Where is the standard for the tariff line? Is this fair on the smaller businesses and the consumer? Money buys a solution without fixing the problem!

- Nvidia and AMD have struck a deal with the U.S. government: they’ll pay 15% of their China chip sales revenues directly to Washington. This arrangement allows them to continue selling advanced chips to China despite looming export restrictions.

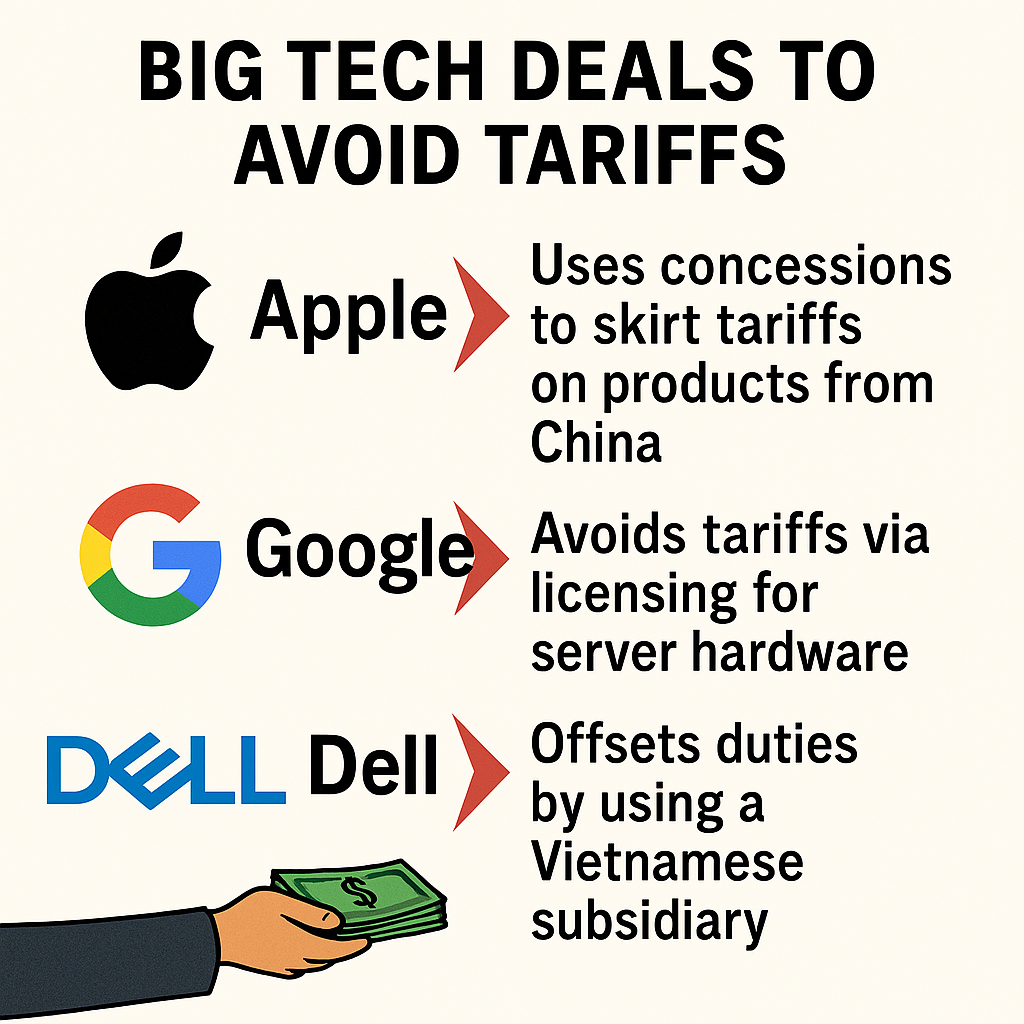

- Apple, meanwhile, is going all-in on domestic investment. Tim Cook announced a $600 billion U.S. investment plan over four years, widely seen as a strategic move to dodge Trump’s proposed 100% tariffs on imported chips.

🧩 Strategic Motives

- These deals are seen as tariff relief mechanisms, allowing companies to maintain access to key markets while appeasing the administration.

- Analysts suggest Apple’s move could trigger a ‘domino effect’ across the tech sector, with other firms following suit to avoid punitive tariffs.

⚖️ Legal & Investor Concerns

- Some critics call the Nvidia/AMD deal a “shakedown” or even unconstitutional, likening it to a tax on exports.

- Investors are wary of the arbitrary nature of these deals—questioning whether future administrations might play kingmaker with similar tactics.

Big Tech firms are striking strategic deals to sidestep escalating tariffs, with Apple pledging $600 billion in U.S. investments to avoid import duties, while Nvidia and AMD agree to pay 15% of their China chip revenues directly to Washington.

These moves are seen as calculated trade-offs—offering financial concessions or domestic reinvestment in exchange for continued market access. Critics argue such arrangements resemble export taxes or political bargaining, raising concerns about legality and precedent.

As tensions mount, these deals reflect a broader shift in how tech giants navigate geopolitical risk and regulatory pressure.

They buy a solution…