William Shakespeare 1564 -1616

This quote is from Shakespeare’s play, Julius Caesar, Act 1, Scene 2, where Cassius tries to persuade Brutus to join the conspiracy against Caesar by appealing to his sense of free will.

This quote is from Shakespeare’s play, Julius Caesar, Act 1, Scene 2, where Cassius tries to persuade Brutus to join the conspiracy against Caesar by appealing to his sense of free will.

Dame Alison Rose, the former chief executive of NatWest Group, will lose out on £7.6m after she admitted to discussing the closure of Nigel Farage’s bank account with a BBC journalist.

She ‘resigned’ from the banking group in July 2023, after the former Ukip leader complained about a BBC report that claimed his accounts with Coutts, a private bank owned by NatWest, were closed for commercial reasons.

The BBC later apologised and amended its story, saying that it had checked with a senior source, whom Dame Alison later confirmed was herself, that Mr Farage’s accounts were closed because he fell below Coutts’s wealth threshold.

The Information Commissioner’s Office (ICO) initially suggested that Dame Alison had breached data privacy laws by confirming Mr Farage’s banking arrangements, but later issued a formal apology, saying it was ‘incorrect’ and that it had not investigated her.

Dame Alison will receive her £2.4 million fixed pay package but will not benefit from share awards and bonuses she had previously been entitled to.

Her saga reportedly wiped £850m off the value of NatWest Group. The long-term damage to the bank and banking sector likely hasn’t been fully realised yet.

It’s about trust and privacy, isn’t it?

Gross domestic product (GDP) showed zero quarterly growth in the three months to the end of September 2023, following an increase of 0.2% in the previous quarter. In annual terms, the UK’s Q3 GDP was 0.6% higher than in the same period in 2022.

Services sector output dropped 0.1% on the quarter, but the decline was offset by a 0.1% increase in construction performance, while the production sector flatlined.

U.K. Chancellor of the Exchequer Jeremy Hunt said high inflation remains the ‘single greatest barrier to economic growth’ in the country, with the consumer price index remaining at 6.7% year-on-year in September 2023.

‘The best way to sustainably grow our economy right now is to stick to our plan and knock inflation on its head’, Hunt reportedly said.

It’s useful to know the government have a plan, even though they were very late to the inflation party! Guess they were sidetracked with all the other parties at No.10!

‘The Autumn Statement will focus on how we get the economy growing healthily again by unlocking investment, getting people back into work and reforming our public services so we can deliver the growth our country needs’.

Up until September 2023, the Bank of England (BoE) raised interest rates 14 consecutive times to try to influence the UK ‘product and service’ price climb.

Interest rates are now at a 15-year high of 5.25%, and are expected to remain high for some time to come. Bank Governor Andrew Bailey reportedly said last week it was ‘much too early’ to be considering rate cuts.

Thank you Governor Baily – it so comforting and reassuring to know that the very people who missed the red inflation flags are still in charge of policy.

Remember, the BoE and others originally suggested inflation would be transitory – I suppose it is, if given years to move back down. What did you think was going to happen after all that borrowing and the country crawling back to work after the pandemic.

Nice job guys! Don’t forget to collect your paycheque on the way out!

This means that Moody’s sees a higher risk of a downgrade in the future, which could affect the borrowing costs and confidence of the U.S. government.

The main reasons for Moody’s action are the rising deficits and debt levels of the U.S., as well as the continued political polarization that hampers effective policymaking. Moody’s also cited the impact of the Covid-19 pandemic and the recent failures of some U.S. banks as factors that have worsened the environment for the U.S. government and the banking system in general.

Moody’s warned that the U.S.’s deficits are likely to remain ‘very large’. It also warned that ‘continued political turmoil or polarization’ in Congress further increases the risk the U.S. will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability‘.

Moody’s still maintains a triple ‘A’ (AAA) credit rating on the U.S. government debt, which is the highest possible rating, but warns of the challenges and uncertainties that the U.S. faces in restoring its fiscal strength and stability.

The ‘AAA‘ rating is at risk.

The federal government is on the brink of another shutdown, with just a week left for the Republican-led House, Democratic-led Senate and Biden White House to reach a breakthrough on funding.

He stressed the Fed nevertheless can be cautious as the risks between doing too much and too little have come into closer balance.

