Trump’s latest flurry of tariff U-turns has left global markets whiplashed but oddly resilient.

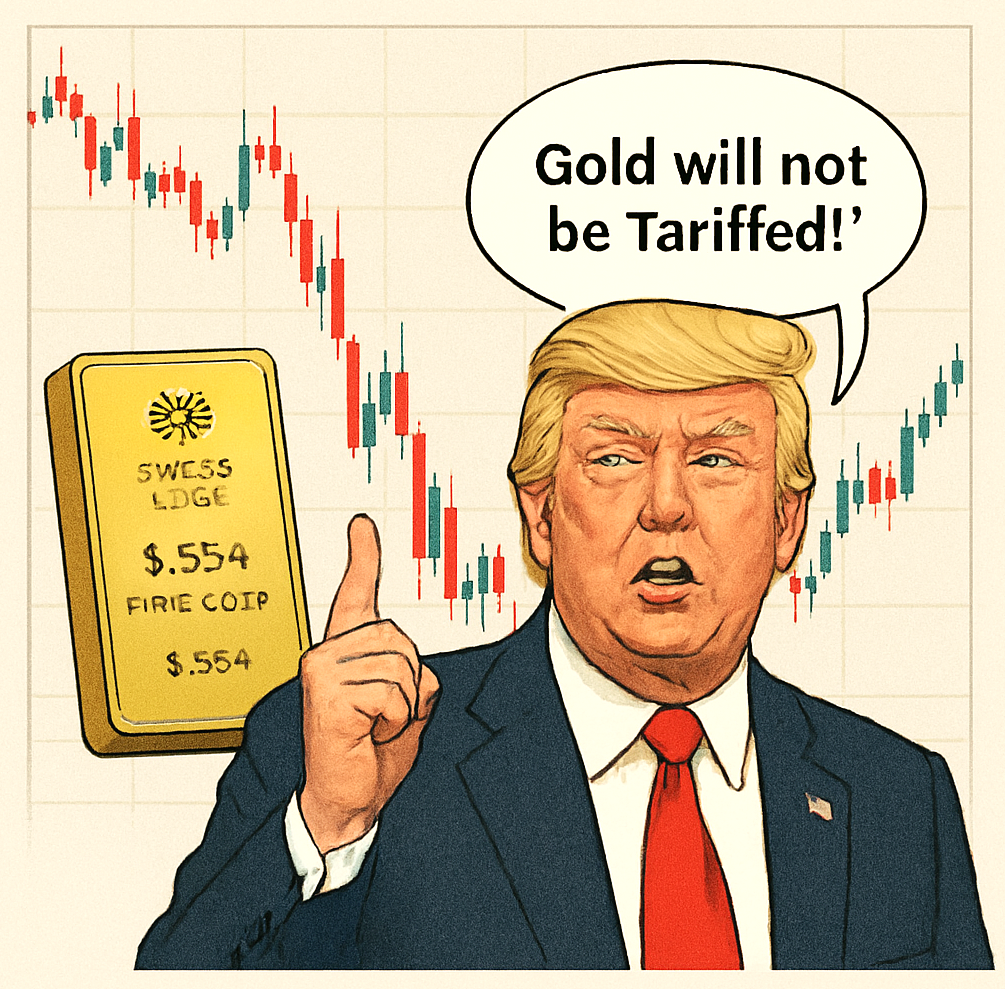

From threatening Swiss gold bars with a 39% levy to abruptly tweeting ‘Gold will not be Tariffed!’ The former president’s reversals have become a hallmark of his political tactic.

Investors now brace for volatility not from policy itself, but from its rapid retraction. With China tariffs delayed, praise for previously criticised CEOs, and shifting stances on Ukraine and Russia, Trump’s tactics seem less about strategy and more about spectacle.

Yet despite the chaos, markets appear unfazed—suggesting that unpredictability may now be priced in

🧠 Why So Many U-Turns?

- Market Sensitivity: Many reversals follow stock market dips or investor backlash.

- Diplomatic Pressure: Allies like Switzerland, India, Ukraine, Canada and Australia have pushed back hard.

- Narrative Control: Trump often uses Truth Social to pivot public messaging rapidly.

- Strategic Ambiguity: Some analysts argue it’s part of a negotiation tactic—others call it chaos.

🔁 Latest Trump U-Turns

| Topic | Initial Position | Reversal | Date |

|---|---|---|---|

| Gold Tariffs | Swiss gold bars to face 39% tariff | Trump tweets “Gold will not be Tariffed!” | 7 Aug 2025 |

| China Tariffs | 145% reciprocal tariffs to begin | Delayed for 90 days | 12 Aug 2025 |

| Intel CEO Lip-Bu Tan | “Must resign, immediately” | “His success and rise is an amazing story” | 11 Aug 2025 |

| Russia-Ukraine Arms | Paused military aid to Ukraine | Resumed shipments after backlash | 8 Jul 2025 |

| India’s Role in Peace Talks | Criticised India’s neutrality | Praised India’s diplomatic efforts | 9 Aug 2025 |

| Global Tariffs | Imposed sweeping import taxes | Suspended most tariffs within 13 hours | 9 Apr 2025 |

| Epstein Files | Promised full declassification | Now downplaying and deflecting | Ongoing |