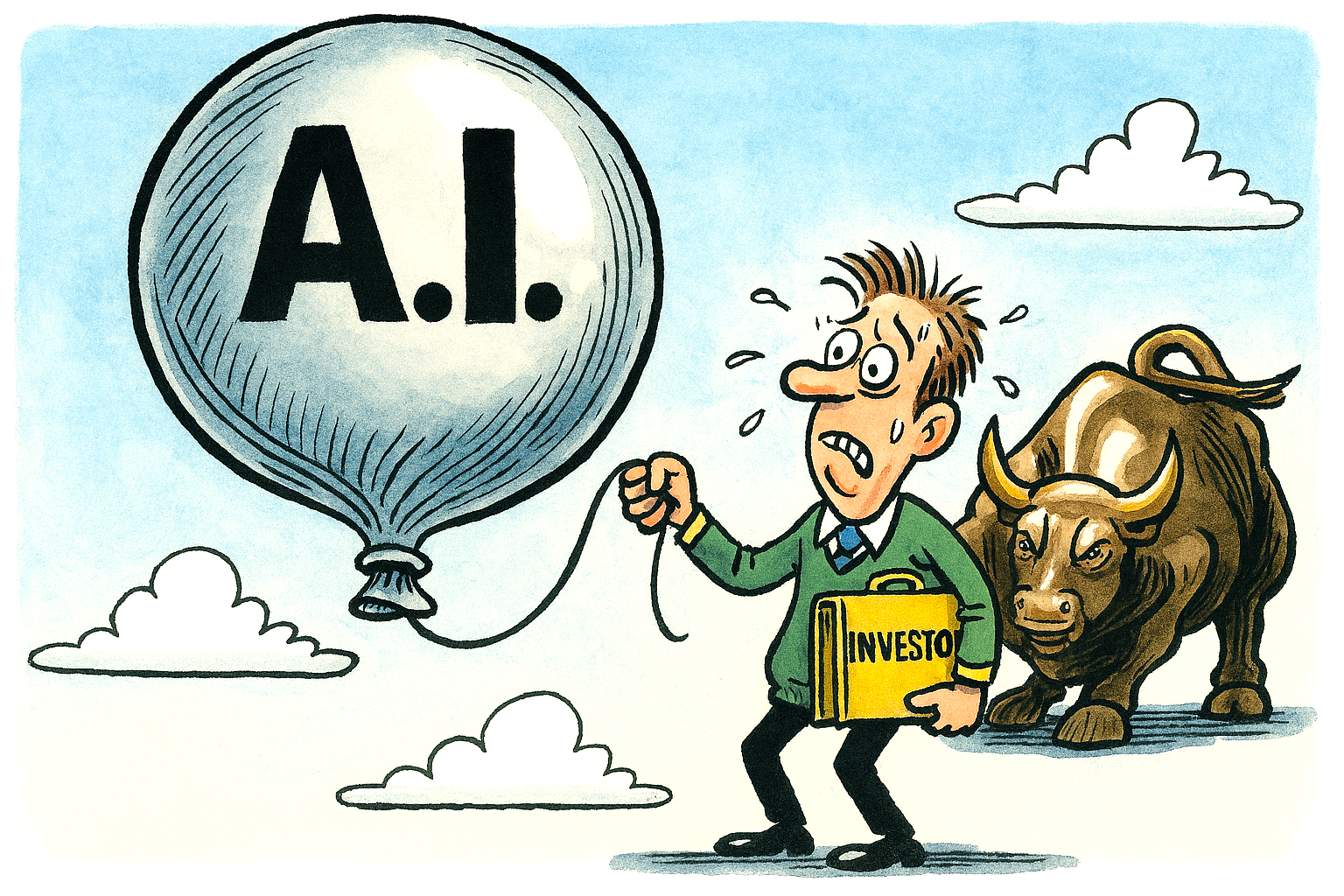

The meteoric rise of artificial intelligence (AI) stocks has captivated investors worldwide, but beneath the headlines lies a growing concern: are these valuations built on genuine fundamentals, or are they the product of collective psychology?

Increasingly, analysts point to the possibility that the fear of missing out (FOMO) is a potential driver of this rally, especially in the AI related ‘retail’ trader.

The European Central Bank recently warned that AI-related equities, particularly the so-called ‘Magnificent Seven’ tech giants—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—are showing signs of ‘stretched valuations‘.

This echoes the dot-com bubble of the late 1990s, when enthusiasm for the internet led to unsustainable price surges.

Today, investors are piling into AI stocks not only because of their technological promise but also because they fear being left behind in what could be a transformative era.

Nvidia, now the world’s most valuable company, exemplifies this trend. Its dominance in AI chips has fuelled extraordinary gains, yet critics argue its valuation has raced far ahead of realistic earnings expectations.

The psychology is clear: when investors see others profiting, they rush in, often ignoring traditional measures of risk and return.

This dynamic creates a paradox. On one hand, AI undeniably represents a revolutionary force with vast potential across industries. On the other, the concentration of capital in a handful of firms raises systemic risks.

If expectations falter, the correction could be brutal, much like the dot-com crash that erased trillions in market value.

Ultimately, the AI boom may prove to be both a genuine technological leap and a speculative bubble. For sure there are undeniable revolutionary technological advancements right now – but is it all just too fast and too soon?

The challenge for investors is to distinguish between sustainable growth and hype-driven inflation—before it is too late.

The FOMO monster is definitely ‘artificially’ affecting the U.S. stock market – it will likely reveal itself soon.