Federal Reserve Chairman Jerome Powell reportedly said Thursday 9th November 2023 that he and his fellow policymakers are encouraged by the slowing pace of inflation but are unsure whether they’ve done enough to keep the momentum going.

Speaking a little more than a week after the central bank voted to hold rates steady, Powell said in remarks aimed at the International Monetary Fund (IMF) gathering in Washington, D.C., that more work could be ahead in the battle against high prices.

The statement comes with inflation still well above the Fed’s long-standing goal but also considerably below its peak levels in the first half of 2022. After 11 U.S. rate hikes, we have witnessed the most aggressive policy tightening since the early 1980s, the FOMC have increased rates from pretty much zero to a range of 5.25%-5.5%.

Those increases have coincided with the Fed’s preferred inflation gauge, the core personal consumption expenditures price index, to fall to an annual rate of 3.7%, from 5.3% in February 2022. The more widely followed consumer price index peaked above 9% in June of last year.

Powell referenced the progress the economy has made. Gross domestic product (GDP) accelerated at a ‘quite strong’ 4.9% annualised pace Q3 2023, though Powell also said the expectation is for growth to ‘moderate in coming quarters’. He described the economy as ‘just remarkable’ in 2023 in the face of a broad expectation that a recession was inevitable.

Nothing like a massive ‘self-pat’ on the back for a job well-done? Remember the Fed’s initial analysis? IT was for inflation to be ‘transitory’. They didn’t get that right either.

Futures pricing, according to the CME Group, suggested there’s less than a 10% chance that the FOMC will approve a final rate hike at its Dec. 12-13, 2023, meeting, even though committee members in September pencilled in an additional 0.25% rise before the end of 2023.

Traders anticipate the Fed will start cutting rates next year, probably around June 2024.

Bitcoin rose to a new high for 2023 on Thursday 9th November 2023 as optimism around a potential Bitcoin ETF approval continued to build.

The price of the Bitcoin rose more than 6% to climb above $37000 for the first time since May 2022. It touched $37900 before drifting back slightly. Ether was little changed but held recent gains and was trading just below the $2000 level.

The rise in the Bitcoin triggered a wave of short liquidation overnight, which aided and propelled crypto prices higher.

Over the past year, cryptocurrencies in general have been desperately searching for a catalyst and the ETF news has been just that. We may witness another big surge when the ETF news fully breaks.

Other crypto assets as well as crypto equities enjoyed the Bitcoin price wave. Solana, one of the biggest outperformers in crypto this year, gained 11%. The tokens related to Cardano and Polygon rose 4% and 3%.

When Bitcoin surges, Ether and other altcoins tend to follow suit. Bitcoin is up over 120% year-to-date, we are seeing many other coins turning bullish now too, and trading volumes are picking up.

The chatbot began returning errors before 9 a.m. ET, affecting OpenAI’s API users, which are used by more than two million developers. ChatGPT users were also told that ‘ChatGPT is at capacity right now’ and a status page referred to the issue as a ‘major outage’.

‘We’ve identified an issue resulting in high error rates across the API and ChatGPT, and we are working on remediation’, OpenAI shared in a status report at 9:50 a.m. ET.

Full services were restored by about 10:50 a.m. ET.

Bu what caused the outage?

Nintendo said on Wednesday 8th November 2023 it plans to develop a live-action film of The Legend of Zelda, one of its most popular game franchises.

Nintendo has been encouraged by the success of The Super Mario Bros. Movie which has generated more than $1 billion at the box office since its April 2023 release.

Nintendo shares surged 6% in Japan on Wednesday 6th November 2023 on the Zelda movie news, and after the company raised its sales and profit forecast for the fiscal year.

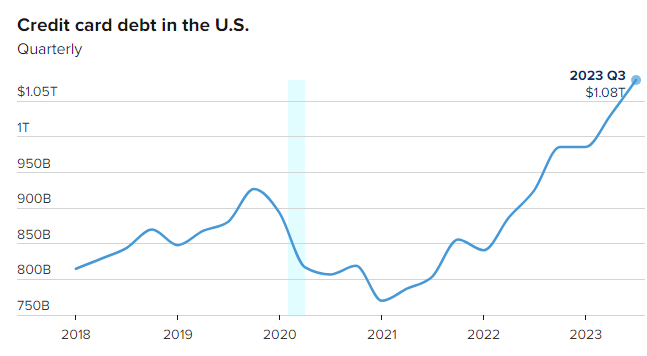

U.S. citizens now owe $1.08 trillion on their credit cards, according to a new report on household debt from the Federal Reserve Bank of New York.

