Greenland has long been portrayed as a remote Arctic frontier, but its bedrock tells a very different story.

Beneath the ice lies a concentration of critical minerals that has drawn global attention, not least from President Trump, whose administration has repeatedly emphasised the island’s strategic and economic value.

Much of that interest stems from the sheer breadth of materials Greenland contains, according to the Geological Survey of Denmark and Greenland, 25 of the 34 minerals classified as ‘critical raw materials’ by the European Commission can be found there, including graphite, niobium and titanium.

Rare Earth Elements

The most geopolitically charged of these are rare earth elements — a group of 17 metals essential for electronics, renewable energy technologies, advanced weaponry and satellite systems.

These minerals are currently dominated by Chinese production and processing, a reality that has shaped US strategic thinking for more than a decade. Analysts note that Trump’s interest is ‘primarily about access to those resources and blocking China’s access’.

Greenland also holds significant deposits of uranium, zinc, copper and potentially vast reserves of oil and natural gas. As Arctic ice retreats, previously inaccessible rock formations are becoming easier to survey and, in some cases, to mine.

Ice melt?

Melting ice is even creating new opportunities for hydropower in exposed regions, potentially lowering the energy costs of extraction in the future.

Yet the island’s mineral wealth remains largely untapped. Reportedly, only two mines are currently operational, with harsh weather, limited infrastructure and high extraction costs slowing development.

Despite these challenges, the strategic calculus is clear: in a world increasingly defined by competition over supply chains for green technologies and defence systems, Greenland represents a rare opportunity to diversify away from existing global chokepoints.

For the Trump administration, the island’s mineral potential, combined with its location along emerging Arctic shipping routes, elevates Greenland from a frozen outpost to a cornerstone of long‑term geopolitical strategy.

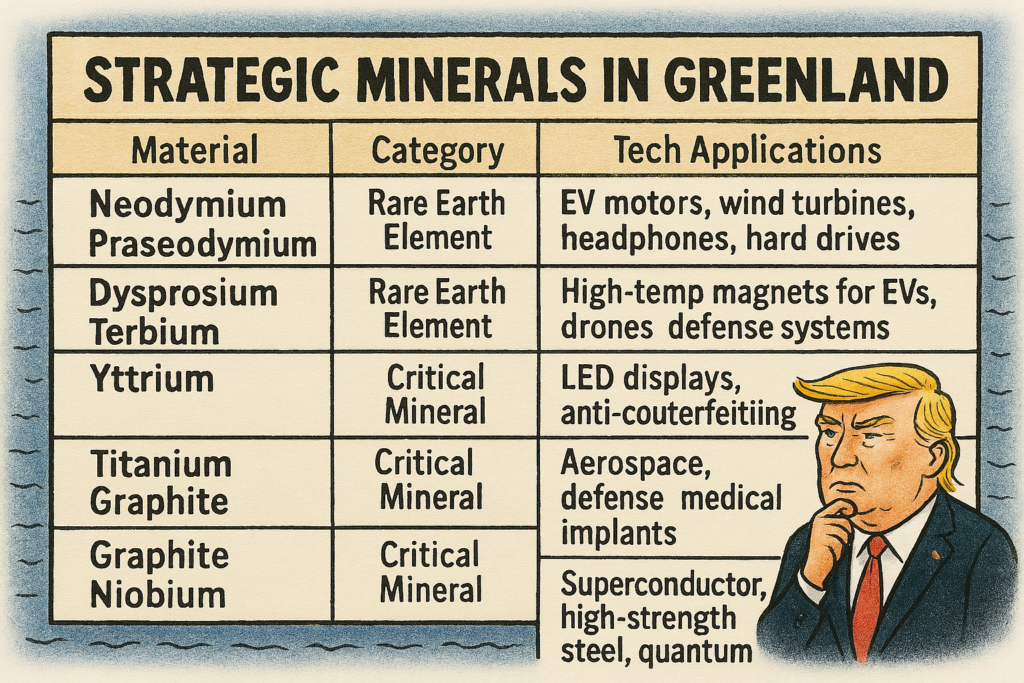

Strategic Minerals in Greenland

| Material | Category | Tech Applications |

|---|---|---|

| Neodymium | Rare Earth Element | EV motors, wind turbines, headphones, hard drives |

| Praseodymium | Rare Earth Element | Magnet alloys, aircraft engines |

| Dysprosium | Rare Earth Element | High-temp magnets for EVs, drones, defence systems |

| Terbium | Rare Earth Element | LED phosphors, magnet alloys |

| Europium | Rare Earth Element | LED displays, anti-counterfeiting inks |

| Yttrium | Rare Earth Element | Lasers, superconductors, ceramics |

| Lanthanum | Rare Earth Element | Camera lenses, batteries |

| Cerium | Rare Earth Element | Catalytic converters, glass polishing |

| Samarium | Rare Earth Element | Heat-resistant magnets, missiles, precision motors |

| Gadolinium | Rare Earth Element | MRI contrast agents, neutron shielding |

| Titanium | Critical Mineral | Aerospace, defence, medical implants |

| Graphite | Critical Mineral | Battery anodes, lubricants, nuclear reactors |

| Niobium | Critical Mineral | Superconductors, high-strength steel, quantum technologies |

These materials are not only present in Greenland’s geology but also feature prominently in strategic supply chains— especially as the West seeks to reduce reliance on Chinese and Russian sources.