In a sweeping rally that spanned continents and sectors, major global indices surged to fresh record highs yesterday, buoyed by cooling inflation data, renewed hopes of U.S. central bank rate cuts, and easing trade tensions.

U.S. inflation figures released 12th August 2025 for July came in at: 2.7% – helping to lift markets to new record highs!

U.S. Consumer Price Index — July 2025

| Metric | Value |

|---|---|

| Monthly CPI (seasonally adjusted) | +0.2% |

| Annual CPI (headline) | +2.7% |

| Core CPI (excl. food & energy) | +0.3% monthly, +3.1% annual |

Despite concerns over Trump’s sweeping tariffs, the U.S. July 2025 CPI came in slightly below expectations (forecast was 2.8% annual).

Economists noted that while tariffs are beginning to show up in certain categories, their broader inflationary impact remains modest — for now.

Global Indices Surged to Record Highs Amid Rate Cut Optimism and Tariff Relief

Tuesday, 12 August 2025 — Taking Stock

📈 S&P 500: Breaks Above 6,400 for First Time

- Closing Level: 6,427.02

- Gain: +1.1%

- Catalyst: Softer-than-expected U.S. CPI data (+2.7% YoY) boosted bets on a September rate cut, with 94% of traders now expecting easing.

- Sector Drivers: Large-cap tech stocks led the charge, with Microsoft, Meta, and Nvidia all contributing to the rally.

💻 Nasdaq Composite & Nasdaq 100: Tech Titans Lead the Way

- Nasdaq Composite: Closed at a record 21,457.48 (+1.55%)

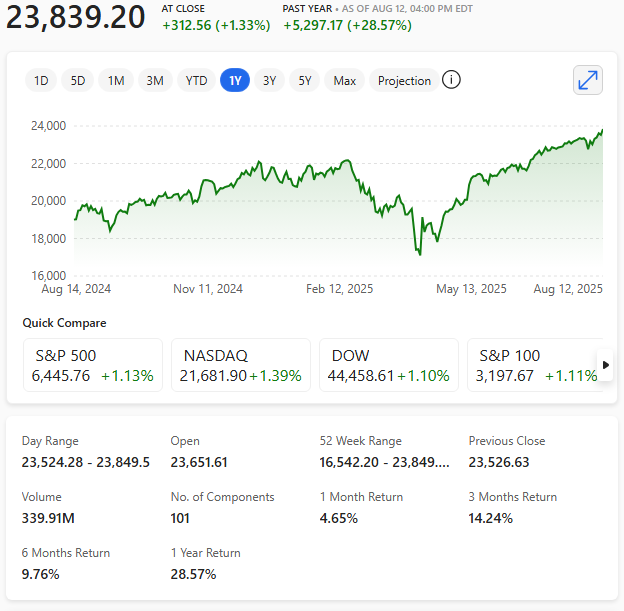

- Nasdaq 100: Hit a new intraday high of 23,849.50, closing at 23,839.20 (+1.33%)

- Highlights:

Nasdaq 100 chart 12th August 2025

🧠 Tech 100 (US Tech Index): Momentum Builds

- Latest High: 23,849.50

- Weekly Gain: Nearly +3.7%

- Outlook: Traders eye a breakout above 24,000, with institutional buying accelerating. Analysts note a 112% surge in net long positions since late June.

🇯🇵 Nikkei 225: Japan Joins the Record Club

- Closing Level: 42,718.17 (+2.2%)

- Intraday High: 43,309.62

- Drivers:

- Relief over U.S. tariff revisions and a 90-day pause on Chinese levies.

- Strong earnings from chipmakers like Kioxia and Micron.

- Speculation of expanded fiscal stimulus following Japan’s recent election results.

🧮 Market Sentiment Snapshot

| Index | Record Level Reached | % Gain Yesterday | Key Driver |

|---|---|---|---|

| S&P 500 | 6,427.02 | +1.1% | CPI data, rate cut bets |

| Nasdaq Comp. | 21,457.48 | +1.55% | AI optimism, Apple surge |

| Nasdaq 100 | 23,849.50 | +1.33% | Tech earnings, institutional buying |

| Tech 100 | 23,849.50 | +1.06% | Momentum, bullish sentiment |

| Nikkei 225 | 43,309.62 | +2.2% | Tariff relief, chip rally |

📊 Editorial Note: While the rally reflects strong investor confidence, analysts caution that several indices are approaching technical overbought levels.

The Nikkei’s RSI, for instance, has breached 75, often a precursor to short-term pullbacks.