Total household debt rose by 1.3% to reach $17.29 trillion in the third quarter of 2023, according to the latest Quarterly Report on Household Debt and Credit.

Mortgage balances increased to $12.14 trillion, credit card balances to $1.08 trillion, and student loan balances to $1.6 trillion.

Auto loan balances increased to $1.6 trillion, continuing the upward trajectory seen since 2011. Other balances, which include retail credit cards and other consumer loans, were effectively flat at $0.53 trillion. Delinquency transition rates increased for most debt types, except for student loans.

See analysis: new report on household debt

Microsoft ended Tuesday’s trading session at a record high of $360.53, following fresh optimism about growth from a key partner in artificial intelligence (AI). The increase gives the company a market value of about $2.68 trillion.

At a tech event on Monday 6th November 2023, Microsoft’s AI partner, OpenAI, announced a batch of updates, including price cuts and plans to allow people to make custom versions of the ChatGPT chatbot.

Microsoft CEO Satya Nadella attended and emphasized that developers building applications with OpenAI’s tools could get to market quickly by deploying their software on Microsoft’s Azure cloud infrastructure.

Microsoft has invested a reported $13 billion in OpenAI, which has granted Microsoft an exclusive licence on OpenAI’s GPT-4 large language model that can generate human-like prose in response to a few words of text.

Last week, Microsoft announced the release of an AI add-on for its Office productivity app subscriptions and an assistant in Windows 11, both of which rely on OpenAI models.

The future is looking bright for Microsoft right now.

In a world first, it was recently reported that artificial intelligence (AI) demonstrated the ability to negotiate a contract autonomously with another artificial intelligence without any human involvement.

Luminance at its London headquarters, demonstrated its AI, called Autopilot, negotiating a non-disclosure agreement in a matter of minutes.

It marks the first time AI has ever negotiated a contract with another AI, with no human involvement.

The only input from a human that is still required, is the signing of the contract.

IBM is investing heavily in AI, cloud computing, and quantum computing, and has recently acquired several AI start-ups, such as Instana, Turbonomic, and Waeg.

IBM also has a partnership with OpenAI, one of the leading AI research organizations, to provide cloud infrastructure for its AI models.

Investors who love IBM expect the company to grow its earnings by around 10% annually over the next five years. Investors were also impressed with IBM’s dividend yield, which is currently around 4.5%. Dividends are a great way to generate passive income.

IBM is not the only tech company that is pivoting to AI. Google, Microsoft, and Anthropic are competing in the field of generative AI, which can create text, images, music, and more from natural language prompts.

These companies are attempting to integrate generative AI into their products and services, such as search engines, maps, word processors, office applications, chatbots, and more. Generative AI is seen as a game-changer for many industries and applications, and could potentially disrupt the dominance of Big Tech.

Legacy companies can pivot to a platform model, which is a business strategy that connects producers and consumers of value through a digital interface. Platform companies like Facebook, Amazon, Google, and Tencent have created value at stunning rates, and have grown rapidly and own large market shares.

Legacy companies can leverage their existing systems, such as customer relationships, data, and brand recognition, to create platforms that offer impressive and immersive products and services.

Other successful platform pivots are Disney+, which transformed Disney from a media producer to a media platform; Nike+, which connected Nike’s physical products with digital services; and John Deere, which created a platform for precision agriculture.

The Omaha-based conglomerate’s operating earnings totalled $10.761 billion last quarter, 40.6% higher than from the same quarter in 2022.

Berkshire held a record level of cash at the end of September 2023 of $157.2 billion.

The ‘Oracle of Omaha’ has been taking advantage of surging bond yields, buying up short-term Treasury bills yielding at least 5%.

Geico, the crown jewel of Berkshire’s insurance empire, reported another profitable quarter.

Warren Buffet probably the greatest consistent investor the world has ever seen.

Aleph Alpha, which has built its own large language models, raised $500 million backed by Bosch, SAP and Hewlett Packard Enterprise.

It is reported that Aleph Alpha will use the new funds to invest in research on foundation models, advanced product capabilities and marketing of its software.

