‘Don’t for one minute think you’re staying, especially after the mess you left last time!’

To the moon and back.

To the moon and back.

This means that by lunchtime on the third working day of 2024, a FTSE 100 company boss will have been paid more than a UK worker’s full annual salary.

So, this means that it takes approximately just three working days for a CEO to earn the FULL years pay of an average worker in the UK.

The study also shows that the pay gap between bosses and workers has increased since 2020, as executive pay has risen by 9.5% while worker pay has risen by only 6%.

This is a disturbing example of inequality in the UK workplace, which has been exacerbated by the cost-of-living crisis and the strike action by many low-paid workers.

Some economists have called for UK government to intervene and reduce the unfair pay gap, such as putting workers on company boards, taxing wealth more fairly, and working with employers and unions to create better living standards.

There is a place for wealth creators but not for greedy wealth takers. We need businesses to be successful to maintain good levels of employment. But unnecessary wealth greed has no place in our modern society.

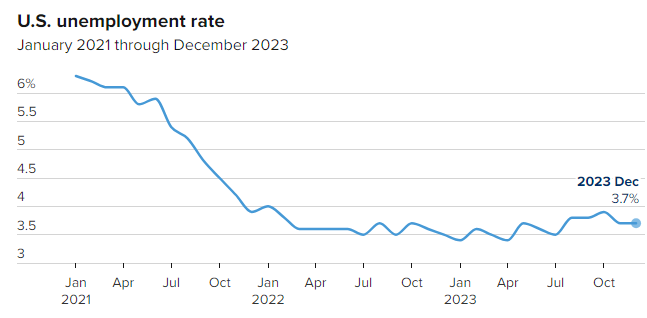

December’s jobs report showed that 216,000 jobs were added for the month while the unemployment rate remained steady at 3.7%. Estimates were in the region of 170,000 as analysts were looking for their ‘goldilocks figure.

The hiring boost came from a gain of 52,000 in government jobs and another 38,000 in health care-related occupations.

Average hourly earnings rose 0.4% on the month and were up 4.1% from the same period 2023, both higher than the respective estimates for 0.3% and 3.9%.

The S&P500 and Nasdaq recovered some early 2024 losses as the fresh data encouraged the debate and chance of a rate cut again. Later however, the strong U.S. jobs growth dampened the likelihood of rate a cut anytime soon. Yields were on the rise again.

Government hiring drove the gains, which extended one of the strongest streaks of job creation on record. The job growth has confounded forecasters expecting job losses as higher borrowing costs slowed the economy.