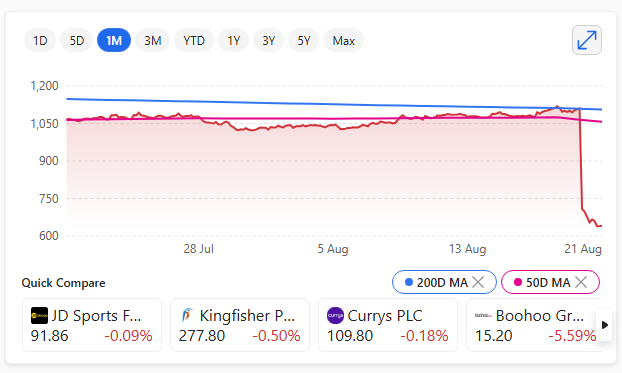

WH Smith’s attempt to reinvent itself as a sleek, travel-focused retailer has hit turbulence, with a £30 million profit overstatement in its North American division sending shares into a 42% nosedive.

The error, stemming from premature recognition of supplier income, has triggered a full audit review and left investors ‘sobbing into their cornflakes’, as one analyst reportedly put it. Not nice!

The timing couldn’t be worse. Having sold off its UK High Street arm earlier this year, WH Smith was banking on its overseas operations to deliver growth.

Instead, the company now expects just £25 million in North American trading profit—less than half its original forecast.

The reputational damage is compounded by the fact that supplier income, often tied to promotional deals, is notoriously tricky to account for.

WH Smith’s misstep suggests not just a lapse in judgement, but a systemic failure in financial controls.

Table of events

| Metric | Details |

|---|---|

| 📊 Profit Overstatement | £30 million |

| 🧾 Cause of Error | Premature recognition of supplier income |

| 🇺🇸 Affected Division | North America |

| 📉 Share Price Impact | 42% drop |

| 📉 Revised Profit Forecast | £25 million (down from £54 million) |

| 🕵️♂️ Audit Response | Full review initiated by Deloitte |

| 🏪 Strategic Context | WH Smith sold UK High Street arm earlier in 2025 |

| 📦 Supplier Income Risk | Often tied to promotional deals; hard to track |

This isn’t merely a spreadsheet error—it’s a strategic setback. The retailer’s pivot to travel hubs was meant to offer high-margin stability, buoyed by a captive audience.

But the accounting blunder casts doubt on the robustness of its operational oversight, especially in a market as competitive as the U.S.

With Deloitte now combing through the books, W H Smith faces a long road to restore investor confidence.

For a brand that once prided itself on reliability, this episode is a reminder that even legacy names can falter when ambition outpaces accountability.

Let’s hope the next chapter isn’t written in red ink.