A big part of what Aleph Alpha is pushing for with its technology is a concept known as ‘data sovereignty’ the concept that data stored in a certain country is subject to that country’s laws.

The fund-raising round was backed predominantly by German firms, with enterprise IT giant SAP and Schwarz Group, (the owner of Lidl). Park Artificial Intelligence and Burda Principal Investments also invested.

Aleph is the first letter of the Hebrew alphabet and Alpha is the first letter of the Greek alphabet.

Nintendo reported better-than-expected sales and profit for fiscal Q2 on Tuesday 6th November 2023 as it continues to benefit from the Zelda game released this year and from the Super Mario Movie.

Nintendo said it sold 6.84 million Switch consoles in the April to September period, up 2.4% year-on-year. The company maintained its forecast for 15 million Switch unit sales. The Nintendo Switch is 6 years old – pretty good going for an old console.

Nintendo raised its sales and profit forecast for its current fiscal year. Nintendo’s revenue fell 4% year-on-year and its profit dropped 19%.

Sales in the first half of the fiscal year were the largest since the launch of the Switch, Nintendo reportedly said in a statement.

The market reaction to the U.S. jobs report comes down to a simple observation: bad news is good news, as long as it is not too bad.

Stocks rallied sharply after the Labour Department said nonfarm payrolls rose by 150,000 in October 2023, 20,000 fewer than expected but a difference caused mostly by the auto strikes, which appear to be over – a case of bad news is good news.

For the Federal Reserve, the relatively constrained job creation coupled with wage gains nearly in line with expectations adds up to a scenario in which the central bank doesn’t really have to do anything.

The Fed finally got what it’s been looking for – a meaningful slowdown in the labour market.

He has recently shared his views on how AI will eventually create a situation where no job is needed, and how humans will have to find meaning in life.

Elon Musk recently reportedly said that AI will have the potential to become the ‘most disruptive force in history’ and that it will be smarter than the smartest human.

He compared AI to a ‘magic genie’ that would grant unlimited wishes to its owners. He also said that AI will be able to do everything, and that people will not need to work for money, but only for personal satisfaction.

This is a very optimistic and futuristic vision of AI, but it also raises some important questions and challenges.

These are some of the issues that were discussed at the AI Safety Summit 2023 at Bletchley Park in England, where world leaders agreed to a global communique on AI that recognized the potential risks associated with AI.

The summit was attended by, Prime Minister Rishi Sunak, U.S. Vice President Kamala Harris and other tech and business executives, including Elon Musk himself.

AI is a powerful technology that can bring many benefits and opportunities to humanity, but it also requires careful and responsible development and regulation. It can bring ‘disaster’ too if not managed constructively.

It is hoped humans and AI can coexist peacefully and harmoniously in the future.

My biggest fear is this will not be the case.

Grok is a neologism (a newly coined word or expression), referenced by Robert A. Heinlein for his 1961 science fiction novel Stranger in a Strange Land. It means to understand something so deeply that you become one with it.

Grok is a term used in computer programming to mean to ‘profoundly understand something‘, such as a system, a language, or an algorithm.

Elon Musk debuts ‘Grok’ AI bot to rival ChatGPT and others. But, ‘Grok’ isn’t quite ready yet for the general public – it still has some learning to do. xAI, Elon Musk’s new AI venture, launched its first AI chatbot technology named ‘Grok’.

The prototype is in its infancy and early stages of training and is only available to a select group of users before a wider release.

Musk is positioning xAI to compete with OpenAI, Inflection, Anthropic and others.

Grok, the company said, is modelled on ‘The Hitchhiker’s Guide to the Galaxy’. It is supposed to have ‘a bit of wit, a rebellious streak’ and it should answer the ‘spicy questions’ that other AI might dodge, according to a statement from xAI.

The company’s published mandate is to build artificial intelligence ‘to advance our collective understanding of the universe’. Musk has previously said that he believes today’s AI makers are bending too far toward ‘politically correct’ systems.

xAI’s mission, it reportedly said, ‘is to create AI for people of all backgrounds and political views’.

Self-driving car technology, an AI Chatbot built around humour with access to current public data through X, a robot called Optimus and Musk’s drive for the ‘different’. If you add all this together, X.ai, through Musk, is likely positioning itself for the next big push in AI…

…A humanoid robot for the workplace and for the home! Get ready… it’s coming!

