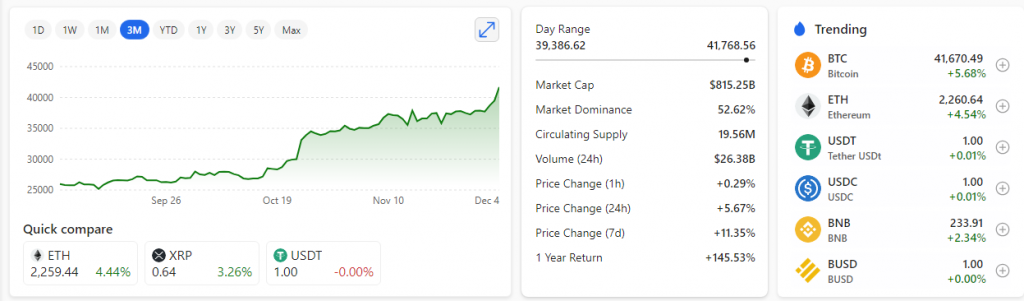

For true cryptocurrency bulls, the most lucrative investments in 2023 were in the stock market.

While Bitcoin rallied over 150% for the year, shares of Coinbase, Marathon Digital, MicroStrategy and the Grayscale Bitcoin Trust, which are all tied closely to the digital currency, did substantially better, rising more than 300% in value. Bitcoin miner Marathon Digital soared some 688%.

Outperform

Not only have these stocks outperformed primary cryptocurrency, but they’ve been among the biggest gainers across the whole U.S. stock market. In the universe of publicly traded U.S. businesses with a market value of at least $5 billion, the four Bitcoin-tied stocks were among the eight best performers, according to analysts.

Boom or bust?

The crypto boom represents a major recovery from 2022, when coin prices plummeted, taking related equities down with them. A year highlighted by hedge fund collapses, crypto lender failures and crippling losses at miners was punctuated in November 2022, when crypto exchange FTX spiralled into bankruptcy, leading to the arrest of founder Sam Bankman-Fried on fraud charges.

Bankman-Fried conviction

In 2023, a New York jury convicted Bankman-Fried on seven criminal counts, setting the 31-year-old former billionaire up for a possible long-stretch behind bars. Weeks later, Changpeng Zhao (CZ), founder of crypto exchange Binance, pleaded guilty and stepped down as the company’s CEO as part of a $4.3 billion settlement with the Department of Justice. He faces a possible prison sentence of 18 months or longer.

By the time of Bankman-Fried’s conviction and Zhao’s plea deal, the damage to the broader crypto market had mostly been realised, and investors were looking to the future. One of the biggest drivers for bitcoin this year was an easing of the Federal Reserve’s interest rate hikes, which created a more attractive case for riskier assets, but only marginally.

Bitcoin halving due May 2024 & ETF’s

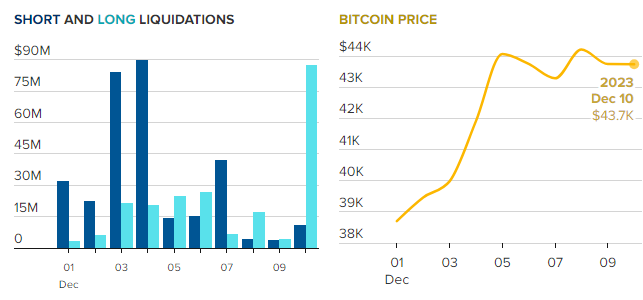

Prices were also bolstered by the upcoming Bitcoin halving, which takes place every four years and is scheduled for May 2024. In the halving process, the reward for mining is cut in half, capping the supply of bitcoin.

Additional buying was sparked by the potential for a flurry of bitcoin exchange-traded funds popping up in the new year.

Marathon

Among companies closely tied to Bitcoin, the best-performing stock this year was Marathon, a mining firm that just eclipsed that market cap level last week thanks to a 125% surge in December as of Tuesday’s close. On Wednesday, the shares surged another 15%.

Last year at this time, Marathon was hanging on by a thread. The company was in the midst of a quarter that ended with a loss of almost $400 million on sales of just $28.4 million because of tumbling bitcoin prices

Mining

Bitcoin mining is an expensive operation because of the high energy costs required to operate the supercomputers. A drop in bitcoin prices means a sharp reduction in the money producers make selling the coins they mine, even as their energy bills get little relief.

Outside of the mining universe, the best-performing crypto stock in the U.S. this year is Coinbase, which has soared some 386% into 2023 year end.

Coinbase

As the only major publicly traded crypto exchange in the U.S., Coinbase has long been a popular way to buy and trade cryptocurrencies in its home market. But with the struggles at Binance, the largest exchange in the world, Coinbase picked up useful market share during non-U.S. trading hours, according to a report from research firm Kaiko in late November 2023.

Shortly after Zhao’s plea deal, Coinbase CEO Brian Armstrong reportedly said that the news amounted to ‘a vindication of the long-term strategy that we’ve taken to focus on compliance, make sure we were building a trusted company.’

Coinbase’s revenue and stock price are still way below where they were during the heyday of crypto trading in 2021, when retail investors were jumping into the market to buy all sorts of digital currencies, including gimmicks like Dogecoin.

But the business has stabilized following drastic cost-cutting measures starting last year and extending into early 2023.

Will 2024 be an outstanding year for crypto?