Santa rally is a term that refers to the tendency of the stock market to rise in the last week of December and the first two days of January.

This is not a guaranteed or consistent pattern, and it may depend on many and various factors that affect the market performance.

However, the stock market trends in December are historically positive, according to some resources.

When it’s cold outside sometimes the market get hot

The term ‘Santa rally’ refers to the tendency of the stock market to rise in the last week of December and the first two days of January.

Some possible explanations for this phenomenon are tax considerations, increased holiday spending, optimism and goodwill, and institutional investors adjusting their portfolios before the year end.

But it can get cold too

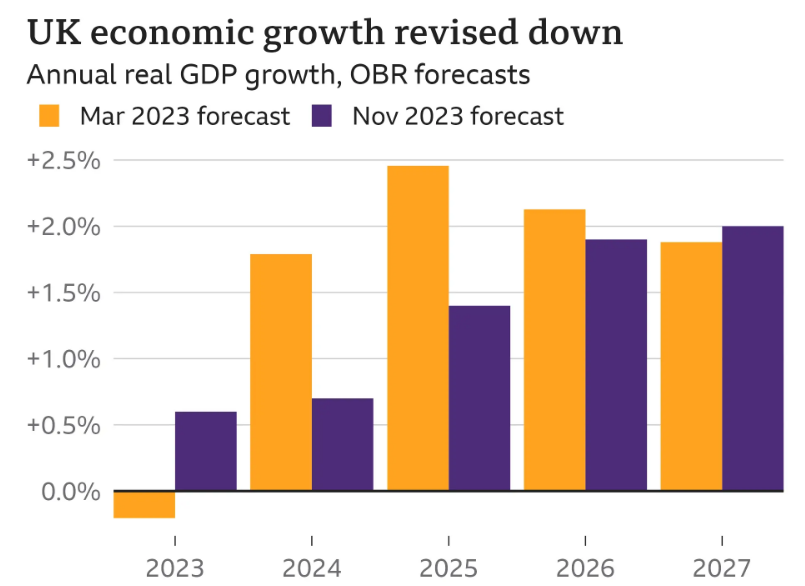

However, the stock market performance in December may vary depending on the economic and political conditions of the year. For example, in 2022, the stock market had its worst year since 2008, and many major indices were negative for December. The coronavirus pandemic, the trade war with China, the Brexit uncertainty, and the U.S. presidential election (2020) and problems that followed that election were some of the factors that contributed to the market volatility and decline.

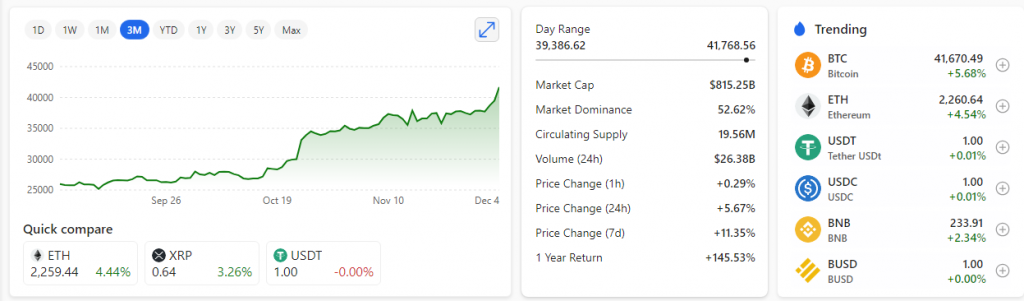

Therefore, the stock momentum going into December 2023 may depend on how the current issues and events are resolved or at least managed. The market for 2023 and right now is in a general upward trend.

Some of the key factors that may influence the market are geo-political issues, the wars between Ukraine and Russia – Israel and Palestine, inflation rates, interest rates, budgets, corporate earnings, fiscal news, central bank interventions and other brewing world tensions.

Impossible to predict, but we can make an educated guess

It is not possible to predict with certainty how the market will behave at this time of year (or any for that matter), but looking at historical data, technical analysis, fundamentals, stock market movements in general and the overall news pattern – it is possible to make a more ‘informed’ decision.

Warning!

Don’t rely on it though – ‘nothing’ is, absolutely ‘NOTHING‘ is definite in the stock market.

Trade carefully and enjoy the holiday.