South Korea stocks surged on Monday, 6th November 2023 after the country imposed a ban on short selling, while most Asia-Pacific markets took the lead from a lighter than expected U.S. jobs report that helped reduce interest rate expectations.

Financial decision makers in South Korea said short selling will be banned until the end of June 2024. Short selling is when a trader sells borrowed shares to buy back at a lower price and pocket the difference.

AI could increase the complexity and opacity of financial markets, making it harder to monitor and prevent systemic risks. For example, AI could enable new forms of market manipulation, fraud, or cyberattacks that could destabilize the financial system.

AI could create feedback loops or cascading effects that could amplify shocks and cause contagion across different sectors and regions. For example, AI could trigger flash crashes or sudden liquidity shortages that could spread rapidly and disrupt market functioning.

AI could create new sources of concentration and interdependence that could increase the vulnerability of the financial system. For example, AI could create a reliance on a few dominant data providers, platforms, or models that could fail or malfunction.

AI bots could take control of a stock trading platform or worse a stock exchange.

These are some of the possible scenarios that AI could create the next financial crisis. However, there are many potential benefits and opportunities that AI could bring to the financial sector, such as enhancing efficiency and innovation and even enhancing easier access and personal financial control for millions of investors and savers.

As always, it is important to balance the risks and rewards of AI and to develop appropriate regulatory frameworks and ethical standards to ensure its safe and responsible use.

Sam Bankman-Fried, founder of the world’s biggest cryptocurrency exchange, has been found guilty of fraud and money laundering at the end of a month-long trial in New York.

He was accused of lying to investors and customers and stealing billions of dollars from FTX, which went bankrupt in November 2022. He now faces up to 115 years in prison. The jury delivered its verdict after less than five hours of deliberations. His sentencing has been set for 28th March 2024.

The verdict was delivered after a month-long trial that saw three of his former associates, including his ex-girlfriend, testify against him as part of a plea deal. They revealed that Bankman-Fried used customer deposits from FTX to fund his other company, Alameda Research, as well as to buy property and make political donations. He denied the charges and claimed that he acted in good faith and made mistakes due to being overwhelmed by the rapid growth of his businesses.

It concludes a dramatic fall from grace for the 31-year-old former billionaire and one of the most public faces of the crypto industry.

The case has been seen as a major blow to the crypto industry, which has been struggling to recover from the market crash and regulatory scrutiny that followed the FTX collapse. Bankman-Fried was once one of the most prominent and influential figures in the sector, known for his philanthropy and crypto industry innovation.

His downfall has been described as the industry’s greatest cautionary tale.

‘Sam Bankman-Fried perpetrated one of the biggest financial frauds in American history – a multibillion-dollar scheme designed to make him the king of crypto’, U.S. attorney Damian Williams said in a statement after the verdict. ‘This case has always been about lying, cheating and stealing, and we have no patience for it’.

Prosecutors had accused Bankman-Fried of lying to investors and lenders and stealing billions of dollars from cryptocurrency exchange FTX, helping to precipitate its collapse. They charged him with seven counts of fraud and money laundering.

He had pleaded not guilty to all the charges, maintaining that, while he had made mistakes, he had acted in good faith.

After the verdict Bankman-Fried’s lawyer Mark Cohen said: ‘We respect the jury’s decision. But we are very disappointed with the result’.

Mr Bankman-Fried reportedly maintains his innocence and will continue to vigorously fight the charges against him.

He now faces up to 115 years in prison.

The Bank of England’s (BoE) Monetary Policy Committee (MPC) voted by a majority of 5-4 to maintain Bank Rate at 5.25%, the highest level in 15 years. However, four members preferred to increase the bank rate, to 5.5%.

The MPC also voted unanimously to reduce the stock of UK government bond purchases held for monetary policy purposes by £100 billion over the next twelve months, to a total of £658 billion.

The BoE’s decision was influenced by the weak economic outlook, the high inflation rate, and the uncertainty surrounding the Covid-19 pandemic and the Brexit saga.

The BoE said that the UK economy was likely to contract by 0.5% in Q3 2023, and that underlying growth in the second half of 2023 was also likely to be weaker than expected. The BoE also warned that there was a 50% chance of a recession in the next year (50/50). I think even I could guess with odds at 50/50.

