Artificial Intelligence (AI) has become a pivotal battleground in the technological race between China and the United States.

“AI is expected to become a crucial component of economic and military power in the near future,” Stanford University’s Artificial Intelligence Index Report 2023 stated.

Both countries are significantly investing in AI research and development, striving to achieve a leading role in this revolutionary sector. This post looks at the major figures in China’s AI scene, their progress, and their comparison with their American counterparts.

China’s AI Landscape

China’s AI aspirations are propelled by a number of significant technology firms, each forging their own AI models and applications.

Baidu: Often referred to as the ‘Google of China,’ Baidu leads in AI development. Its premier AI model, ERNIE (Enhanced Representation through Knowledge Integration), fuels the Ernie Bot, a chatbot aimed to compete with OpenAI’s ChatGPT. Baidu asserts that ERNIE 4.0 matches GPT-4’s capabilities, demonstrating sophisticated understanding and reasoning abilities.

Alibaba: Alibaba’s AI model, Tongyi Qianwen (commonly known as Qwen), is a comprehensive set of foundational models adept at a range of tasks, from generating content to solving mathematical problems. Select versions of Qwen are open-source, enabling developers to utilize and modify them for various uses. Alibaba has announced that Qwen models are in use by over 90,000 enterprise clients.

Tencent: The Hunyuan model from Tencent is a prominent component of China’s AI landscape. Offered through Tencent’s cloud computing division, Hunyuan is tailored to facilitate a broad spectrum of applications, encompassing natural language processing and computer vision.

Huawei: In spite of considerable obstacles stemming from U.S. sanctions, Huawei persists in AI innovation. The firm has created its own AI processors, like the Kunlun series, to diminish dependence on international technology. Huawei’s AI features are incorporated into a diverse array of products, including smartphones and cloud solutions.

Comparison to the U.S.

The U.S. continues to be a dominant force in AI, with leading companies such as OpenAI, Microsoft, Google, Anthropic and Meta spearheading advancements.

Generative AI: U.S. firms have advanced significantly in generative AI, with OpenAI’s GPT-4 and Google’s Gemini at the forefront. These models excel in creating text, images, and videos from user inputs. Although Chinese models like ERNIE and Qwen are strong contenders, the U.S. maintains a slight lead in capabilities and market penetration.

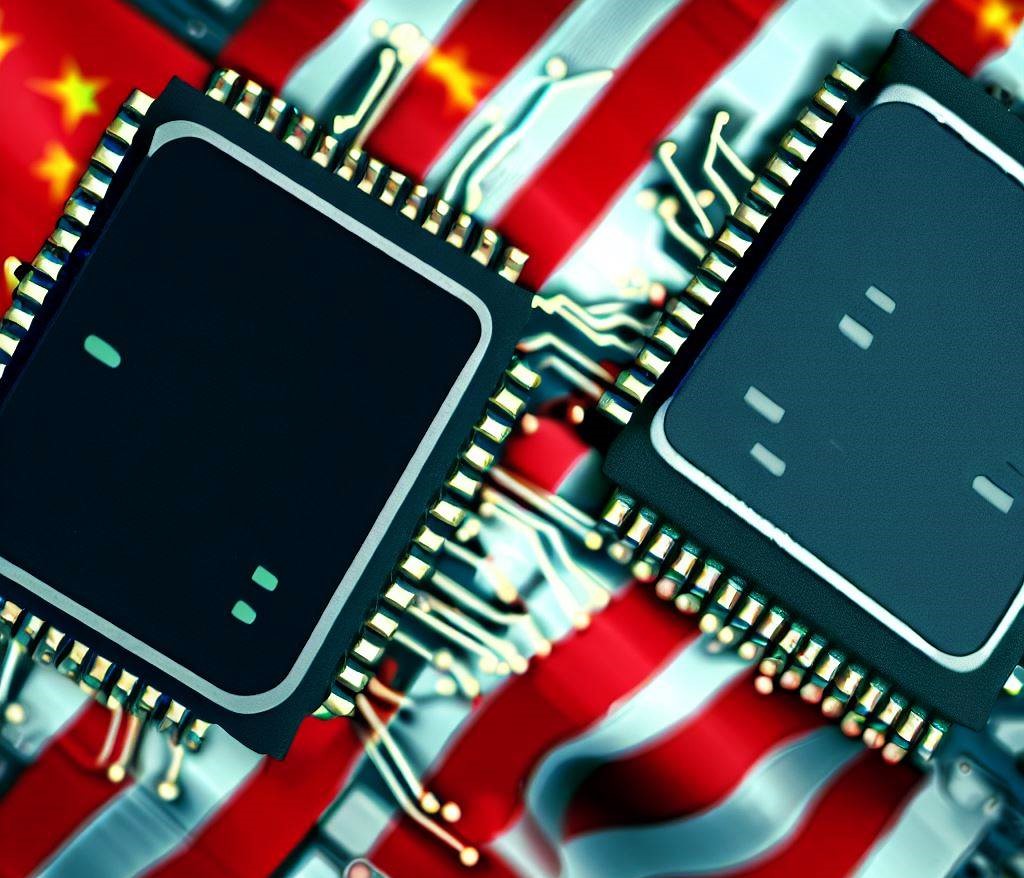

Semiconductor Design: The U.S. leads the semiconductor design industry, vital for AI progress. U.S. companies command an 85% global market share in chip design, crucial for AI model training and system operation. China’s dependence on imported semiconductors is a notable obstacle, but there are ongoing efforts to create homegrown solutions.

Research and Innovation: Both nations boast strong AI research sectors, yet the U.S. edges out slightly in generating state-of-the-art AI products. U.S. tech giants frequently introduce AI breakthroughs to the market, with Chinese firms quickly gaining ground.

Government Support: The Chinese government ardently backs AI advancement, enacting strategies to spur innovation and lessen foreign tech reliance. Such support has spurred China’s AI industry’s rapid expansion, positioning it as a strong rival to the U.S.

Conclusion

The competition in AI development between China and the U.S. is escalating, as both countries achieve significant breakthroughs. Although the U.S. maintains a marginal lead in some respects, China’s swift advancement and state backing indicate that the disparity might keep closing. The quest for AI dominance by these nations is set to influence the worldwide technological and innovative landscape profoundly.

As of September 2024, it is estimated that China’s AI development is approximately nine months behind that of the U.S.