Stocks dropped on Tuesday 13th February 2024 after hotter-than-expected inflation data for January caused Treasury yields to spike

The new inflation figure raised doubts that the Federal Reserve would be able to cut rates several times this year, a key part of the equity market bull run case.

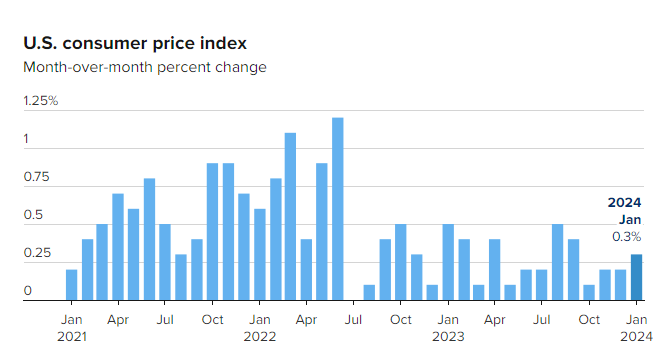

The consumer price index rose 0.3% in January 2024 from December 2023. CPI was up 3.1% year-to-year. Economists expected CPI to have increased by 0.2% month over month in January and 2.9% from a year earlier.