Nvidia’s Q3 results show strength, but the real risk of an AI bubble may lie in the debt-fuelled data centre boom and the circular crossover deals between tech giants.

Nvidia’s latest quarterly earnings were nothing short of spectacular. Revenue surged to $57 billion, up 62% year-on-year, with net income climbing to nearly $32 billion. The company’s data centre division alone contributed $51.2 billion, underscoring how central AI infrastructure has become to its growth.

These figures have reassured investors that Nvidia itself is not the weak link in the AI story. Yet, the question remains: if not Nvidia, where might the bubble be forming?

Data centre roll-out

The answer may lie in the debt-driven expansion of AI data centres. Building hyperscale facilities requires enormous capital outlays, not only for GPUs but also for power, cooling, and connectivity.

Many operators are financing this expansion through debt, betting that demand for AI services will continue to accelerate. While Nvidia’s chips are sold out and cloud providers are racing to secure supply, the sustainability of this debt-fuelled growth is less certain.

If AI adoption slows or monetisation lags, these projects could become overextended, leaving balance sheets strained.

Crossover deals

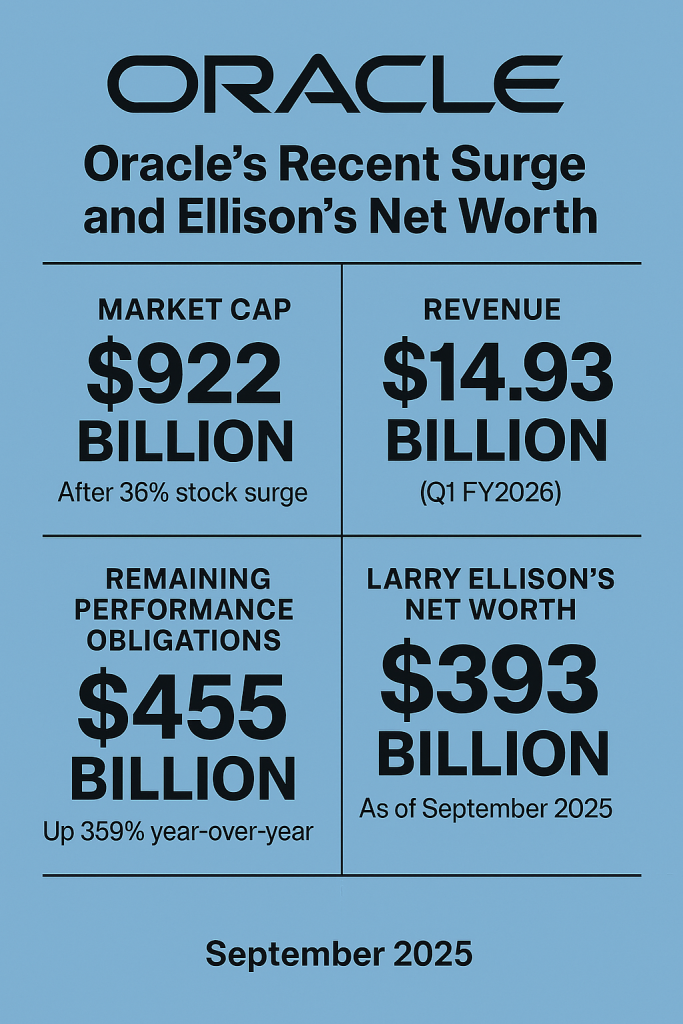

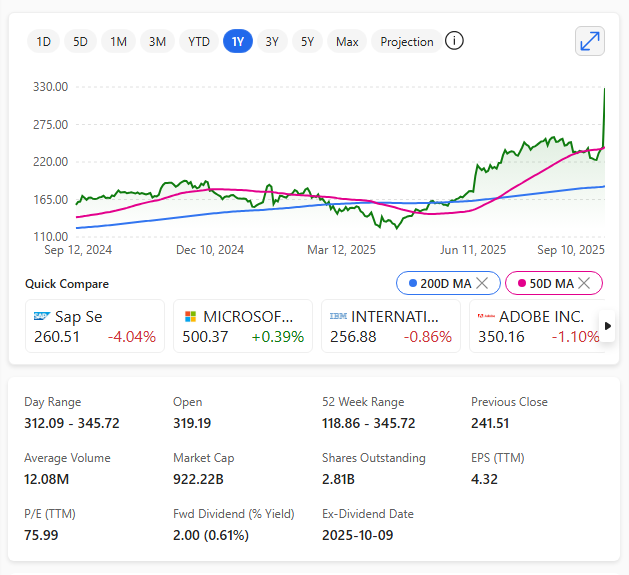

Another area of concern is the crossover deals between major technology companies. Nvidia’s Q3 was buoyed by agreements with Intel, OpenAI, Google Cloud, Microsoft, Meta, Oracle, and xAI.

These arrangements exemplify a circular investment pattern: companies simultaneously act as customers, suppliers, and investors in each other’s AI ventures.

While such deals create momentum and headline growth, they risk masking the true underlying demand.

If much of the revenue is generated by companies trading capacity and investment back and forth, the market could be inflating itself rather than reflecting genuine end-user adoption.

Bubble or not to bubble?

This dynamic is reminiscent of past bubbles, where infrastructure spending raced ahead of proven returns. The dot-com era saw fibre optic networks built faster than internet businesses could monetise them.

Today, AI data centres may be expanding faster than practical applications can justify. Nvidia’s results prove that demand for compute is real and immediate, but the broader ecosystem may be vulnerable if debt levels rise and crossover deals obscure the true picture of profitability.

In short, Nvidia’s strength does not eliminate bubble risk—it merely shifts the spotlight elsewhere. Investors and policymakers should scrutinise the sustainability of AI infrastructure financing and the circular nature of tech partnerships.

The AI revolution is undoubtedly transformative, but its foundations must rest on genuine demand rather than speculative debt and self-reinforcing deals.