Nvidia, traditionally recognised within the gaming community for its graphics chips, has become the world’s most valuable publicly traded company.

On Tuesday 18th June 2024, Nvidia’s shares rose by 3.6%, increasing its market cap to $3.34 trillion and overtaking Microsoft, now valued at $3.32 trillion. Earlier in the month, Nvidia’s valuation reached $3 trillion for the first time, surpassing Apple.

Nvidia $3.34 trillion market cap

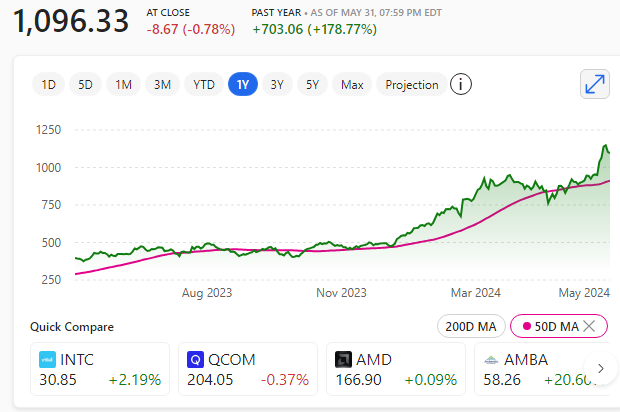

So far this year, Nvidia’s shares have surged over 170% and saw further gains after announcing first-quarter earnings in May 2024. Since the close of 2022, the stock has increased more than ninefold, paralleling the rise of generative artificial intelligence.

Apple’s shares dropped by 1.1% on Tuesday, resulting in a market value of $3.29 trillion for the tech giant.

Nvidia commands roughly 80% of the market share for AI chips in data centres, a sector that has expanded rapidly as companies like OpenAI, Microsoft, Alphabet, Amazon, and Meta have competed to acquire the necessary processors for constructing AI models and managing growing workloads.

In the latest quarter, Nvidia’s data centre business saw a 427% increase in revenue from the previous year, reaching $22.6 billion and comprising approximately 86% of the company’s total sales.

Established in 1991, Nvidia initially focused on hardware, selling gaming chips for running 3D games. The company has also ventured into cryptocurrency mining chips and cloud gaming services.

However, in the last two years, Nvidia’s stock has soared as investors recognised its pivotal role in the AI boom, a trend that continues to accelerate. This surge has increased the net worth of co-founder and CEO Jensen Huang to an estimated $117 billion, ranking him as the 11th richest individual globally, according to Forbes.

But is the rise too fast and is it time for a share price valuation adjustment in its meteoric rise, to bring it back down to Earth?

Nvidia share price one year chart 18th June 2024