The BoE also said that inflation, which was 6.7% in September 2023, was expected to peak at around 7% in Q4 2023, before falling back to the 2% target by 2025 Q2. The BoE said that the inflation spike was largely driven by temporary factors, such as higher energy and food prices, and that it would not respond to it.

The Bank of England was behind the curve calling it transitory. Can we trust any future forecasts?

The BoE’s decision was in line with the market expectations, as most analysts and investors had predicted that the BoE would keep rates on hold.

The UK supercomputer project is a major initiative by the UK government to boost the country’s capabilities in artificial intelligence, weather forecasting, climate research and other highly important scientific research projects.

The project involves building and connecting two new supercomputers across the UK: Isambard-AI and Dawn.

Isambard-AI will be the UK’s most powerful supercomputer, with over 5,400 NVIDIA GH200 superchips, capable of 200 quadrillion calculations per second. It will be based at the University of Bristol and delivered by Hewlett Packard Enterprise (HPE). It will offer computing capacity never seen before in the UK for researchers and industry to make AI-driven breakthroughs in fields such as robotics, big data, climate research, and drug discovery.

Dawn will be a new supercomputer cluster at the University of Cambridge, delivered by a partnership with Dell and UK SME StackHPC. It will be powered by over 1,000 Intel chips that use water-cooling to reduce power consumption. It will target breakthroughs in fusion energy, healthcare and climate modelling.

The two supercomputers will form the government’s AI Research Resource (AIRR), which will give researchers access to resources with more than 30-times the capacity of the UK’s current largest public AI computing tools. The AIRR will support the work of the Frontier AI Taskforce and the AI Safety Institute, which are tasked with analysing and mitigating the risks posed by the most advanced forms of AI.

The UK supercomputer project is part of a £300 million investment from the government to create a new national Artificial Intelligence Research Resource for the country. The project is expected to be completed by summer 2024.

The investment comes as the UK hosts an AI safety summit in Bletchley Park, home of World War II codebreakers.

These announcements are all part of the £1 billion supercomputer plan launched in May 2023.

The Federal Reserve’s rate remains at 5.25%-5.5%.

The bank has been raising interest rates in an attempt to tame the economy and slow inflation, (the rate at which prices rise). Recent data showed the U.S. economy grew faster than expected.

Raising interest rates is a way for central banks tackle rising inflation. The idea is that by raising interest rates and making it more expensive to borrow, consumers will spend less and that would lead to slower price rises. In the U.S. however, the consumer is not slowing down. This may lead to higher rates, or higher for longer which in turn could push the U.S. into a recession.

The bank had faced criticism, with some suggesting that holding interest rates at higher levels could put the U.S. economy at risk of entering a recession.

House prices had the biggest monthly rise in October for more than a year, according to the Nationwide Building Society.

However, they were still down sharply on a year ago, the UK’s biggest building society noted. The rise in prices was most likely due to there not being enough properties to meet demand.

However, activity in the housing market is still extremely slow, as buyers struggle with higher mortgage rates.

Interest rates, which underpin mortgage pricing, have moderated recently but they are still well above the lows of 2021. The Bank of England has raised interest rates from lows of around 0.1% to 5.25% in its inflation battle.

UK inflation is over 6.5% – the target is 2%.

According to the latest data from Eurostat, the statistical office of the European Union, the euro area annual inflation was 2.9% in October 2023, down from 4.3% in September 2023.

The main factor behind the decline in inflation was a sharp drop in energy prices, which fell by some 15% year-on-year in October 2023, compared to a 10.7% decrease in September.

The euro area economy also contracted by 0.1% in the third quarter of 2023, after growing by 0.6% in the second quarter, according to preliminary estimates from Eurostat. This puts the eurozone on the brink of recession, as high interest rates and weak demand weigh on the economic activity.

However, some analysts argue that the ECB’s monetary policy is too tight and risks choking off the recovery. They suggest that the ECB should adopt a more flexible approach and consider cutting rates or expanding its bond-buying programme if the economic outlook worsens.

Core inflation which excludes volatile food and energy prices dropped to 4.2% year-on-year in October 2023 from 4.5% in September 2023, according to European Union statistics agency Eurostat.

The agency also revealed Tuesday that the euro zone economy contracted by 0.1% in the third quarter, according to initial estimates, below consensus estimates for GDP to be unchanged from the previous quarter.

The ECB expects the euro zone economy to grow by just 0.7% this year, by 1% in 2024 and 1.5% in 2025.