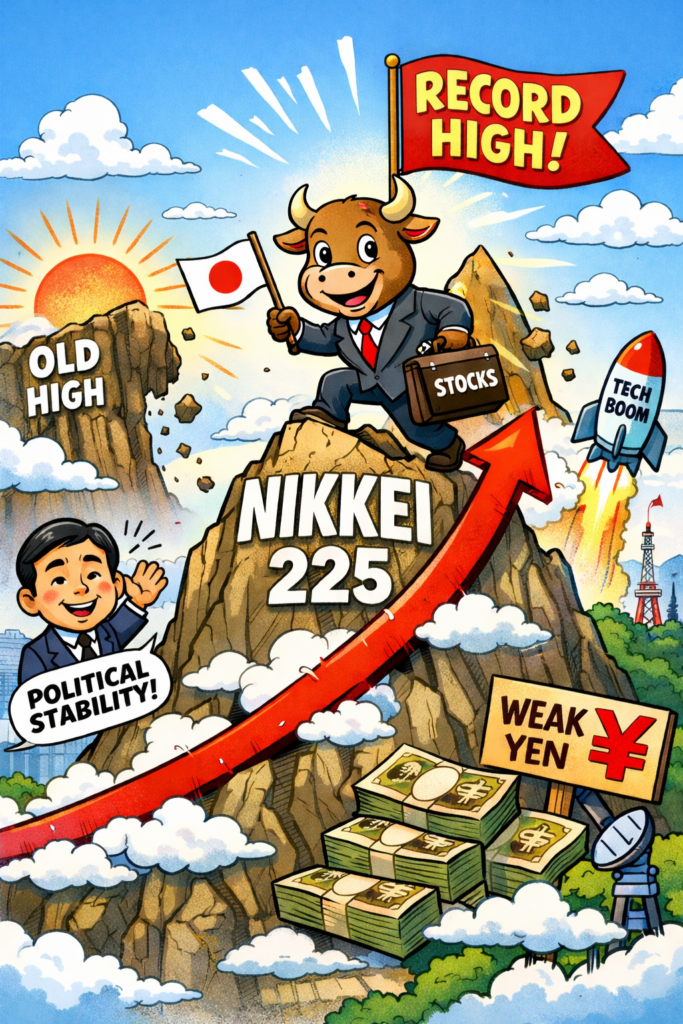

Japan’s Nikkei 225 has smashed through the 58,000 barrier for a second time, marking a defining moment in the country’s market renaissance.

The index briefly touched an intraday high of around 58,015 before easing slightly, but the symbolic breakthrough underscores a powerful shift in investor confidence and Japan’s evolving economic narrative.

Takaichi’s rally

The rally has been fuelled by a blend of political stability, expectations of aggressive pro‑growth policies, and robust corporate earnings.

Prime Minister Sanae Takaichi’s decisive election victory has strengthened assumptions that her administration will push ahead with fiscal expansion and structural reforms, echoing a new phase of ‘Abenomics‑style’ stimulus.

Market enthusiasm has also been supported by global investors seeking alternatives to China, as well as domestic buyers encouraged by improving sentiment and a clearer policy direction.

Analysts reportedly note that the broader Topix index has risen in tandem, signalling that the rally is not confined to a handful of heavyweight stocks but reflects wider market participation.

Still, some experts warn that the surge may be running ahead of economic fundamentals, with questions lingering over wage growth, consumption, and long‑term productivity.

For now, though, Japan’s markets are enjoying a rare moment in the global spotlight — and investors are watching closely to see whether this momentum can be sustained.