Meta is making a serious play to become the dominant force in AI-powered consumer devices, and it’s not just hype—it’s backed by aggressive strategy, talent acquisition, and a unique distribution advantage.

🧠 Meta’s Strategic Edge in AI Devices

1. Massive User Base

- Meta has direct access to 3.48 billion daily active users across Facebook, Instagram, WhatsApp, and Messenger.

- This gives it an unparalleled distribution channel for deploying AI features instantly across billions of devices.

2. Platform-Agnostic Approach

- Unlike Apple and Google, which tightly integrate AI into their operating systems, Meta is bypassing OS gatekeepers by embedding AI into apps and wearables.

- It’s partnering with chipmakers like Qualcomm and MediaTek to optimize AI performance on mobile hardware.

3. Talent Acquisition Blitz

- Meta poached Ruoming Pang, Apple’s head of AI models, and Alexandr Wang, co-founder of ScaleAI, to lead its Superintelligence group.

- This group aims to build AI that’s smarter than humans—an ambitious goal that’s drawing top-tier talent from rivals.

4. Proprietary Data Advantage

- Meta’s access to real-time, personal communication and social media data is considered one of the most valuable datasets for training consumer-facing AI.

- This gives it a leg up in personalization and contextual understanding.

🍏 Apple and Google: Still Strong, But Vulnerable

Apple

- Struggled with its in-house AI models, reportedly considering outsourcing to OpenAI or Anthropic for Siri upgrades.

- Losing this battle could signal deeper issues in Apple’s AI roadmap.

- Has robust AI infrastructure and Gemini models, but faces competition from Meta’s nimble, app-based deployment strategy.

🔮 Could Meta Win?

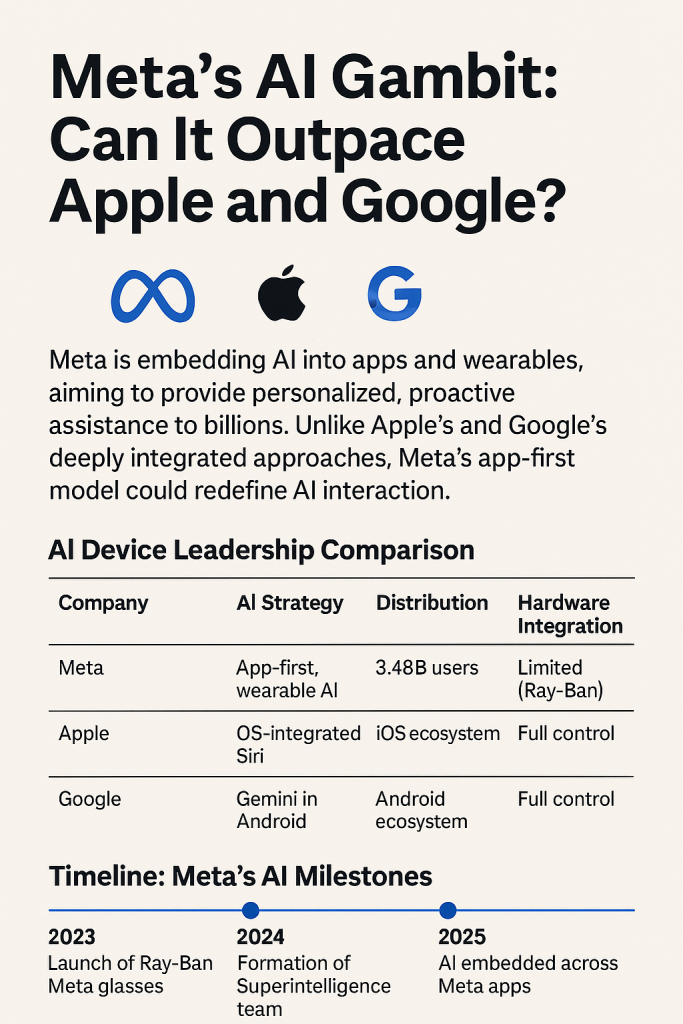

Meta’s approach is disruptive: it’s not trying to own the OS—it’s trying to own the AI interface. If it continues to scale its AI across apps, smart glasses (like Ray-Ban Meta), and future AR devices, it could redefine how users interact with AI daily.

That said, Apple and Google still control the hardware and OS ecosystems, which gives them deep integration advantages. Meta’s success will depend on whether users prefer AI embedded in apps and wearables over OS-level assistants.

1. AI Device Leadership Comparison

| Company | AI Strategy | Distribution | Hardware Integration |

|---|---|---|---|

| Meta | App-first, wearable AI | 3.48B users | Limited (Ray-Ban) |

| Apple | OS-integrated Siri | iOS ecosystem | Full control |

| Gemini in Android | Android ecosystem | Full control |

2. Timeline: Meta’s AI Milestones

- 2023: Launch of Ray-Ban Meta glasses

- 2024: Formation of Superintelligence team

- 2025: AI embedded across Meta apps

Remember, Meta has direct access to nearly 3.50 billion users on a daily basis across Facebook, Instagram, WhatsApp, and Messenger.

Bit of a worry, isn’t it?

But good for investors and traders.