers, as it will increase their monthly payments and reduce their affordability. It may also dampen the demand for housing, which has already been affected by low inventory and high prices.

Some buyers are already seeing 8% mortgage rates, especially those who have high loan-to-value ratios, high balance-conforming loans, or non-qualified mortgage loans. These could also be borrowers with lower credit scores or non-prime borrowers.

The course is said to be one of the first of its kind in the UK and aims to explore the history and impact of witchcraft and magic around the world on society and science.

The course leader, Prof Emily Selove, reportedly said that the course was created following a recent surge in interest in magic and the occult, (worrying) – inside and outside of academia. She also said that the course would allow students to re-examine the assumption that the West is the place of rationalism and science, while the rest of the world is a place of magic and superstition.

The course will be offered in the Institute of Arab and Islamic Studies and will involve academics from various disciplines such as history, literature, philosophy, archaeology, sociology, psychology, drama, and religion.

Some of the modules that students can choose from include dragons in western literature and art, the legend of King Arthur, palaeography, Islamic thought, archaeological theory and practice and the depiction of women in the Middle Ages.

The university said that the course could prepare students for careers in teaching, counselling, mentoring, heritage and museum work, work in libraries, tourism, arts organisations or the publishing industry, among other areas of work.

To be perfectly honest, I really do not know what to think. This is for real!

Bed bugs are small, blood-sucking insects that can infest homes, hotels, public transport, and other places where people sleep or rest. And Paris has its fair share at the moment.

They can cause skin irritation, allergic reactions, and psychological distress to their hosts. Bed bugs are not known to transmit any diseases, but they can be hard to irradicate once they establish.

According to some news reports, Paris is facing a ‘widespread’ outbreak that has been increasing over the past few years.

The bed bug issue in Paris may pose a challenge for the city’s image and reputation, especially as it prepares to host the 2024 Olympic Games. However, there are some solutions that can help prevent and control bed bug infestations.

Not just for Paris – probably coming to a city near you too… and soon.

This will take some time to fix.

Walt Disney was an American animator, film producer and entrepreneur. A pioneer of the American animation industry, he introduced several developments in the production of cartoons. As a film producer, he holds the record for most Academy Awards earned and nominations by an individual.

Metro Bank shares have plunged by 25% after reports emerged that the bank is urgently seeking to raise millions to bolster its finances.

The bank is in talks with investors about raising £250m in equity financing and £350m in debt, while asset sales are also being considered to strengthen the lender’s balance sheet.

The bank’s shares have already suffered substantial falls in September after regulators refused to approve a request to lower the capital, or cash, requirements attached to its mortgage business.

It has been reported that the Metro Bank share price has dropped by 70% so far this year.

As of now, it’s unclear whether the bank will be able to secure the funding it needs. As much as £600 million has been muted as need in in some reports.

Is this a worrying sign of worse to come, or just a one-off?